How to profit steadily with a high-profit-factor EA

I have developed more than 100 EAs so far.

From my experience in EA development, I noticed a correlation between the number of trades and the profit factor.

If you simply want to increase the profit factor, you can achieve it by carefully selecting entry points and reducing trade frequency.

In other words, EA with high trade frequency tends to have a lower profit factor.

When operating an EA, I believe a certain level of trade frequency is necessary.

For example, suppose there is a high-profit-factor EA that trades 500 times over 10 years.

That averages 50 entries per year.

In this case, there are only about four entries per month, so some months may have zero or one trade.

If the win rate is high, there is value in operating it, but from the perspective of total profit, even if the profit factor drops somewhat, total profit will increase with a certain number of trades.

In other words, win rate and profit factor are important, but in terms of profit, balance is the most important.

In EA development, I prioritize total revenue over recovery factor or profit factor.

To increase total profit, increasing the number of trades is effective.

With U.S. interest rates plateauing, I expect range-bound markets to dominate going forward.

The bonus market for trend-following EAs is ending, and I expect contrarian, anomaly-based, and martingale EAs to perform at a high level in the future.

In such stable markets, using high leverage is also useful.

In other words, for an EA with a high profit factor but few trades, a strategy of setting a higher lot size can aim for higher returns.

In highly volatile markets, high leverage is a double-edged sword and comes with risk.

However, in stable markets where price moves are small, taking a proportional lot size keeps risk limited.

From these perspectives, the EA developed as a high-profit-factor EA is the Morning Bear.

Morning Bear

Since Morning Bear experienced a fairly large drawdown soon after launch, as of September 2024 it shows a slight negative return, but it is an EA with a high profit factor capable of profiting in stable markets.

Morning Bear is a multi-logic EA equipped with two logics.

【Logic 1】 BearHands

Adopts an improved version of BearHands that reduces trade frequency and increases profit factor.

【Logic 2】 Morning Reversal

A contrarian-type EA using Bollinger Bands, targeting the early morning hours in Japan time.

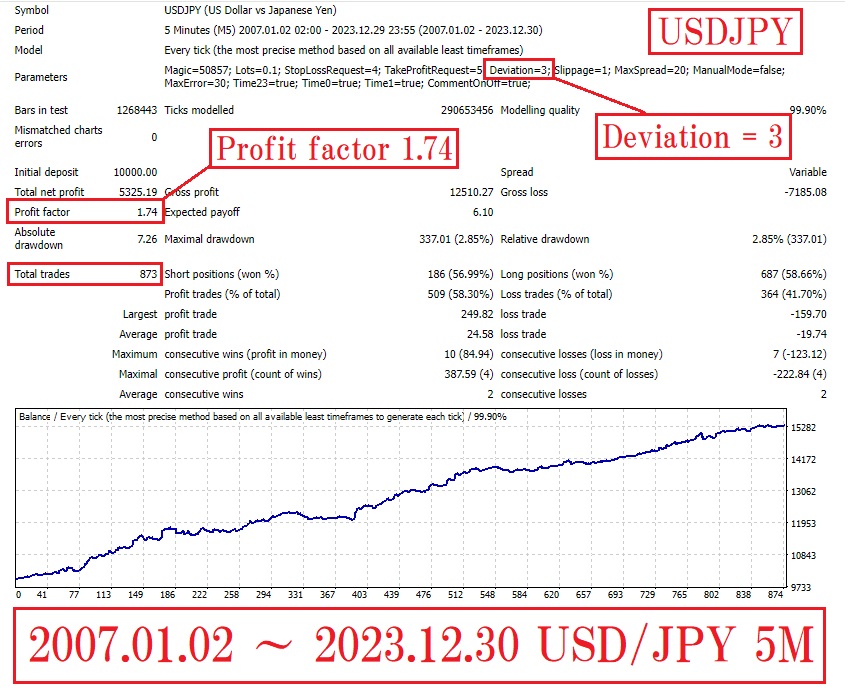

In the default setting, Deviation = 3, and the backtest shows an annual trade count of 50 with a profit factor of 1.74.

From the profit-factor perspective, setting the Bollinger Band sigma to 3 is optimal, but since trade frequency decreases, total profit is not necessarily the best choice.

Therefore, we made it possible to change the Bollinger Band sigma.

