December 1 (Fri): [Bollinger Bands] Nikkei 225 VS GOLD

Good evening?

I have plans from the morning tomorrow as well (to buy my child's Christmas gift…)

Please consider this tonight’s post?♂️?

Yesterday’s「Do not carry year-end money」as a supplement.

Do you all remember the “Flash Crash” I introduced last year?

For those who recently started investing, some may not know it, so I’ll post it again.

Copied from last year’s article though…?

January 3, 2019…

Do you know about the incident that happened on this day?

Yes,the “Flash Crash”!!!

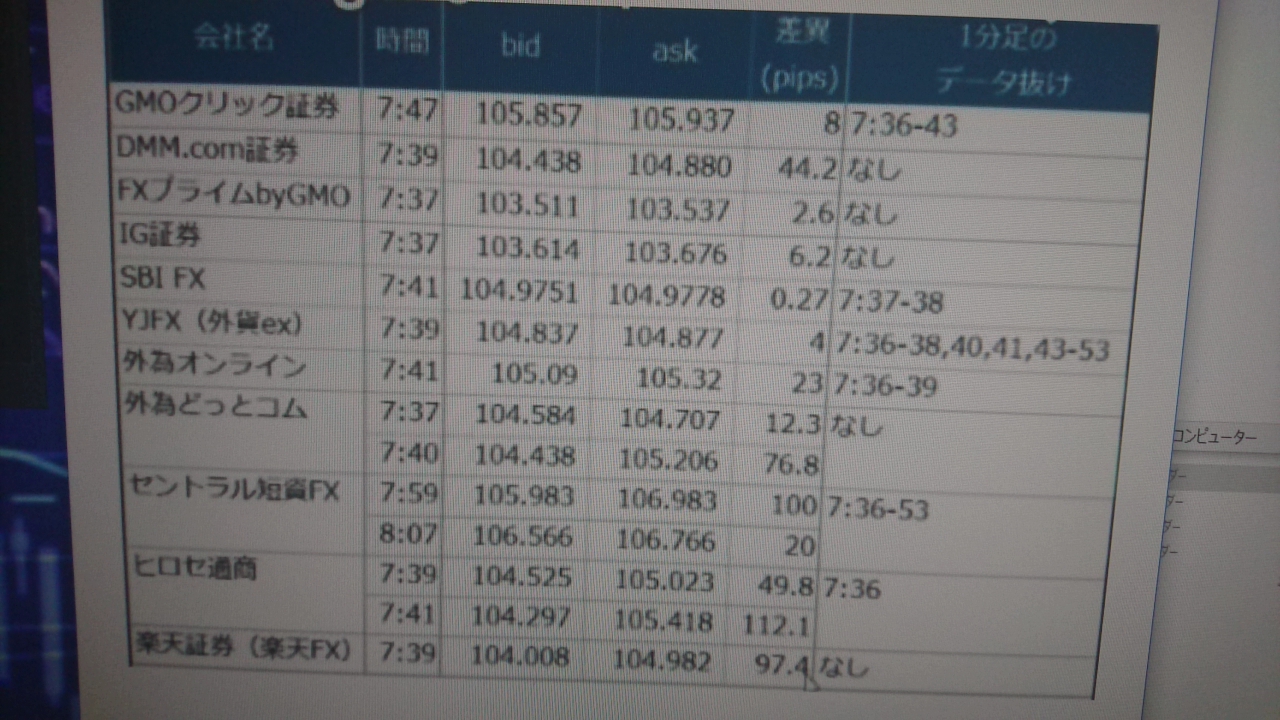

Dollar-Yen dropped sharply at the start of the year?

The spreads widened to an unbelievable extent??

There are huge discrepancies between brokers, aren’t there?

With large brokersspreads widened by 100 pips or more as well?

It is generally said that you shouldn’t hold positions over year-end/ New Year.

Because you could get swept up in a flash crash like this, you know?

Please also think carefully about what you will do to avoid regrets!

An industry where spreads widen is a bad broker,

and a broker where spreads do not widen is a good broker.

That’s not necessarily true?♂️

A broker whose spreads widen isn't inherently bad; sometimes it happens to prevent trading from being blocked,

and as a result they connect to a liquidity provider, which causes spreads to widen.

That’s also one of the reasons.

There are various underlying factors I’d like to mention,

but GogoJungle has cautioned about this several times, so I’ll refrain this time lol

Broker selection is also part of trading.

No broker is perfect, but among them, choose a place where you feel you can entrust your precious money!

This time I will look at the comparison with GOLD, which usually has an inverse correlation with stock prices.

(※From here on, it is limited to members.)