How to survive a historically severe market crash

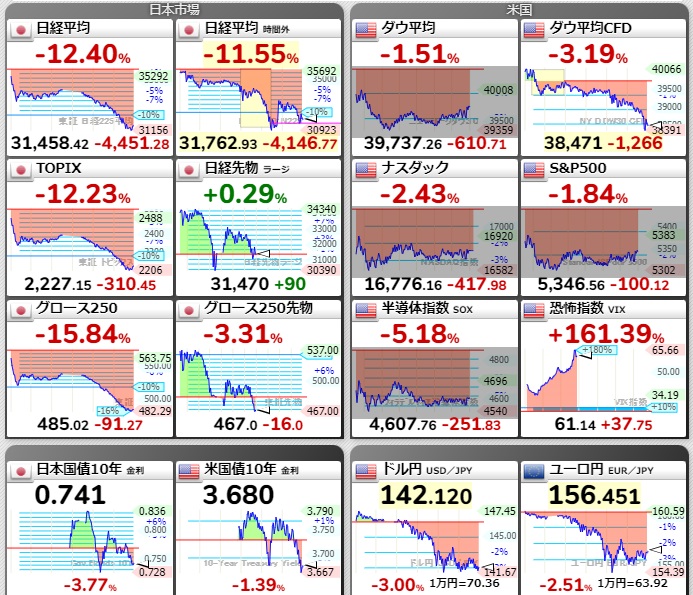

Today, Monday, August 5, 2024, has become a historic crash market, hasn’t it?

It was a day that reminded me of the market during the Lehman Brothers crash.

By the way, the foreign exchange market on October 24, 2008, saw the dollar/yen fall from 98 to 91 yen, and the euro/yen fall from 127 to 114 yen, a drop of nearly 10%, so the impact on the FX market was greater during the Lehman crash.

The significant drop in the Nikkei Stock Average after the Lehman Brothers collapse occurred on October 10, 2008.

On this day, the Nikkei average fell by 9.6% (881.06 points) and closed at 8,276.43.

On this occasion, circuit breakers were triggered in the Nikkei futures market.

(A circuit breaker is a temporary halt in trading to curb excessive market volatility)

In terms of instantaneous declines in the stock market, this crash had volatility comparable to the Lehman era.

I started investing in stocks and FX in 2007.

Experiencing the market during the Lehman crash allows me to trade calmly even in markets like the COVID era or today.

In EA trading, by using a mix of trend-following EAs and contrarian EAs, I can ride out this market.

For example, with the contrarian EA I developed, asset progression looks like this.

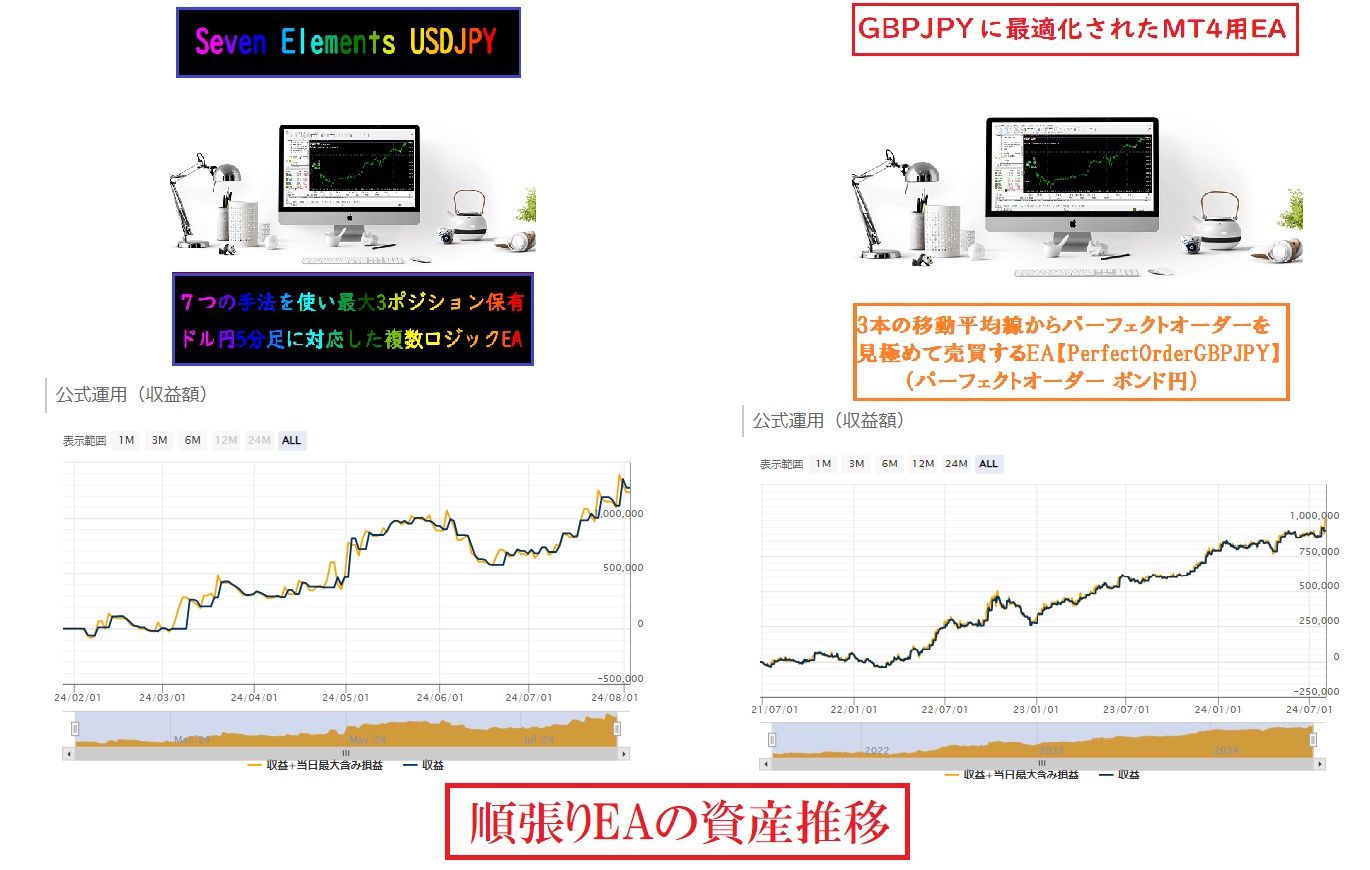

However, with a trend-following, momentum-following EA, profits can be substantial as shown here.

You understand, right?

In other words, in current high-volatility markets, trend-following EAs are the strongest.

Even when using contrarian methods, make sure to manage risk with proper stop losses or by reducing lot sizes.

× ![]()