Range-bound market and trend market, an EA that can win in both markets

For FX traders, winning in both range-bound and trend markets is a goal that everyone strives for.

Is such a thing actually possible?

What I pay attention to in EA development is volatility.

When volatility is high, it tends to be a trend market, and conversely, when volatility is low, it tends to be a range market.

In other words, trend-following logic is strong in high-volatility markets, while mean-reversion logic is weak in high-volatility markets.

By developing EAs with this point in mind, you can deliberately create market conditions that suit and challenge the EA.

Because an EA that can run for ten years is rare.

If performance starts to decline midway, you would stop operating it, but if you clearly understand which markets the EA struggles with, you can avoid hesitating about stopping the EA at all.

That said, developers and users alike idealize an EA that can steadily earn over time.

In an EA, you understand that there is no Holy Grail.

Even if there is some drawdown, you chase an EA whose asset curve climbs upward in the long term.

I have only four years of EA development experience, but through building various EAs—trend-following, mean-reversion, anomaly-type, and grid-checked EAs—I know EAs that can win in both range-bound and trend markets.

Today, I special-cased this strategy and compiled an article to share it with everyone.

Before diving into the main topic, I would like to share my thoughts on the market in September 2024.

Since the coronavirus pandemic, with rising U.S. interest rates, the yen has weakened against the dollar and then reversed to strengthen against the dollar after a peak, leading to a period of large price swings.

Going forward, as U.S. interest rates decline, market volatility is expected to shrink.

However, there is one concern.

Could AI-driven trading move the currency market significantly enough for FX markets to become a money game?

If the currency market were to swing 10% in a single day, governments would intervene, and even in a money-game scenario, such extreme volatility would not occur.

Crude oil, natural gas, and cryptocurrencies seem to be less responsive to technical analysis.

MT4 can trade crude oil.

When developing EAs using CFDs such as crude oil, the Nikkei, and gold, crude oil often underperforms compared to others.

With crude oil, the wider spreads may be a factor, but technicals clearly seem less effective.

As world events and supply-demand dynamics for oil drive trades, it is evident that crude oil does not respond to technical analysis as FX does.

If AI begins reading economic indicators and demand-supply and moves markets instantaneously, trading could become more difficult.

The September 2024 market was range-bound with no clear direction, shaking up and down.

Despite the range, volatility remained high.

It has been a tough environment for trend-following EAs.

In equities, the rapid-speed trading system 'IEX' (Arlo Head) and AI algorithms accelerated in the 2010s.

At that time, the rise of AI- and machine-learning-based algorithmic trading drove many day traders out of business.

There is a lingering concern that the same could happen in the FX market in the future.

Since brokers able to handle large hedge fund trading volumes are limited, direct interbank rate manipulation would incur spread costs. Therefore, broad AI-driven trading by large hedge funds might not become widespread.

In any case, as U.S. rates decline and the long-standing single-direction trend markets fade, it will be urgent to build portfolios using EAs that can win in range-bound markets.

So, as a method to win in both range-bound and trend markets, my answer is a properly disciplined stop-lossing grid EA (averaging down).

This does not mean any grid EA will do.

It is important to implement proper stop losses.

A grid EA without stop losses can incur devastating losses when a drawdown occurs.

Therefore, an averaging-down EA that intentionally uses stop losses will be active in the new market environment.

Although the biggest allure of averaging-down EAs is their high win rate and steady daily earnings, I believe they should not crash the asset chart, even if it means avoiding a total collapse.

I would like to introduce two averaging-down EAs I developed.

Bear Mind

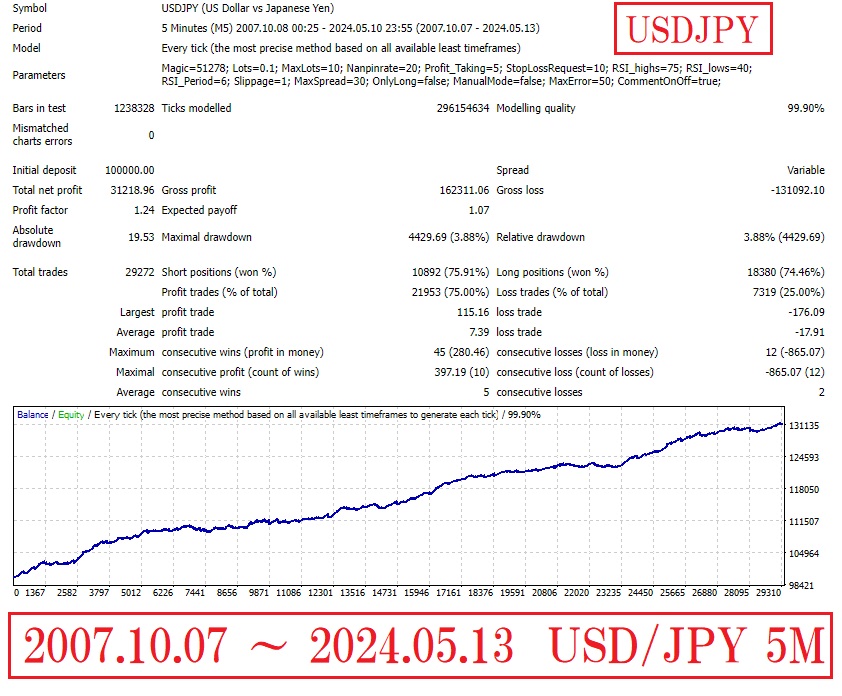

A down-dollar/yen 5-minute chart averaging-down EA. A stable grid-trade EA that incurs losses when the market moves sharply against the position.

It has navigated the volatile 2024 market without issue.

When the market moves significantly in the opposite direction from the position, loss-cutting is triggered by a crisis-avoidance mode using multi-timeframe analysis.

Because it exits positions before suffering a fatal loss, it tends to incur fewer large losses.

Backtest results from October 2007 to May 2024

Bear Grid

A down-dollar/yen 5-minute chart averaging-down EA using multi-timeframe analysis and grid trading.

A fatal drawdown occurred shortly after its launch in July 2024.

This EA is designed to incur somewhat large drawdowns in extreme market conditions that occur once every several years.

In version 1.01, although there were stop-loss settings, the stop loss was set deeply at 1000 pips, turning loss-cutting into a large loss.

A averaging-down EA tends to incur larger damages at stop-loss times for EAs with higher win rates.

Therefore, in version 1.02 I revised the parameters and customized it to be an EA that can stop losses appropriately.

Because it cuts losses frequently, you can run it safely even in extremely volatile markets.

Version 1.02 is under review as of September 2024.

An update is expected in October.

If you like it, I would appreciate your consideration for purchase.

× ![]()