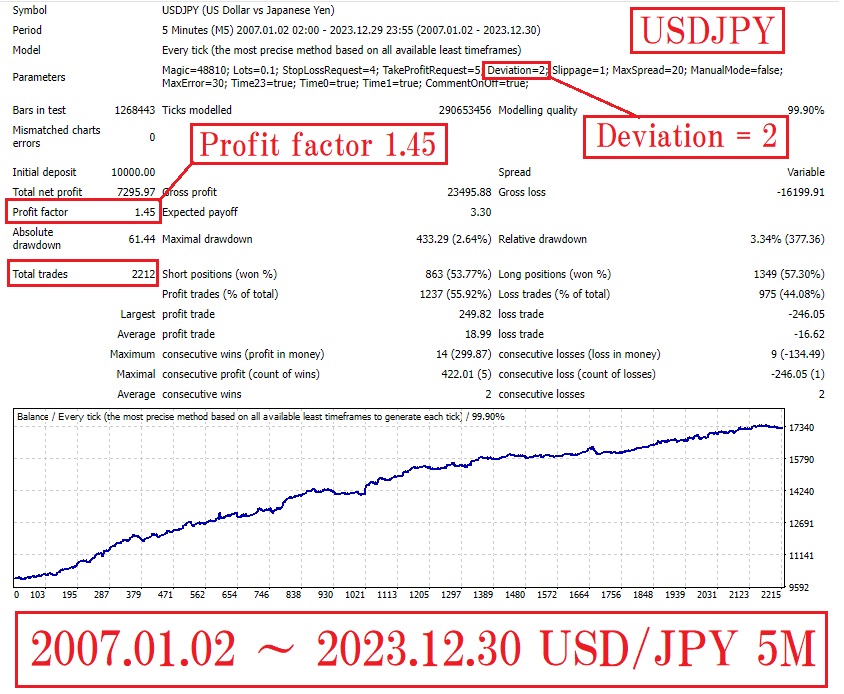

Deviation = 2 yields an annual trade count of 150 and a profit factor of 1.45

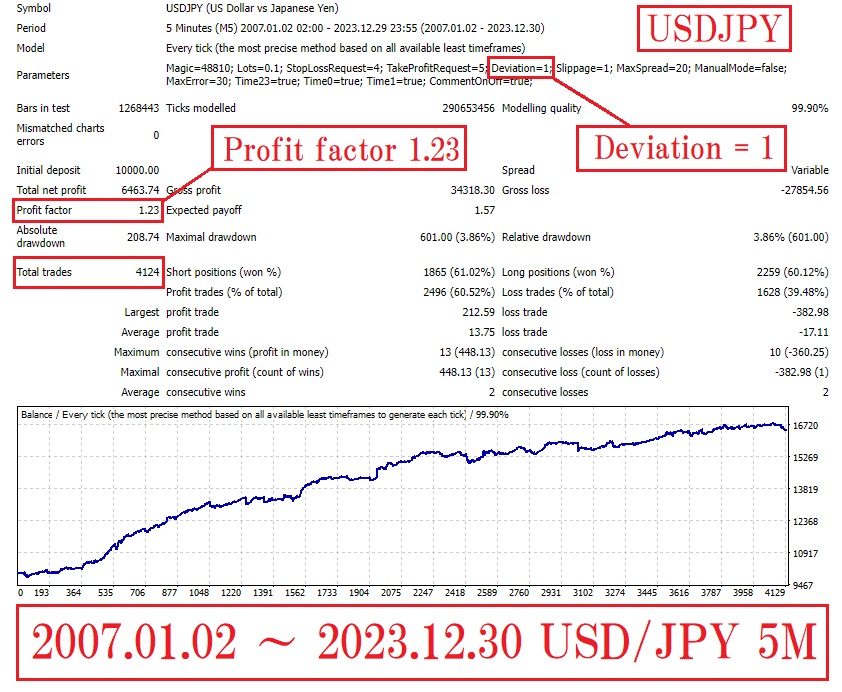

Deviation = 1 yields an annual trade count of 250 and a profit factor of 1.23

In total profit, Deviation = 2 shows the best performance.

By changing parameter values, you can tailor the EA's characteristics to your preferences as an EA purchaser.

We publish real-trade performance, so please refer to it.

FXTF REAL TRADE

By the way, in late September 2024, when I increased lot sizes for a trend-following EA and went for broke, I was hit by a sharp reversal, and the account balance dropped from 2,500,000 to 1,700,000 yen in two weeks, an 800,000 yen loss.

On the day of Ishiba Shock on September 27, when I faced positions going the opposite way, it became an extremely painful situation.

I expect high-volatility markets to continue for a while, so I will continue to operate the main trend-following EA.

However, I will view this drawdown as a market turning point and plan to reduce the number of trend-following EAs in the portfolio, while increasing contrarian and martingale EAs that include stop losses.

I wrote about the martingale EAs with stop losses in the previous article.

EA that can win in both ranging and trending markets (previous article)

× ![]()