While the dollar is strong, there is a possibility of a sharp drop in USD/JPY around 13:45

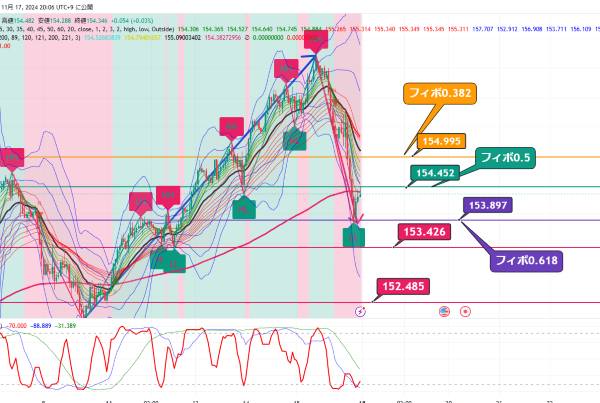

The USD/JPY 15-minute chart

In a downtrend, it has retraced to Fibonacci 0.216

Looking at the 1-hour chart, within the downtrend

It has retraced to the half-level after pulling back to the 0.618 Fibonacci of the recent rise

The RSI is about to turn upward

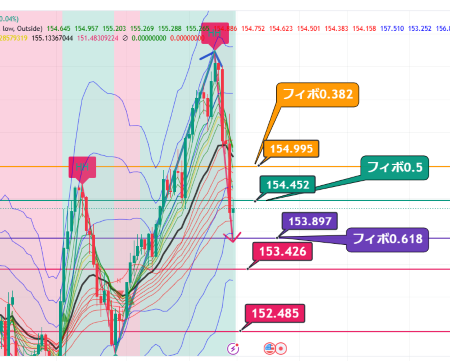

On the 4-hour chart

There seems to still be upward pressure

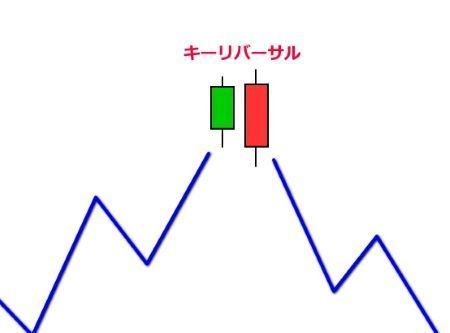

On the daily chart

GMMA is pointing upward, but Friday’s candlestick indicates a strong decline, serving as a key reversal

Technically, a downward trend reversal is possible

However,

last week, despite strong US data and a strong dollar

the USD/JPY plunged at the end of the week

Dollar index 4-hour chart

Perhaps the Trump trade has cooled down,

With talk of skipping December rate hikes by the FOMC and policy under the Trump administration

Concerns about renewed inflation leading to dollar strength

The BOJ may move to cut rates earlier?

Or

There may be a sense of position adjustments selling on Friday

This week also includes expectations for a rise in USD/JPY from short covering

For two weeks in a row, the weekend is a ceiling

This week too could rise toward the weekend

In the short term

All eyes on today’s Ueda's remarks as BOJ Governor and his appearance at the Finance and Economic Council and the subsequent press conference

If he makes hawkish comments about rate hikes

the yen would strengthen dramatically and the USD/JPY would plunge

If that happens, breaking 153.426 would target a decline toward 152.485

If he ends doveishly

With rising US 10-year yields,

there would be gradual dollar buying from London time,

and USD/JPY would rise

US 10-year yield 1-hour chart

In that case, could 155.0 be a key level?

In the short term

The fundamentals will outweigh the technicals, so it depends on Governor Ueda

Speech around 10:00, press conference at 13:45

This week too there are economic indicators, so we may see a roller coaster

I’ll try to scalp and capture profits

× ![]()