I feel a wall near USD/JPY around 154.29. Maybe I’ll go long~

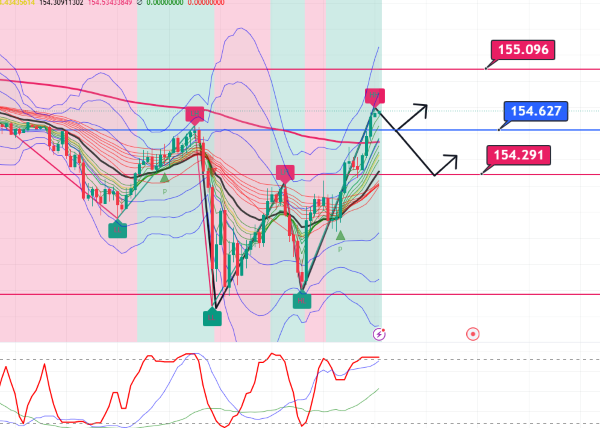

This is the USD/JPY 15-minute chart

Nice inverted W bottom forming, should rise

Around 154.291 is the pullback of the recent upward move, at the 38.2% Fibonacci level

Based on the chart shape, there will be a resistance there

Whether it will rebound and rise or not after pulling back

The GMMAs are pointing up

Looking at the 5-minute chart

It looks like this

Whether it will break below 154.6 in the short term; the 20 MA is approaching

If you look at the 1-hour chart

The short-term GMMAs are turning up

There is a strong resistance around 154.29

Looking at it this way, today seems to carry expectations for the morning rise on Go-To day, but

There is something that concerns me a little

After last week's data release, it fell instead of rising

Yesterday it fell from the morning (though it reversed during the New York session...)

I feel a large trader was selling

Then, looking at the monthly chart

The black circled area represents the November-December declines (downward candles) over the past two years

This is the profit-taking by the large traders who had been long USD/JPY

In preparation for the European and American Christmas holidays

There are already large traders who have achieved their target

I think they initiated profit-taking selling

With that scenario, and about a month left until Christmas this year as well

I wonder if the large traders are aiming to sell

Although people say the Trump rally is over

They might be increasing buy orders of the large players

and initiating profit-taking selling around those levels

If today’s Tokyo mid-price strategy shows weak upward momentum,

I'll look for a move to go short after 10 o'clock

× ![]()