April 26, 2024 Large fluctuations in cross-currency pairs in the foreign exchange market and EA operations

Let's consider the factors behind the high-volatility market on April 26.

1. Rapid Cross-Yen declines and suspected intervention and rate-check

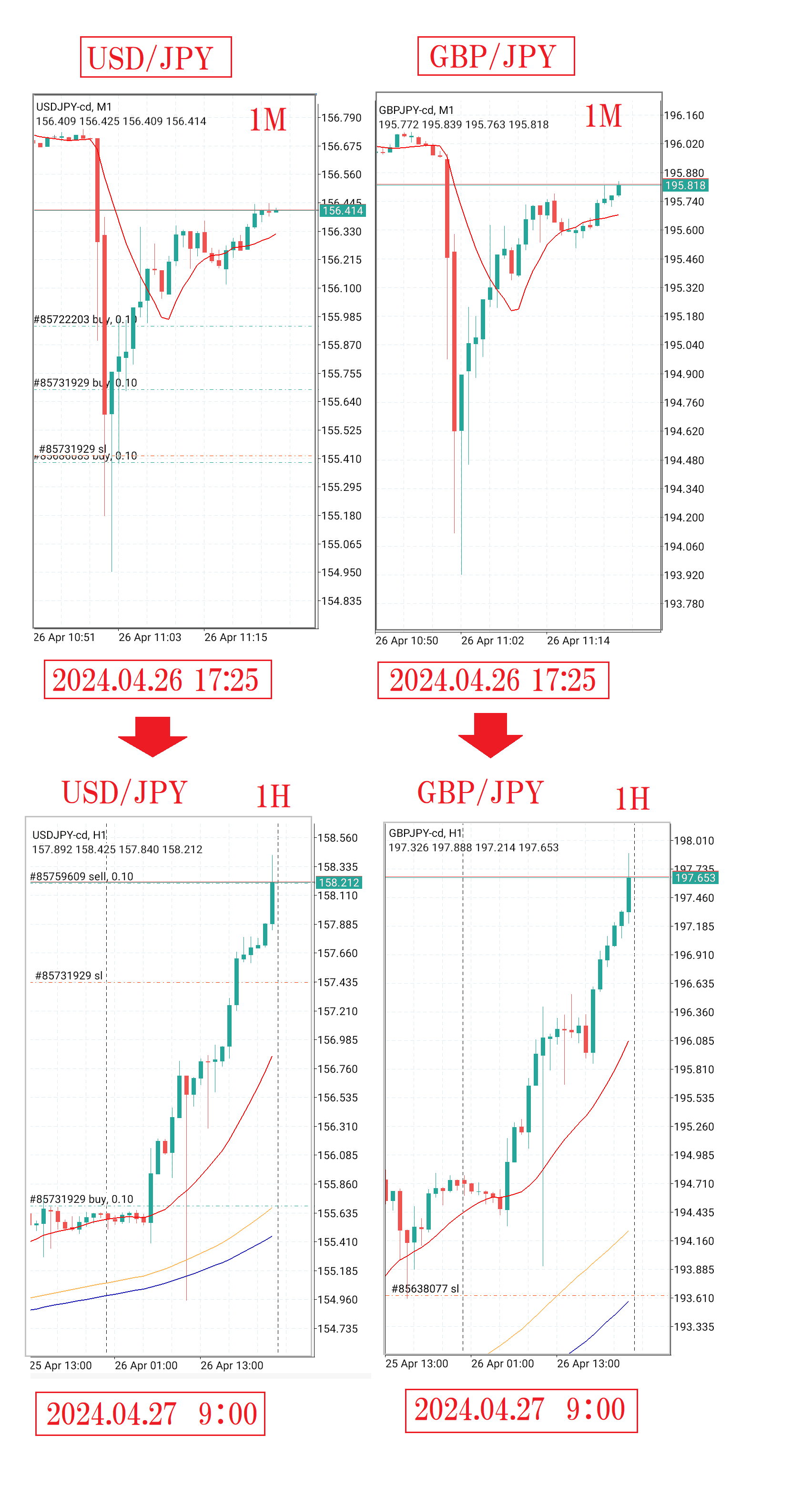

After 5:00 p.m. on April 26, following a press conference by BOJ Governor Kazuo Ueda, the USD/JPY sharply fell from the high 156s to 154.97 in about two minutes (yen appreciation).

There were rising suspicions of intervention or rate checks, but afterward the USD/JPY returned to its original level, and views skeptical of intervention strengthened.

There was also a sense of vigilance that intervention might occur in the evening after the BOJ meeting, suggesting the possibility of manipulation by a large player.

2. BOJ considering reducing large-scale government bond purchases

On the second day of the policy meeting on the 26th, the BOJ was examining a reduction in government bond purchases.

In March, with a move toward normalizing large-scale easing such as ending negative rates, a reduction in government bond purchases had been postponed.

If Governor Ueda had stated in the press conference that monetary tightening was warranted, there was a high likelihood that the market would have shifted to a stronger yen trend.

3. Impact on EA (Expert Advisors)

On the 26th, cross-yen currency trend-following EAs would have been long at the timing of the press conference.

After the press conference, there was a sudden drop to 154.97 due to a speculative move, but the price quickly recovered, so EAs that did not trigger a stop-out survived safely.

However, if the press conference contained statements suggesting monetary tightening or if actual intervention had occurred, USD/JPY could have fallen below 150.

On days with highly volatile moves at the time of events, many EA developers recommend stopping EA activity because technical analysis may be ignored during these moves.

I am of the view that EA should continue to operate even during economic data releases and events.

4. Why I do not stop the EA

The greatest advantage of automated EA trading is that it can run hands-free.

It trades automatically 24 hours while you are working or sleeping.

If you stop during economic data releases or events, you need to operate the EA.

Events with a known schedule can be handled, but unexpected events cannot.

In other words, you are always exposed to risk when you have open positions.

As an EA developer, what I can do is design the EA logic to anticipate sudden price movements.

If the EA can handle it, it can be left running even during economic data releases or events.

5. What happened to my EAs on the market swing on the 26th?

PerfectOrder_GBPJPY

There had been a losing streak since January, causing a drawdown, but thanks to the rise in GBP/JPY this time, the current unrealized profit is 64,184 yen.

The monthly plateau is coming into view.

This is a trend-following EA. Due to the spike in USD/JPY, the unrealized profit is 32,059 yen.

A recently released EA. Since starting forward testing, assets have been increasing steadily, and the current unrealized profit is 226,630 yen due to the recent USD/JPY surge.

During the active trading hours of the day, it grows profits with trend-following; during the less volatile periods, it uses contrarian trading.

The market movement matched, and the performance on the 26th yielded a profit of 28,766 yen.

Since the USD/JPY entered an uptrend, forward testing began, and it has held long positions for over a month without a single take-profit, approaching 1,000 pips in unrealized gains.

Of the five EAs above, four are momentum (trend-following) types, excluding Hybrid EA Trade.

If intervention had occurred on the 26th or if Governor Ueda had spoken about monetary tightening in a press conference, I think these momentum EAs would have cut losses in the downturn and reversed to short positions.

If the trading had been stopped, there would have been neither wins nor losses.

Ultimately, since you cannot know whether it will rise or fall, you may choose to keep the EAs running or stop them; however, if your logic has an edge, continuing to run will likely increase total profits.

I think this is a matter of personal preference for how to handle it.

Finally, the contrarian EA “Reversal Seven.”

Reversal Seven is a contrarian EA, and during this sudden change it did experience a drawdown.

Since forward testing began, it has steadily increased assets.

× ![]()