Dollar/Yen briefly breached 160 yen; then sharply fell back, strengthening by more than 5 yen! Was there currency intervention?

Around 10:30 AM on April 29, the USD/JPY briefly surged into the 160 yen range! After that, the yen strengthened sharply, and the yen was bought up to 154.50 yen.

It was a day when the USD/JPY moved more than 5 yen.

Finance Deputy Governor Kanda remained “no comment” on yen-buying intervention, but many experts believe there was intervention.

At the press conference, there was frequent use of phrases like “excessive volatility by speculators,” clearly signaling the Bank of Japan’s cautious stance toward these speculative moves.

Now, suppose we predict that intervention becomes more likely once the dollar/yen rate exceeds 160 yen in discretionary trading.

As a strategy, taking profit on long positions or triggering short positions would be effective.

However, even after breaking through 152 yen, there was no currency intervention, and at the April 26 Monetary Policy Meeting, Governor Kuroda’s remarks were interpreted as accepting yen depreciation, leading to the 160 yen breakthrough on April 29. Therefore, trades expecting intervention would carry risk.

If you could predict the timing of intervention when it exceeded 160 yen, you might have made substantial profits.

In EA trading, it is difficult to translate fundamentals analysis into a logic, so a decision had to be made whether to halt operation.

Since I am in the business of selling EAs, a real account is meaningful not only for asset management but also for checking EA performance.

Therefore, even in an extremely volatile market like this, I continued to operate the EA.

Also, the EAs I develop are designed to withstand sudden market moves, so if you watch your leverage, the risk of account ruin should be low.

For cross-yen momentum EAs circulating in the market, if you can endure a 5-yen price range, you could achieve explosive profits, but EAs that could not endure it would likely ruin the account.

With currency pairs like AUDCAD, the moves this time were not as large, so there didn’t appear to be much damage.

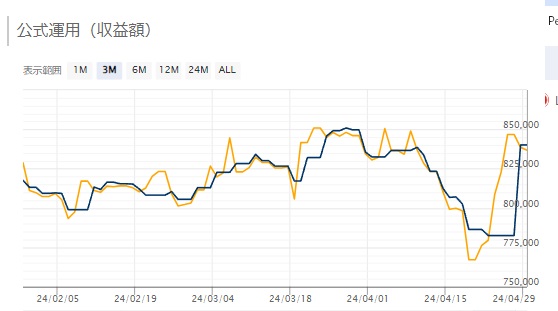

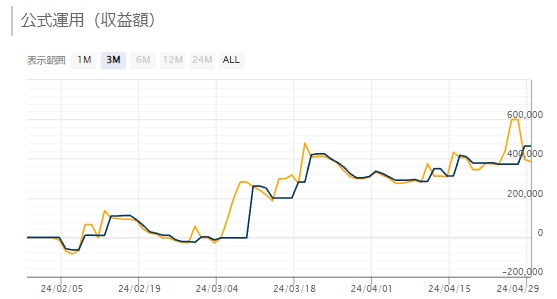

I’ll check what happened to my EAs during the market’s sharp move on the 29th.

Since the results come from GoGoJungle forward tests, there may be slight differences from real accounts.

PerfectOrder_GBPJPY

Around 10:30 AM on April 29, when USD/JPY jumped into the 160 range, there was an unrealized profit of over 100,000 yen (about 1,000 pips), but

after intervention and the yen strengthened, unrealized profit was halved to 57,514 yen at the time of profit realization.

Seven Elements

An EA released recently. Unrealized profit as of the 24th was 226,630 yen, reduced to 92,070 yen and then closed.

Hybrid EA Trade USDJPY

As of the 26th, there was a unrealized profit of 28,766 yen, but on the 29th, the yen appreciation wiped out the unrealized profit, resulting in a -43,490 loss.

MTF Trading USDJPY

Holding a long position for more than a month and not taking profit until the moment unrealized profit reached 1,000 pips, did intervention occur?

Unrealized profit dropped sharply and closed with a realized profit of 62,196 yen.

The four above are all trend-following EAs.

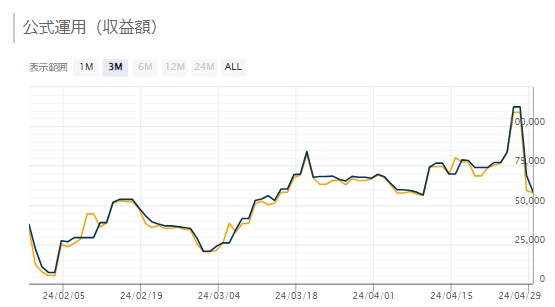

Contrarian EA "Reversal Seven"

Reversal Seven is a contrarian-type EA, and in this sudden move, its performance was the exact opposite of the other trend-following EAs.

At 160 yen for USD/JPY on the 29th, the trend-following EAs achieved maximum unrealized profits.

Then yen strength, likely due to intervention, halved the unrealized profits, and some EAs turned to losses.

For the status of currency intervention, you can check the Ministry of Finance homepage under “Status of Foreign Exchange Market Operations.”

Whether there was intervention on 4/29 will be published by the end of May.

In terms of performance alone, unrealized profits increased only to disappear; unrealized profits are illusory until they are realized, and assets do not grow unless you realize profits.

For trend-following EAs, this “bearish-to-bullish in price” market is just noise.

If there is no intervention and the yen remains weakening, trend-following EAs will yield huge profits.

Also, if the intervention’s effect is not just a 5-yen range but a 10-yen or greater swing to the yen, taking a quick reverse short would also lead to profits.

Ultimately, trend-following EAs profit when strong trends occur, while range-bound or whipsaw markets favor contrarian EAs.

× ![]()