Will the USD/JPY fair value gap in the 151 yen area be filled?

Dollar/yen may be strong but the head may be getting heavier

Isn't there more people who want to sell?

When indicators attract buyers

I feel like sellers take profits there

After a round of selling, it repeats to rise again

Now, if it drops significantly, I want to buy

However, if held for a long time, there is a risk of a sudden plunge triggered by something

so I will trade in the short term

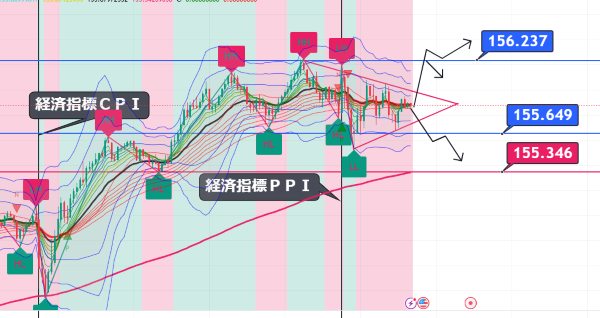

First, which way will the triangle consolidation break?

Two U.S. economic indicators are dollar-positive, yet the dollar/yen fell

The U.S. October Producer Price Index (PPI) accelerated from the previous month.

Items reflected in the Personal Consumption Expenditures (PCE) price index, such as portfolio management services fees, acted as upward drivers

Last week's U.S. initial jobless claims decreased, hitting a low not seen since May.

Impact of hurricanes and strikes was seen, but

this statistics suggest that labor demand remains healthy.

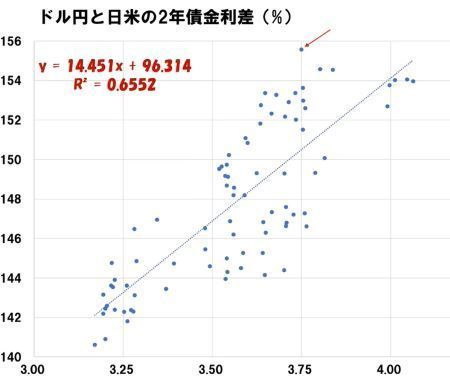

Watching the USD/JPY from the interest-rate differential

From the U.S.-Japan interest-rate differential, the current dollar/yen price is overvalued

The arrow shows the current position

The fair value for USD/JPY is in the 151 range

There is currently a gap

The rise is due to expectations of the Trump administration

but interest rates have a large impact on exchange rates

eventually this gap will be filled

Looking at the medium to long term, this gap

can be filled in two ways

Either USD/JPY falls and closes the gap,

or the U.S.-Japan 2-year government bond yield spread rises

and closes the gap

I think these will be the two options

The level of USD/JPY, driven by expectations of economic expansion, is

significantly overvalued relative to fair value

and the gap should be closed by a widening interest-rate differential or a decline in USD/JPY

likely

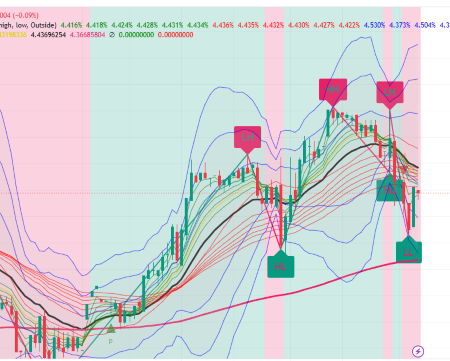

Trading will continue with an eye on the usual interest rates, but

I feel the wind may blow toward yen strength when the Trump administration takes office

U.S. 10-year yield hourly view

× ![]()