June 5 (Mon): Nikkei 225 vs Russell 2000 (Course: Everything is already priced into the charts)

Good morning ☀

Last weekend also surpassed the previous high again.

When you browse the internet, there are various opinions, so I’ll be vague about them.

The Kishida administration

・yen depreciation ~

・stock price increases ~

・the Bank of Japan ~

There are many things said, but the result isyen depreciation and stock price increases will continue in the future.

and some say things like that…。

Well, regardless of what the news or the world says, my trading is

'Everything is already priced into the chart'

I analyze and trade with that premise in mind.

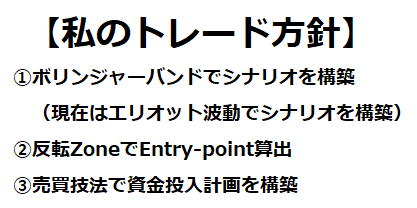

? This is something I’ve posted several times; it is my entire trading approach.

Because of this idea, at the second point of reversal Zone

'The chart stops at the points where it should stop'

I take contrarian entries based on this idea.

Therefore I don’t care about fundamentals,

analyze only from the chart,

and when it comes to points where a reversal may occur,

I enter without hesitation.

'Cleanly, purely, and untaintedly, and mechanically, I must enter' (day trading)

Mr. Oliver Velez and Mr. Greg Capra wrote something similar in their book “Day Trading,” didn’t they?

The book “Day Trading” is truly a good read, so for traders who haven’t read it, it’s worth a read!

(※The following is limited to members only.)