We asked Mr. Tomo Hirano to teach us a method that makes RSI respond sensitively to detect clear entry opportunities【FX Video】

We spoke with Tomoyuki Hirano, who is proficient in technical analysis and continues to thrive in the FX world using a wide range of trading methods. He shared a method for catching buy/sell timing with an RSI tuned to respond sharply to price movements. (Interview: Editorial Department, Shikanai)

What you can learn from this video

In this video, you will learn the following:

- Common uses of RSI and the differences and advantages of this method's unique approach

- The meaning of using two timeframes

- Unique rules for taking profits and cutting losses

- Illustrative trading points using real charts

● Video length: 7 minutes 13 seconds

Tomoyuki Hirano Profile

After graduating from a university in the United States and working in overseas exchange-related roles, he joined Himawari Securities. He has handled FX operations in trading, served as a dealer in the proprietary trading desk, and provided FX and Nikkei 225 information through the Investment Information Room, as well as giving seminars. He is currently independent and has established Trade Time Co., Ltd. He actively disseminates information to FX companies and conducts seminars while engaging in proprietary trading, investment education, and support for individual investors.

Official site:TradePress Winning FX Blog

A word from the editor in charge, Shikanai

Most general oscillator indicators, including RSI, tell you when price has gone too high or too low over a fairly long trend.

But with this method, by deliberately using RSI more actively, it becomes a technique that clearly indicates trading opportunities.

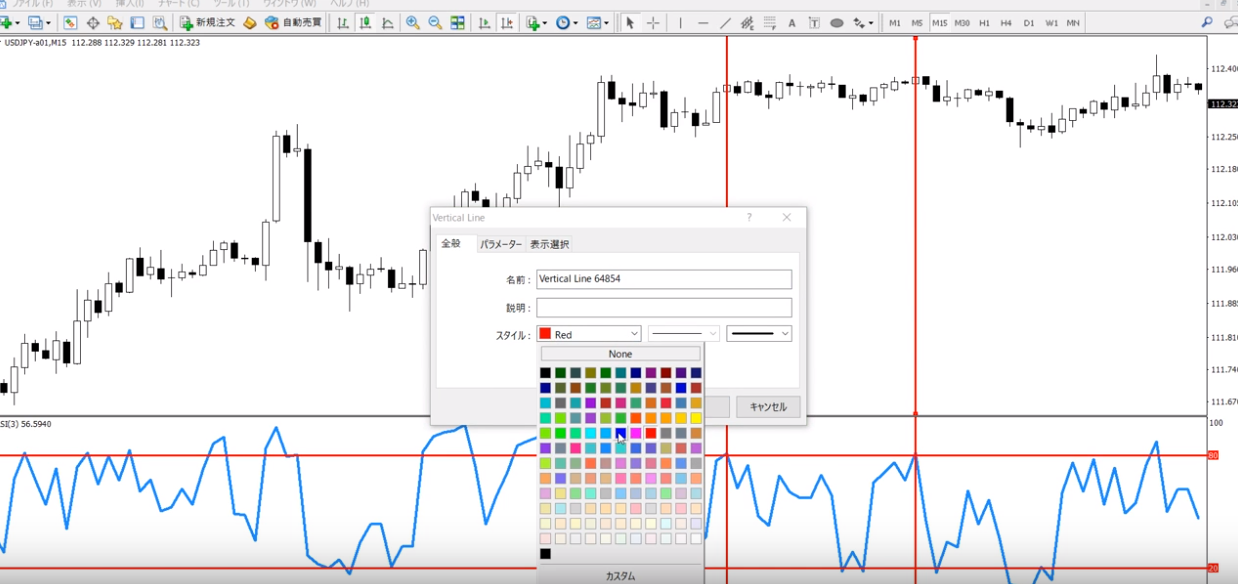

This is a sample from the video.

How to view FX strategy videos

The portion that those who purchased the article can view (located at the bottom of this article) embeds the FX strategy video. Click the play button to start the video.