Cryptocurrency Market Analysis [March 21]

Cryptocurrency Practical Investment Article March 21

To all subscribers

If you have topics you’d like us to cover or questions, please contact us.

Q&A

We will introduce some of them in the corner.

【Ranked 5th in MagMag Mag Magazine Award】

The annual big newsletter site of 2020,

MagMag announced the newsletter awards,

and we were able to win an award.

※Current MagMag distribution has ended

and has transitioned to this article.

【Cryptocurrency Market Analysis】

Price changes of cryptocurrencies since last week

(one week) are summarized as follows

Summary: Current price (change over the past week)

※From this time, we will useドル (USD) notation. (Many cryptocurrency sources are from overseas, so USD notation is easier to express)

※11 USD = 134 yen

Bitcoin28,200USD(17%)

Ethereum1,773USD(5%)

Binance Coin337USD(9%)

Ripple0.39USD(5%)

Solana22.5USD(10%)

Cardano0.34USD(-%)

Polkadot6.2USD(1.6%)

Avalanche 17.7USD(4%)

Uniswap6.3USD(-%)

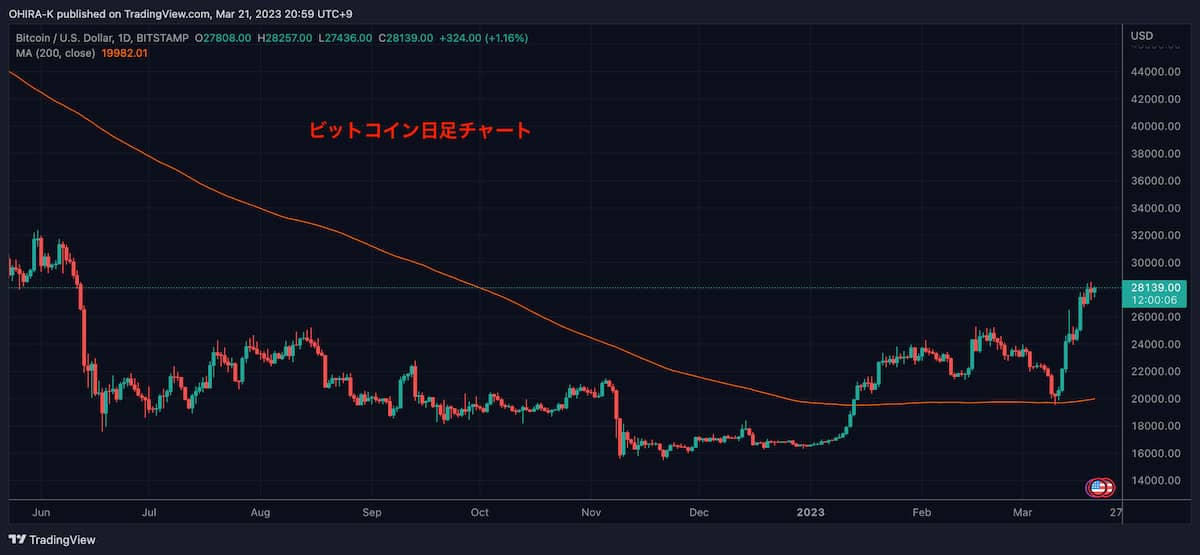

Bitcoin daily chart (USD)

Two weeks ago, it recorded an intrayear high of 26,000 USD, and last week it rose further, recording another intrayear high of 28,000 USD.

If 25,000 USD is considered a previous milestone, it suddenly surged and broke above it.

From the current perspective,

○Target price is 28,000 USD (level of May last year)

○Above the 200-day moving average

For the next target price, the milestone of 30,000 USD corresponds to last May’s level.

Weekly chart analysis is as follows.

