The Way of Investment (Part 88)

The Way of Investing (Part88)

“Autumn Festival Special Edition”

Invest with a broad perspective

1. This time, I will change my viewpoint a little and take a broader, more big-picture view of the market situation.

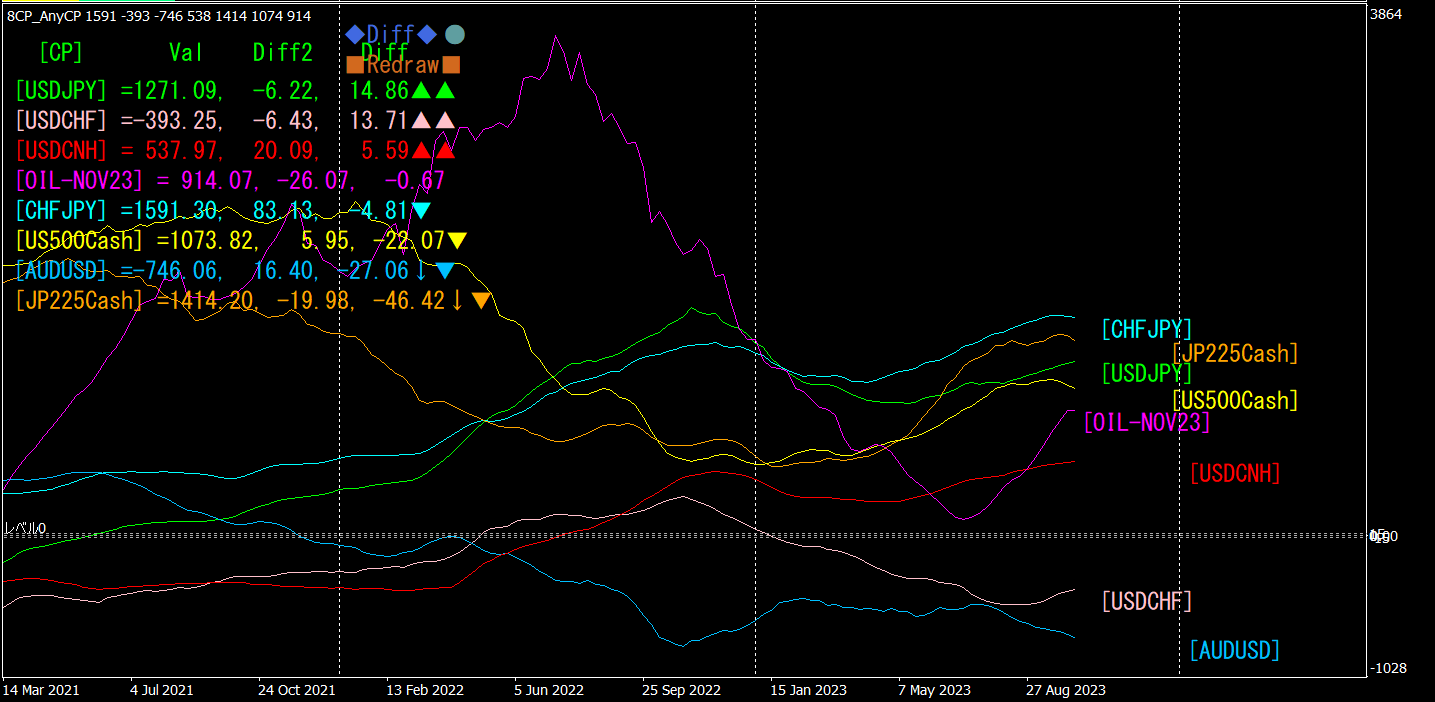

So, I will use a weekly chart. The indicators used are32040“8CP Visualization IndicatorAnyCP.” As the name suggests,AnyCP, soCFD

USDJPY,USDCHF,CHFJPY,AUDUSD,USDCNH,OIL,JP225,US500 are8 instruments compared.

(USDCNH is the USD/RMB pair.)

USDJPY andJP225 (Nikkei 225) appear to have an inverse correlation.

OIL andUSDJPY seem to have a positive correlation.When the price of OIL rises, it damages the Japanese economy, which leads to a depreciation of the yen as a result.When the price of OIL falls, the USDJPY tends to move toward the yen appreciation with a slight lag. Right now,OIL seems inclined to increase, so in the futureUSDJPY is expected to move further toward depreciation of the yen (could the dollar-yen reach yen?!).

Just by glancing at the weekly chart, one can grasp a coarse directional sense: crude oil prices rising, the dollar/yen weakening the yen, and the Nikkei average falling.