How to build an EA portfolio to stabilize profits and losses (from an EA developer's perspective)

Last time, I wrote an article on the theme of replacing EAs according to the market environment.

Today, I will write an article on the theme of structuring an EA portfolio to stabilize profits and losses.

I started developing EAs in 2020 and have since developed over 100 EAs.

Since I began operating EAs in 2021, the annual net has remained positive every year.

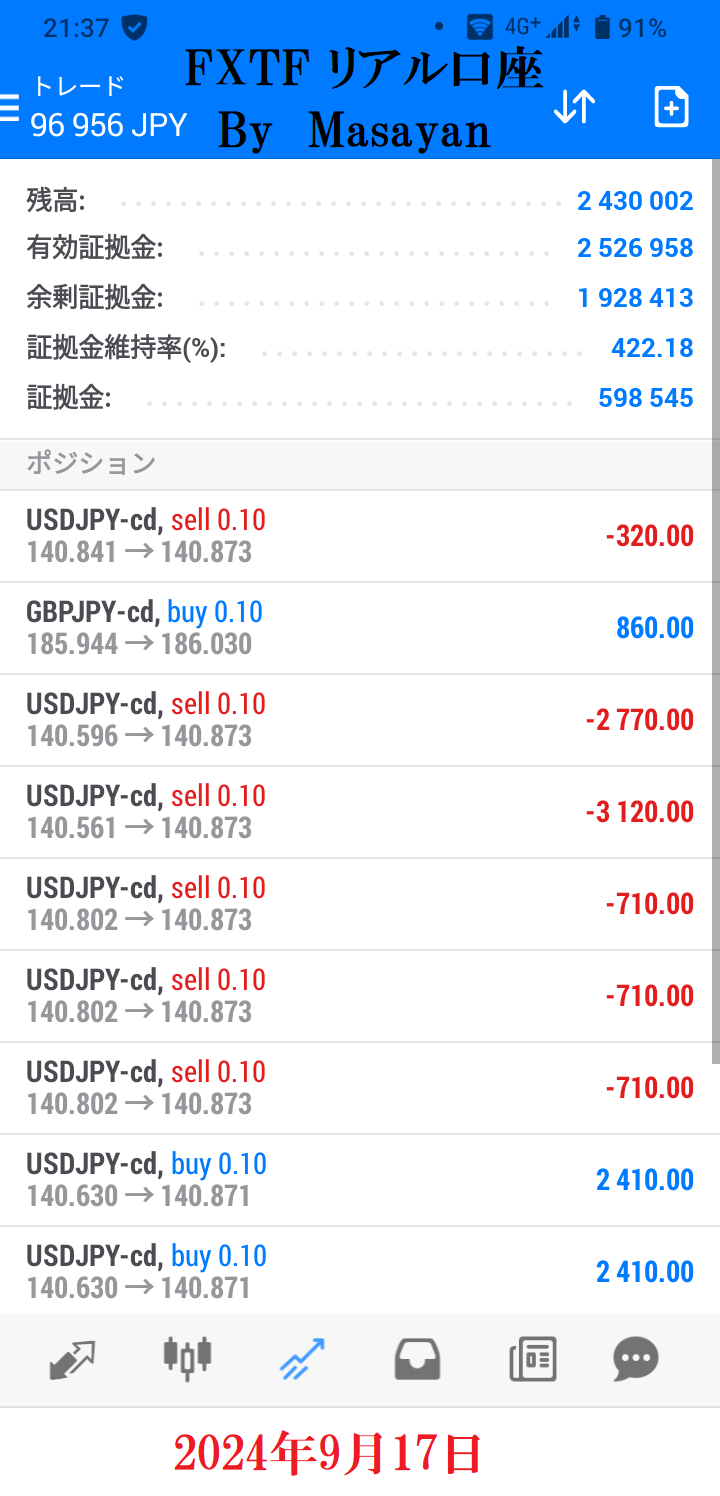

As proof of winning in actual trading, I will公開 my EA real account.

REAL TRADE

The above is a real FXTF account; a deposit of 300,000 yen in 2021 has grown to a balance of 2.5 million yen as of September 2024 purely from EA operation.

Now, in 2020 when I started developing EAs, it was the year of the COVID-19 pandemic.

With fewer outings and more time at home, I wondered what to do in the spare time, and decided to develop EAs and indicators.

I had some programming knowledge from my original web-related work, so after about three months of study I could create EAs and indicators.

MT4 EA development is relatively challenging among programming tasks.

The reason for the high difficulty is not programming difficulty, but the importance of whether you can find a profitable method.

In other words, the method construction is more important than programming skill.

Nowadays there are no/low-code tools to build EAs, templates for EAs, and even with ChatGPT you can rewrite only the logic portion, so the hurdle to EA development has lowered.

However, only a minority of people who can create a truly profitable EA for real trading.

If you want to build a scalping EA, of course you need to know a winning scalping method.

For day-trade or swing EAs, you can confirm the method's edge through repeated backtesting.

By conducting long-term backtests (from 2007 for 15+ years, from 2013 for 10+ years), you can verify across different market environments.

Obviously a clean, steadily rising asset chart is desirable, but here you encounter a big pitfall.

From the seller's perspective, EAs with low drawdown sell well.

From the buyer's side (user), what they want is an EA that wins reliably.

