3/19【Backtest Evaluation Method】We explain all items in the backtest image18

This is Double-Eye from the era of Reiwa, the EA developer.

First of all

EA developers assess the quality of an EA through

“backtesting.”

Therefore, as a user,

to “distinguish the quality of an EA”

you need the skill to evaluate backtests.

With that in mind, this series will

describe how to find consistently profitable EAs from backtests.

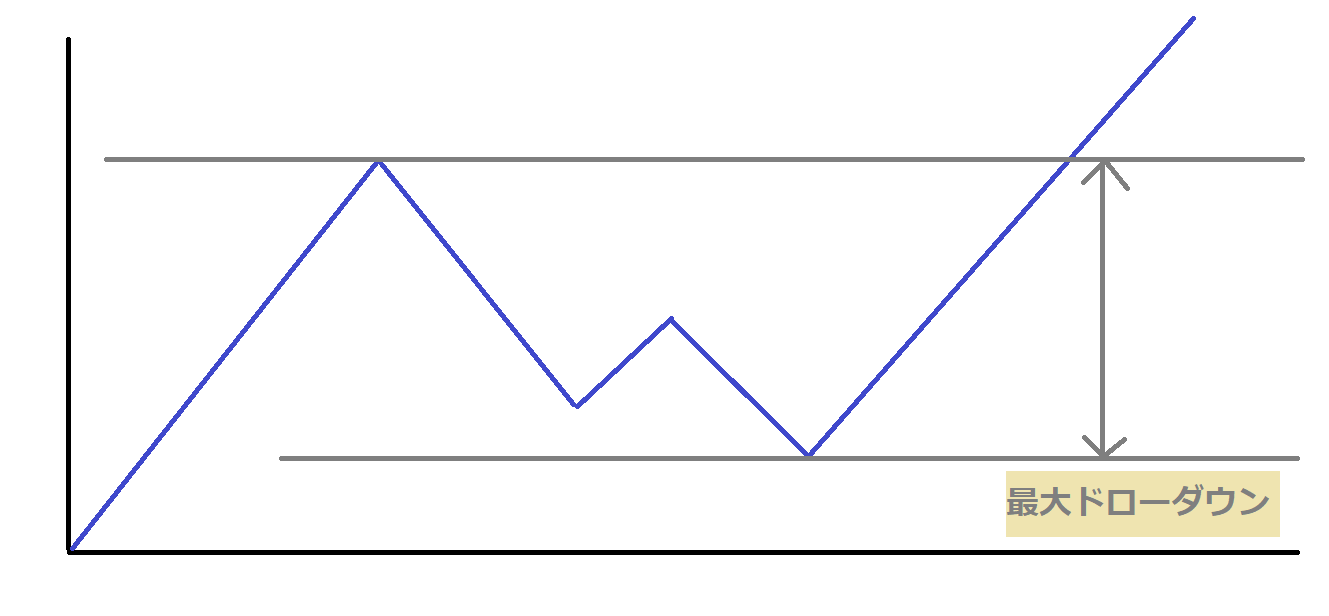

【Absolute Drawdown, Maximum Drawdown, and Relative Drawdown】

In backtests,

many people check the maximum drawdown.

It is important to know roughly how large the expected maximum drawdown is.

Among them, there are three types of drawdowns listed.

● Absolute Drawdown

This can be ignored.

It represents the amount of maximum drawdown from the start of the backtest,

but it varies depending on the start time, so it is not very informative.

Some unscrupulous EA developers may

adjust the start time so that this value becomes zero,

and then claim things like “Absolute Drawdown is zero! No losses!!”

to hype sales, but you can ignore such claims.

● Maximum Drawdown

This is the amount of loss from the peak to the trough until a new peak is reached,

including drawdown that occurred during the period.

(Includes unrealized losses)

If the EA starts operating awkwardly right at a peak,

the maximum loss that can occur is shown.

