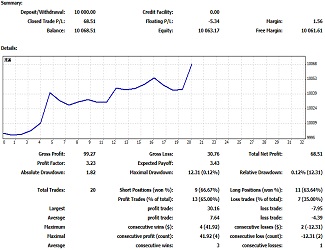

EA「Zix」 since launch 7 months, profit/loss rate 46.3%, win rate 77.31%, profit factor 1.71

The EA "Zix" being forward-tested on GogoJyan has now reached exactly seven months since operation began.

So far, I believe the development concept of an EA with no trendiness or lulls—no ups and downs—has been realized.

About one month after starting, I incurred a sizable unrealized loss, and the maximum drawdown reached 70,722 yen. This has been a bottleneck, making the risk-return ratio (profit ÷ maximum drawdown) hard to exceed 1, but recently it has surpassed 1.

Other figures are: profitability 40.96%, win rate 77.31%, profit factor 1.71, etc.—these can be considered excellent results.

The EA “Zix” is a grid (n-placing) EA that trades only in the direction specified by its parameters.

Forward testing is conducted on the AUD/JPY 15-minute chart, and it is a buy-only strategy aiming for positive swaps.

Profit comes from price difference profits and swaps.

The graph above appears to show only the price difference profits, while the actual P/L including swaps is as follows.

There are cases where swaps are not earned on 15-minute trades, but swaps still push profits up by more than 5%.

There are many periods with unrealized losses, but when the market trends downward, this is how it looks. During these times, I n-plot (averaged) and accumulate swaps while waiting for a market reversal. The largest number of positions held to date is seven, meaning the number of times I placed grid orders is six.

When the market is in an uptrend, I take profits by repeating take-profit actions with fewer grid placements (or with no grid placements at all).

Looking at monthly performance,

Profit in February was lower since operation started mid-month, but other months are nearly around 10,000 yen. This is the result of trading with the minimum lot size (the margin is 1,000,000 yen for forward testing, but there is room to increase the lot size since there is margin available).

Win rate remains around 75% and relatively stable.

I believe these points reflect the development concept of an EA with no pronounced ups and downs—the idea of stable performance.

The currency pairs support all pairs, and all timeframes are supported, but it is advisable to avoid five-minute charts or shorter. The detailed reasons are written on the product page.

As a long-term swap strategy, operating NZD/JPY on a 4-hour chart could also be effective.

↓ This is also performing well

This article is an excerpt from the blog “テく and freely set up can make the market a tool of luck”読んで自在に張ると相場は打ち出の小づちになる”