The so-called Holy Grail.

You may know that there is no Holy Grail method in stocks or FX.

I have a question for you all.

In choosing an EA, are you not doing the same as searching for the Holy Grail?

Aren't you looking for a completely perfect EA that wins in any market?

I intended to answer this in the previous article.

Previous article “How to Replace EAs According to Market Environment”

When I operate EAs, I think it’s better to build a portfolio.

Putting all capital into one EA would be gambling trading unless there is no Holy Grail.

At least you should form a portfolio with about three EAs.

If you were to choose three EAs, which type would you pick?

1. Trend-following EA

2. Counter-trend EA

3. Anomaly-based

4. Scalping EA

5. Morning scalping EA

6. Averaging down (martingale) EA

Currency diversification is important, and dispersing the logic is also effective, isn’t it?

In my first year of EA development, I focused on anomaly-based EAs and EAs using technical indicators.

■ For trend-following market, “PerfectOrder_GBPJPY” was successful.

PerfectOrder_GBPJPY

However, anomaly-based EAs and counter-trend EAs failed completely.

The reason is that with anomaly-based EAs, even if there is some edge, in currently high-volatility markets the supply-demand factors are so large that anomalies lose their edge.

For counter-trend EAs, compatibility with the current market is at its worst.

If the market becomes more stable in the future, their performance should improve.

Since they currently have poor compatibility with the market, the anomaly-based EA I developed and the counter-trend EA have become useless to run.

A good EA developer would include logic that works even in high-volatility markets.

If you are going to buy counter-trend or anomaly-based EAs, make sure the forward performance in the current market is still positive.

From my second year onward, I developed many different logic-based EAs.

Morning scalping EA, scalping EA, breakout technique, price action trading, multi-logic.

In the current market, only the multi-logic EA stands out with good performance.

■ Multi-logic EA

Seven Elements

An EA that holds up to three positions depending on the evaluation derived from seven techniques.

Hybrid EA Trade USDJPY

A hybrid EA that adopts two logics: counter-trend in the morning and trend-following during the day and night.

Other logics

Morning scalping EA, scalping EA, breakout method, price action method, all seem like promising logics, right?

At least in backtests they showed profitability, but perhaps they simply do not fit the current market, or the logic has expired.

Regardless of the reason, if the results do not translate, they become unusable.

As of 2024, a tendency of relatively good-performing EAs on Gogojungle is trend-following (buying dips and selling rallies).

For long-term charts, a trend-following approach with occasional counter-trend entries on shorter timeframes, or a strictly trend-following type.

Even my own developed EAs tend to show good forward performance for trend-following EAs.

I decided to create a Stably Earning Averaging-Down EA...

In 2024, I started development of averaging-down EAs.

How does an averaging-down EA avoid bankruptcy risk? That is the hallmark of an EA developer's skill.

My answer is an averaging-down EA that properly cuts losses.

■ Averaging-down with Loss Cutting

Bear Mind

A stable grid-trade averaging-down EA that cuts losses during sudden market changes.

In fact, I released another EA called Bear Grid at the same time as Bear Mind.

Bear Grid

An averaging-down EA using multi-timeframe analysis and grid trading.

Bear Grid suffered a significant drawdown in July 2024, sharply reducing assets.

Although there are loss-cutting settings, a 1000-pip depth causes large damage when a stop is hit.

Ultimately, as with Bear Mind, you must cut losses when positions move strongly against you, otherwise you will face forced liquidation.

In fact, Bear Mind pairs exceptionally well with trend-following EAs.

If you compare Bear Mind and PerfectOrder_GBPJPY on REAL TRADE below, you can see their inverse correlation.

REAL TRADE

Counter-trend averaging-down EAs can achieve large profits in bear-trend-trending markets, i.e., in markets that oscillate, if timing is right for trend-following EAs.

EAs that place grid averaging down orders on counter-trend are good at ranging markets.

Running Bear Mind (trend-following) together with a trend-following EA that only trades in one direction stabilizes the net profits.

Combining a trend-following EA with a counter-trend averaging-down EA is an advanced technique in portfolio management, so please take it as a reference.

Lastly, I will write about the core part.

EA developers aim to create EAs with a clean, steadily rising asset chart, which sells better.

Reason: it sells more.

But in actual trading, you do not necessarily need to profit consistently all the time.

Even the best EA developers will encounter drawdowns in forward testing.

Since a Holy Grail EA does not exist, some losses are unavoidable.

If you cannot achieve it, you simply do not chase it.

Then how should you operate EAs?

My recommendation is to aim for positive results over a span of years.

Experiencing monthly losses is inevitable, but you want annual positive overall performance.

To achieve this, you need to employ the method described in the previous article: “Replacing EAs according to market environment.”

Additionally, by properly forming a portfolio you can raise leverage to some extent.

Of course, sound money management is essential, and you must set appropriate lot sizes for each EA.

I wrote about how to choose EAs in past articles.

How to Find Winning EAs (Gogojungle edition)

■ Today’s Summary

・If you assemble an appropriate portfolio, you do not need every EA to be profitable.

・By offsetting weak market periods with an EA portfolio, profits become more stable.

・Use different logics to build your EA portfolio, such as trend-following and averaging-down, or trend-following and counter-trend.

・Currency diversification is important, but it’s more effective to diversify EAs with different logics.

× ![]()