Therefore in backtests,

must be considered; otherwise, the account could be wiped out, so this is a factor to reference.

(Some people operate with only the maximum drawdown capital, but that is NG!)

※Sorry for the lack of artistic flair…

If you search a site, you’ll probably find proper representations (laugh).

And now comes an important point,

In backtests for simple (single) operation,

do not view Maximum Drawdown in percent.

Sometimes backtests for simple operations are published,

with statements like “Maximum Drawdown under 5%!!”.

But if you set more initial margin or reduce lot size to 0.01, you can reduce the percentage as much as you want,

so developers who write that are either unethical or lack sufficient knowledge, so please steer clear.

Therefore,

you should view it based on the amount per published lot,

in other words

you should be able to see the Maximum Drawdown in pips.

And,

As a guideline, when it exceeds 100,000 per 0.1 lot,

I feel that the Maximum Drawdown is relatively high,

but don’t judge by that alone,

always check the balance with the net profit,

that is, check using the recovery factor.

----------------------------------------------------------------

2/13 – About the Recovery Factor that is important in EAs2/13 – About the Recovery Factor that is important in EAs

https://www.gogojungle.co.jp/finance/navi/articles/65039">https://www.gogojungle.co.jp/finance/navi/articles/65039">https://www.gogojungle.co.jp/finance/navi/articles/65039https://www.gogojungle.co.jp/finance/navi/articles/65039

----------------------------------------------------------------

On the other hand,On the other hand,

for compound interest operations you should view it in percent (i.e., ratio).for compound interest operations you should view it in percent (i.e., ratio).

In compound interest operations, you operate with a certain lot ratio relative to your funds,In compound interest operations you operate at a certain ratio of lots to funds,

so the lot size always changes as a percentage of your funds.so the lot size always changes as a percentage of funds.

Therefore, please check using percentage figures.Therefore, please check using percentages.

● Relative Drawdown● Relative Drawdown

The previous Maximum Drawdown was based on absolute monetary value, butPreviously, Maximum Drawdown was in monetary terms, but

this shows the Maximum Drawdown as a percentage.this is shown as a percentage.

For example,For example,

starting with 1,000,000 yen and experiencing a 100,000 yen drawdown immediately,starting with 1 million yen and a 100,000 yen drawdown occurs,

that is 10% of funds.that is 10% of funds.

Meanwhile,Conversely,as funds grow to 2,000,000 yen,as funds grow to 2 million yen,

and the same 1,500,000 yen drawdown occurs,the same amount of 1.5 million yen drawdown occurs,

the percentage is 7.5%.but the percentage is 7.5%.

The amount is larger at 150,000 yen, but as a percentage, 10% is larger.The amount is larger at 150,000 yen, but as a percentage, 10% is larger.

So for compound interest, it is good to check this.So for compound interest operations, it is good to check this.

With that said,That said,

--------------------------------

2/13 – EA Important Recovery Factor

https://www.gogojungle.co.jp/users/112481/products">https://www.gogojungle.co.jp/users/112481/products">https://www.gogojungle.co.jp/users/112481/productshttps://www.gogojungle.co.jp/users/112481/products

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

instead, balance it with net profit using the recovery factor.instead, balance with net profit using the Recovery Factor.【Reiwa no Daru Ei’s listing of EAs】【Reiwa no Daru Ei’s serial articles】

■EA Beginner’s Course

https://www.gogojungle.co.jp/finance/navi/series/1700

--------------------------------

https://www.gogojungle.co.jp/finance/navi/articles/64703

https://www.gogojungle.co.jp/finance/navi/articles/64738

https://www.gogojungle.co.jp/finance/navi/articles/65619

https://www.gogojungle.co.jp/finance/navi/series/1701

https://www.gogojungle.co.jp/finance/navi/articles/64723

https://www.gogojungle.co.jp/finance/navi/series/610

【Reiwa no Daru Ei’s Beliefs】