“Adult Economics” Basic Course for FX Traders – Episode 8 Understanding the Relationship Between the Stock Market and the Foreign Exchange Market [Koichiro Amaya]

The theme this time is "The relationship between the stock market and the foreign exchange market." Stock prices are in a different domain from fundamentals and economic indicators, but because their impact on investor sentiment is extremely large, in recent years they have become the factor that exerts the greatest influence on the foreign exchange rate. For those who perform fundamental analysis, stock markets are becoming important materials, so let's study them properly here.

Outline for the 8th Session

1. What does “stock price” mean in the foreign exchange market: “stock price index”

2. Japanese stock market rising does not necessarily mean yen appreciation

3. What is risk-on

4. What is risk-off

5. The virtuous cycle and the negative spiral

6. The fear index that indicates the degree of risk-on/off

7. The trinity of stocks, interest rates, and exchange rates

8. Summary of the 8th session

※This article is a repost and re-edit of an article from FX攻略.com January 2018 issue

Amaya Koichirō (Amaya Kōichirō) Profile

For more than 20 years, he held key foreign exchange roles at major overseas banks such as UBS, JP Morgan, and BNP Paribas. He has a background of ranking high in the Tokyo foreign exchange market popular dealer rankings in the financial magazine “Euro Money.” In 2006, he became a freelance financial analyst, providing FX market information with his own sharp perspective to FX companies and portal sites.

twitter:https://twitter.com/geh02066

What does “stock price” mean in the foreign exchange market: “stock price index”

When you say stock price, there are a vast number of listed stocks in stock markets around the world. For us participants in the foreign exchange market, there is not enough time to check the price movements of individual stocks, which number in the stars. What is utilized then is the stock price index. In the foreign exchange market, when we say “stock price,” we usually mean the stock price index.

The first thing we must check is the representative U.S. stock indexDow Jones Industrial Average (NYSE Dow)For market participants in the United States, stock indices like the S&P 500 and the Russell indices cover more stocks, but the Dow is the index that is most often featured in news and has a name recognition that everyone knows. For those mainly trading the FX market, you would normally watch the Dow, and if you have leeway, also check the tech-heavy Nasdaq Composite Index.

For Japan, watching the Nikkei 225 is sufficient. However, you should not only monitor movements in the Tokyo market, but also keep an eye on the Osaka Securities Exchange Night Session that trades after hours and the Nikkei 225 futures traded on the Chicago Mercantile Exchange (CME). If you check how the CME Nikkei 225 futures closed the previous day, you can roughly anticipate how the Tokyo Stock Exchange might open that day.

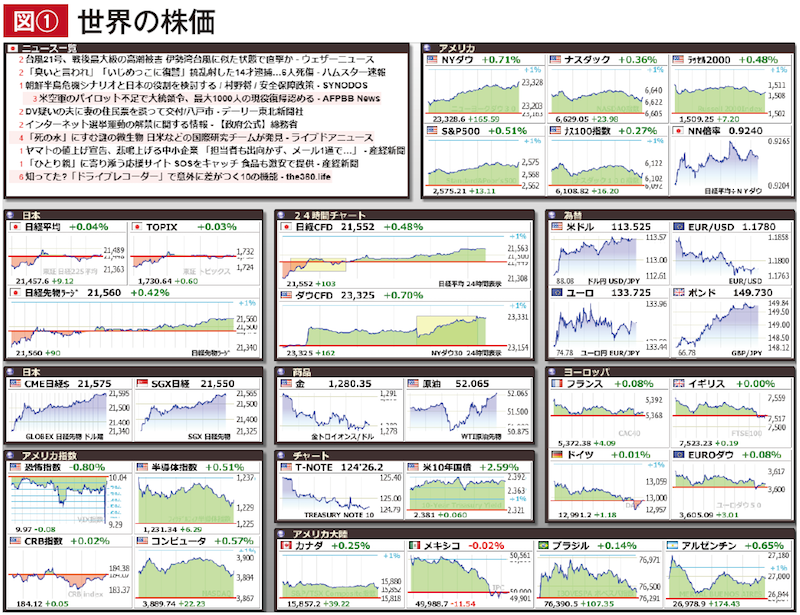

Also, the Dow futures are traded on CME Globex and can move significantly during Asia and European time zones. There are various portal sites (e.g., Figure 1) where you can view these indices and futures in real time, so please try them out.

By the way, compared with U.S. and Japanese stock indices, European and other regional indices have a smaller impact on the foreign exchange market. Beginners should first develop a habit of thoroughly checking the U.S. and Japanese stock markets.