Cryptocurrency arbitrage x compounding investment strategy

![]() That Einstein once said.

That Einstein once said.

"Compound interest is humanity's greatest discovery!"

Do you know the word arbitrage?

In Japanese, it is also called arbitraje (arbitrage).

Cryptocurrencies like Bitcoin are bought and sold on sites called exchanges, but

the price of coins varies by exchange.

and sell it on Exchange B for 1,100 yen to gain a profit margin—this is arbitrage.

Because you buy and sell at the same time once a price spread appears (in other words, profit is realized at that moment),

it is a trading method with almost no chance of loss.。

What happens if you apply compounding to this arbitrage method?

In operation from November to December last year, monthly yields exceeded 20%;

even now, it averages around 7–10%.

If you reinvest the profits obtained here every month and operate this long-term, what will happen?

Yes,"the effect of compounding"is used.

Even with a minimum monthly yield of 5%, compounding would produce enormous profits.

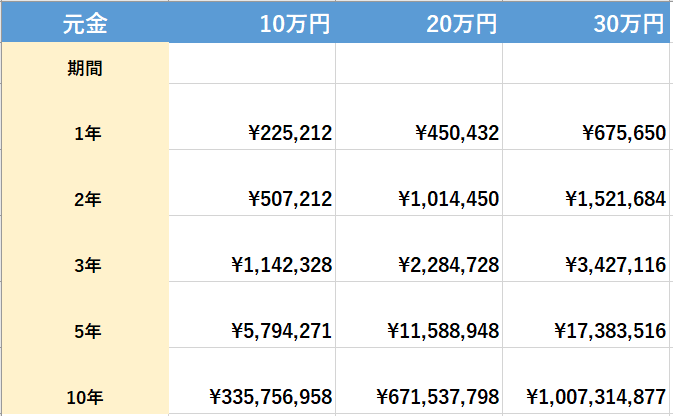

I have run a compound interest calculation simulation.

<Simulation of compounding at 7% monthly in a cryptocurrency arbitrage system>

Arbitrage is a zero-risk, high-return, groundbreaking investment method with no losses.