How to Ride a Big Market with Averaged Entries (Nampin EA)

In August 2024, as many grid averaging EAs faced account insolvency and huge unrealized losses, a problem came to light regarding the effectiveness of the averaging method.

That problem is that the averaging method will eventually fail.

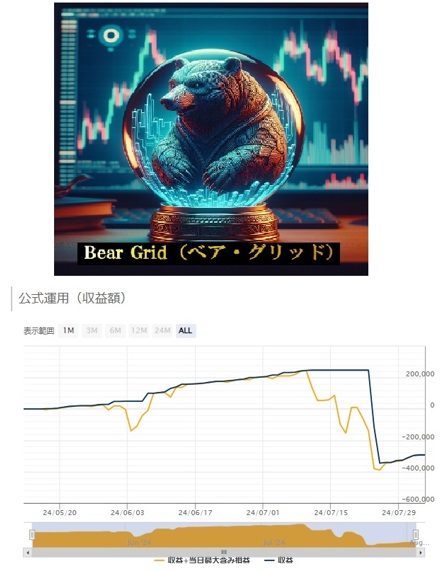

I have two grid averaging EAs for sale on Gogojungle, and one of them suffered a fatal drawdown.

Bear Grid

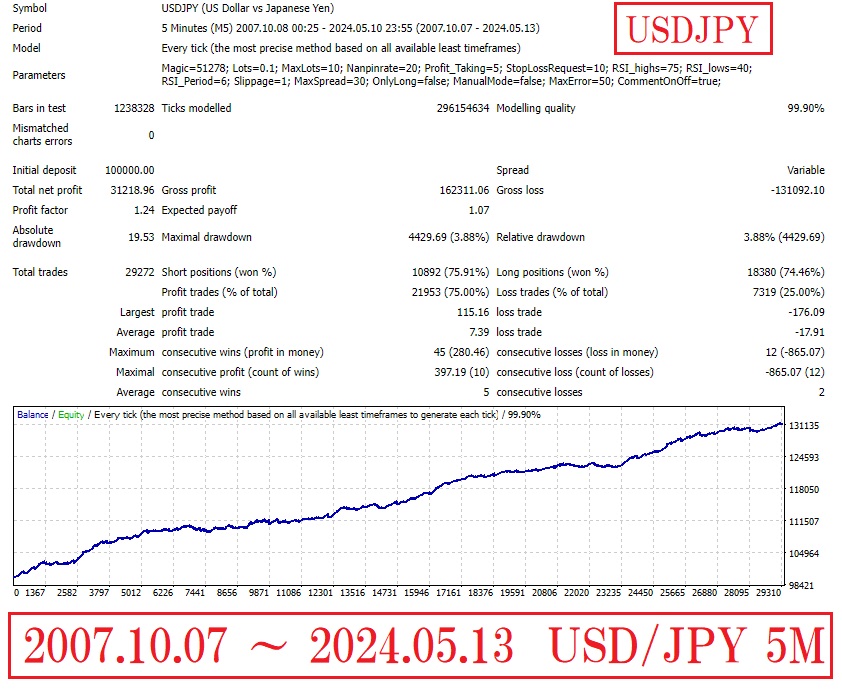

A multi-timeframe analysis and grid trading EA for USD/JPY on the 5-minute chart.

This EA is designed to incur a sizable drawdown in market conditions that occur only once every several years.

There are stop-loss settings, but if you set the stop to be deep, a stop-loss equals a large loss.

The higher the win rate, the larger the damage at the time of stop-loss tends to be.

How can we avoid such large drawdowns as this time?

From the perspective of an EA creator, I would like to share three answers with everyone.

First answer: "Reduce account capital"

When a sizable drawdown occurs, it is a deliberate method to cause the account to go bankrupt.

If bankruptcy cannot be avoided, operate the EA with the premise of bankruptcy from the start—that is a complete shift in thinking.

In fact, some people earn steadily every year with the averaging EA using this approach.

Perhaps the image is to use forced liquidation in place of stop-loss.

When the market stabilizes, you deposit again and resume EA operation.

Second answer: "Choose currency pairs with similar price movements"

Popular currency pairs for averaging EAs like gold, cross-yen, and major dollar crosses tend to struggle in extreme volatile markets like the current one.

When the market moves sharply in one direction, a contrarian averaging EA has little chance.

Therefore, an averaging EA that handles currency pairs with similar moves, such as AUDNZD, AUDCAD, EURGBP, can ride out the current market.

A drawback of these pairs is that when price moves are calm, the entry frequency is low and profits in a stable market are small.

Third answer: "Choose an averaging EA that properly uses stop-loss"

This is the method I chose.

One of the advantages of averaging EAs is a high win rate.

If you minimize stop-losses and close positions when profits appear, the win rate increases.

If you frequently apply stop-losses with averaging EAs, the win rate decreases.

As a result, the asset chart will fluctuate up and down similarly to other EAs.

A clean, steadily rising asset chart is a feature of EAs that do not use stop-losses.

Therefore, using an averaging EA that cuts losses frequently allows you to operate the EA with confidence even in a volatile market.

Bear Mind

A USD/JPY 5-minute chart compatible averaging EA. A stable grid-trade EA that uses stop-loss in the event of a rapid market move.

As of 8/6, it has somehow endured the current extreme market conditions.

If the market moves significantly against the position, a crisis-avoidance mode based on multi-timeframe analysis triggers a stop-loss.

I believe closing the position before suffering a fatal loss is the best risk-avoidance method for averaging EAs.

Backtest results from October 2007 to May 2024

× ![]()