What is the advantageous time to buy USD/JPY? 13 years of research, Part 2

Hello!

This is Satori, researching FX.

This time we will deliver “What are the advantageous times to buy USD/JPY? 13 years of research, Part 2.”

Last time, “” was used, with DailyTrade’s buy side only turned on.。

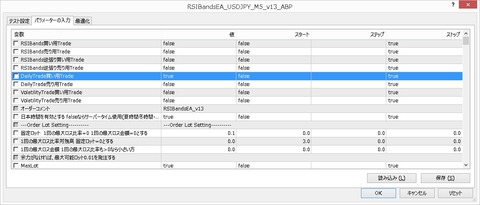

For reference, the lot size is fixed to 0.1 in Order Lot Setting.

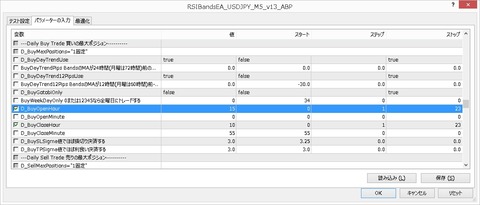

The diagram below shows the part that moves the trade start time and the settlement time.

Only the parameters that are checked will move the time from start to stop in steps.

In the diagram above, we move the new order time and settlement time from 0:00 to 23:00, one hour at a time.

The reason the settlement minutes are set to 55 is that the day’s exchange rate is determined at 9:55, known as the fix (benchmark rate).

That said, 55 minutes does not necessarily carry any special meaning.

Regarding the trend here, the Band’s most recent 20MA is higher than BuyDayTrendPips=0 (the 1-day-old 20MA),

and the Band’s most recent 20MA is higher than BuyDayTrend12Pips=0 (the half-day-old 20MA).

Incidentally, it is possible to set a push rule where the Band’s most recent 20MA is at least 50 pips higher than BuyDayTrendPips=50 (the 1-day-old 20MA),

and at least 25 pips lower than BuyDayTrend12Pips=-25 (the half-day-old 20MA).

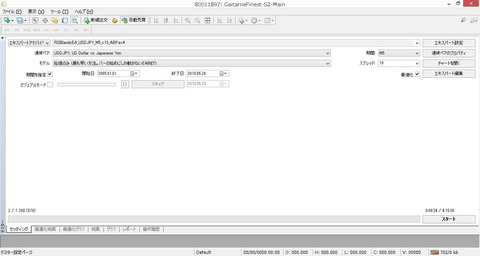

The diagram below is the MT4 Strategy Tester settings screen.

In the diagram above, the currency is USD/JPY, and the optimization data is generated at the open of the 5-minute chart.

The results are as shown below.

It seems best to buy around 3 PM or around 6 AM.

Next, in “What are the advantageous times to buy USD/JPY? 13 years of research Part 3,” we will look at the remaining balance curve and win rate of the advantageous times.

Thank you very much for reading today as well.

Please trade based on your own judgment and responsibility.