EA「Miw」 is steadily increasing profits. This is the AUDCHF backtest result.

An EA named "Miw" undergoing forward testing at GoGoJungle since February 16 has seen its profitability rise to 83.28%.

It has been four months since the forward test began, and profits are steadily increasing.

In the Profitability Ranking (3 months), it had been #1 for a while, but is now second. Nevertheless, the 3-month return has consistently stayed around 60%.

The forward test is conducted on AUD/JPY 1-hour timeframe, but with the parameter settings, this EA can handle any currency pair and time frame.

Now, to the main topic.

Recently there have been inquiries like, “Are there any good currency pairs other than AUD/JPY and USD/JPY?”

Thus, I looked at several currency pairs that had not been tested before and found that AUD/CHF seemed promising, so I ran a backtest (actually, CHF has been treated cautiously since the Swiss Franc Shock in January 2015, making long-term backtests difficult, and Japanese traders do not trade CHF very much, so it was avoided).

As for how to find currency pairs suitable for this EA, those with large ranges on weekly and daily charts, and with many overlapping swing movements, are well suited.

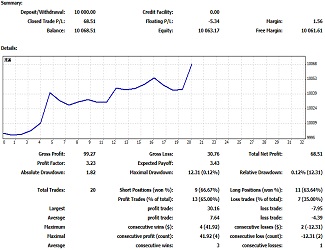

Two backtests were performed on the 1-hour chart. One started the week after the Swiss Franc Shock, and the other covered the entire period including the Shock. The parameter settings are the same as the GoGoJungle forward test (both Take Profit and Reference Value set to 300 points).

AUDCHF 1-hour, from January 19, 2015

Detailed data ⇒st_audchf.htm

In this test, the Profit Factor is 2.57 and the Relative Drawdown is 5.30% (55255.71), which are very good figures.

This is because the maximum number of averaging-down (grid) trades is four.

Next is the backtest including the Swiss Franc Shock for the entire period.

AUDCHF 1-hour, from September 8, 2014

Detailed data ⇒st_miw_audchf.htm

Looking at this chart alone, there doesn’t seem to be a shock market.

Therefore, let’s examine the chart on the day of the Swiss Franc Shock.

On the day of the Swiss Franc Shock, AUDCHF swung by over 1500 pips.

As you can see, the EA closed all positions a few hours before the shock and waited with hedged positions for the Swiss Franc Shock. Thereafter, it stepped in as the market declined, buying on the way down. It’s somewhat coincidental, but it shows that it can endure such markets, which surprised me (this is just a backtest; in reality, spreads can widen abruptly and orders may not fill, making real trading different from the backtest).

Incidentally, the chart of the backtest that started the week after the Swiss Franc Shock is as follows.

AUDCHF is a minor pair, and some FX brokers may not offer it, but I think it’s worth considering running this EA on it.

↓ For details about the EA, click here

This article is an excerpt from the blog “Observing and Spreading Will Make the Market a Cauldron of Fortune.”From there.