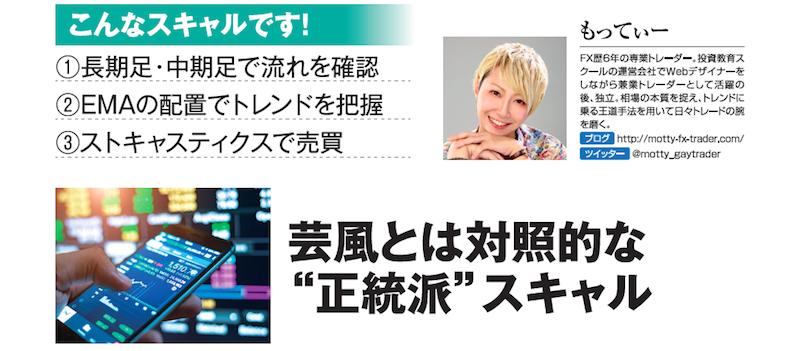

【“Able to do” Scalping Course ③】The "orthodox" scalp in contrast to the style [Motti]

This is the scalping method like this!

① Check the trend on the long and medium time frames

② Understand the trend from the placement of EMAs

③ Buy and sell with Stochastic

Table of Contents

1. The importance of looking at the trend on daily and 1-hour charts

2. How much evidence can be stacked

3. Point ① | Predicting market trends and turns on three time frames (short, medium, long)

4. Point ② | Seeing the environment clearly by looking at three EMAs

5. Point ③ | Recognizing the influential resistance band by looking at horizontal lines

6. Point ④ | Visually grasping the market rhythm with Stochastic

7. Point ⑤ | Understanding the flow from entry to exit

8. Trade Example ① | Picking up pullbacks accurately within a clean uptrend

9. Trade Example ② | Selling is the correct choice in a clear downtrend

● Character count: 2392 characters (including headings)

● Images: 8

※This article is a re-edited version of an article from FX攻略.com November 2018 issue

Motty’s Profile

A full-time trader with 6 years of FX experience. After working as a web designer at a company running an investment education school, he pursued trading as a side job and then became independent. He captures the essence of the market and hones his trading skills daily using a classical trend-following method.

Official site:FX blog that turns market into an ATM

twitter:https://twitter.com/motty_gaytrader

The Importance of Viewing the Trend on Daily and 1-Hour Charts

Recently, Motty has become increasingly active, and his most proficient trading style is scalping using a 1-minute chart.

That said, he does not trade only on a 1-minute chart. First, he looks at the daily and 1-hour charts to confirm the overall trend. Riding the trend on these timeframes tends to yield higher profits, and the support and resistance on the longer timeframes strongly influence the shorter timeframes as well.

As the axis to grasp the 1-minute flow, he uses three EMAs (Exponential Moving Averages). If the three EMAs—80, 240, and 960—are aligned from top to bottom (perfect order), he targets pullbacks for buying on dips.

If the three EMAs are crossing each other, it indicates no clear trend, so entries are generally avoided.