EA「Zix」 can also trade Bitcoin?!

This is only a playful level, but I ran a backtest on BTC using the EA “Zix.”

Why did I decide to run such a test?

Because EA “Zix” has a feature that automatically adjusts the profit target range and averaging intervals based on the time frame and price, so I thought it might be applicable to BTCJPY markets that jumped from several tens of thousands to over two million yen.

I chose daily bars to reflect the market’s character (I only tested on daily data).

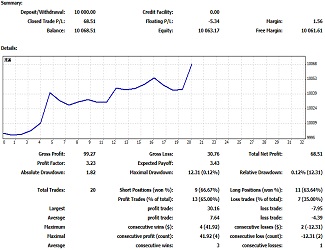

The results are as follows.

Test account: BITPoint Real Account

Margin: 1,000,000 yen

Currency pair: BTCJPY

Backtest period: 2016.12.26 - 2018.07.24

Time frame: Daily

Detailed data ⇒st_zix_btcjpyDA.htm

The final drop in the equity curve occurs because the data reached the end and some averaging positions were closed midway (see the chart below).

The reliability of the test itself is low. This is because MT4 can only backtest with fixed spreads.

Actual markets fluctuate from tens of thousands to over two million yen, so spreads should adjust accordingly, but that isn’t possible, so for now I backtested with a normal FX spread (as if testing with a zero spread). As of today, the BTCJPY spread is around the 4,300 point range.

Nevertheless, the automatic adjustment function by time frame and price works effectively, and it seems to be usable to some extent.

↑ The current price is just a little below the profit-taking point.

If anyone is considering operating the EA “Zix” on Bitcoin, please set the parameter “Max Spread” to several thousand points.

This article is an excerpt from the blog “Watching and placing freely makes the market a magic wand.”