Shall we set up a long position aiming for after Thanksgiving?

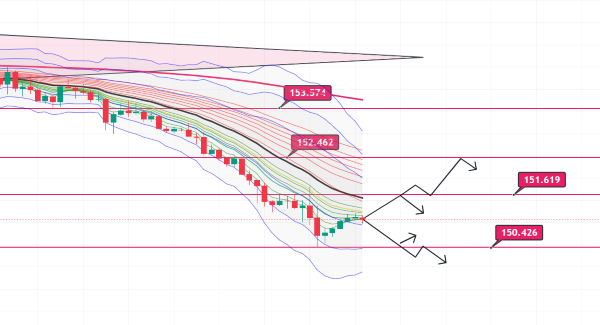

USD/JPY hourly chart

Today also, upside movement is expected to be heavy

First, will it break through 151.6 and rise?

However, I would like to look to short near 151.6

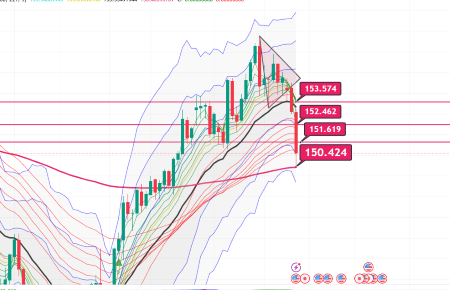

A review of yesterday

I wondered how far it would drop

On the daily chart, it bounced at the red 200 MA line

On the pivot line, S4 was broken and it fell

It was a strong downtrend

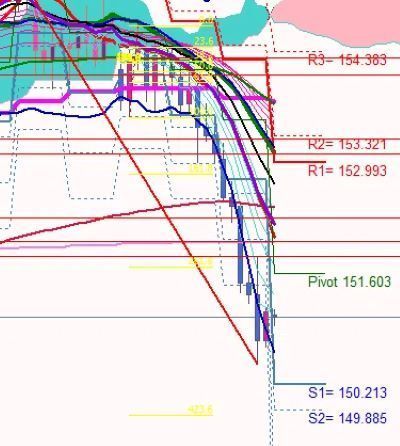

Today’s pivot line is

If it breaks S1, 150.0 becomes visible

Will it come this far?

Safe-haven buying of the yen progresses

Until now, with the Trump trade

profit-taking of accumulated positions is

underway. In particular, with the appointment of

Mr. Vestant as U.S. Treasury Secretary,

the concerns about fiscal expansion leading to a rise in U.S. long-term yields have lessened, and rather, with a fiscal hawk like

Mr. Vestant as Treasury Secretary, there is a belief that

U.S. long-term yields will fall, hence

dollar selling occurs when U.S. yields fall.

Of course, Thanksgiving is a special

period, which is one contributing factor.

Today’s Thanksgiving market tends to lose extreme

liquidity.

Many traders take extended holidays,

making position adjustments easier.

Today, should I skip trading,

or anticipate a buying rebound after the break?

Wouldn’t it be interesting to lightly initiate long positions?

Many traders’ perspectives are

likely shifting after Thanksgiving.

Will it continue to be Trump trade,

or Vestant trade?

There are already talks about tariffs on Canada and Mexico.

With fundamentals supporting a stronger dollar also observed

we are watching for a timing to rise after the break next week.

× ![]()