Again, the buying opportunity hits the mark right on target! Futures buying advice at yesterday's open ~ From Tetsuo Inoue's "Market Trends" 10/16 issue ~

This article is reprinted from the e-newsletter of Investment Salon Tetsuo Inoue “Market Trends” distributed on Oct 16.

'Trend 651: Important - Five Buy Signals Lit for the First Time in 2 Years 4 Months; Check 32'

“As noted in ‘Sign’, the ‘Nikkei 5-Sign’ (buy signal), whose details were reposted last week, fully lit at the close yesterday.

Last Friday (close Thursday) it lit fully, on Monday (close Friday) the signal reduced to one, and today (yesterday, close Monday) it lit fully again, fulfilling the criterion of “fully lit in 2 out of 3 trading days.” Therefore today, a quantitative (system) advisory, “buy 2 mini futures (December contract) at the opening” will be carried out.

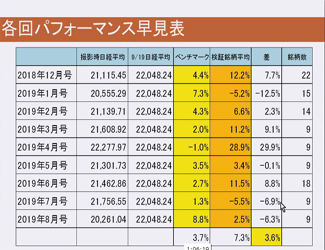

This lighting remains the same as the previously described “since 2010, nine buy-signal appearances.”This time marks the first signal since it appeared in April 2016, i.e., the first time in 2 years and 6 months. On a Nikkei Average closing price basis, it appeared after an 8-trading-day drop of exactly 2,000 yen (from 24,270 to 22,271 yen), a decline of 8.2%.

As shown in yesterday’s four charts, we have not yet confirmed a bottom using quantitative evidence; therefore,going forward, if the index falls further and the futures are in a loss state, the buying by qualitative signals could ultimately become averaging-down purchases, which is noted in advance.

Post-purchase-advice, exit decisions are up to individuals, but in this series, as a level to be mindful of, we first highlight the daily “three divergences (5-day, 25-day, 75-day) total plus 5%” level described in ‘Sign’.