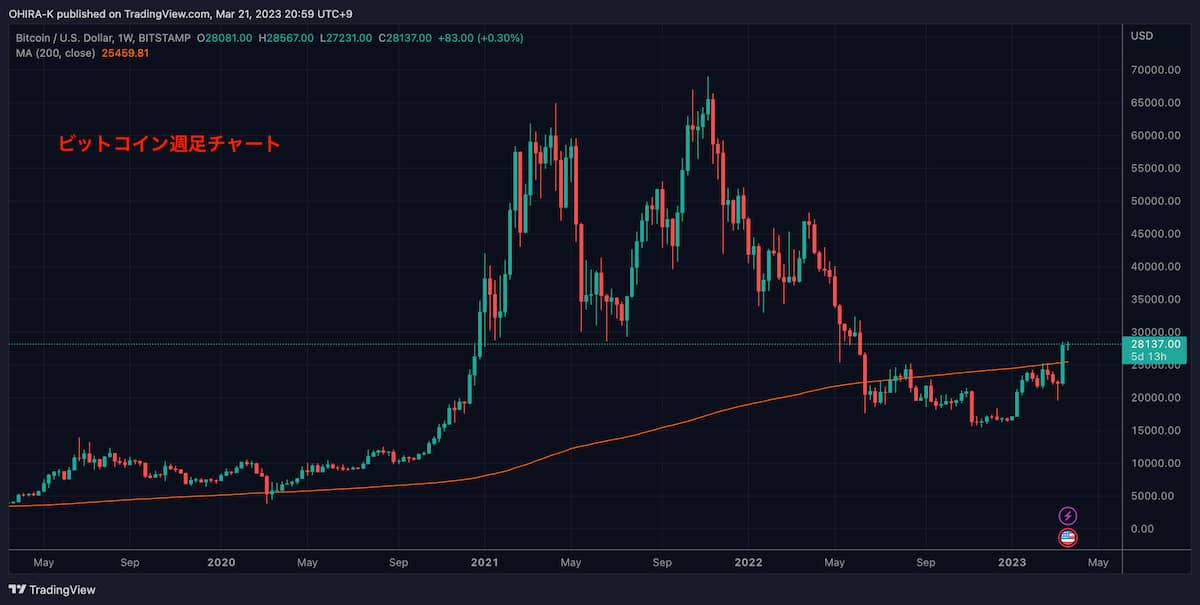

Weekly chart

・At the end of 2017 the peak price fell below for the first time this year.

・Break above the 200-day moving average (orange line)

Continuing from the week before, the weekly chart is breaking above the 200-day moving average.

In the short term, an uptrend is in place, and the 30,000 USD milestone is around the level of May last year and June two years ago; surpassing this would further reinforce the uptrend.

Nevertheless, recent Bitcoin price increases seem related to the banking turmoil and an increased focus on risk assets.

Australian big four banks issue stablecoins on Ethereum

Australia’s “Big Four” banks, the National Australia Bank (NAB) announced that it has completed the first interbank cross-border transaction using its own stablecoin

In issuing this stablecoin, the digital asset infrastructure providerFireblocksand fintech platformBlockfoldaided with smart contracts, direct custody of tokens, issuance, and settlement.NABissued as anERC-20token.

https://crypto-ai-digest.com/2023/03/14/1678793485009/

Stablecoins are cryptocurrencies pegged to fiat currencies (like dollars or yen), and they are issued on the Ethereum-basedERC-20standard. This is likely due to the high reliability of the Ethereum chain.

UK government adds “crypto assets” to tax filings

UK taxpayers will be required to separately report profits from crypto assets (virtual currencies) on their tax returns. Jeremy Hunt, the UK Financial Secretary to the Treasury, announced this in the annual budget released on March 15.Jeremy Hunt氏3月15日に公表された年次予算にて発表

https://www.neweconomy.jp/posts/303434

Foreign cryptocurrency taxes are increasingly applying not only to the amount but also, in some cases, taxing holdings for over one year at a 20% rate, among other measures.

In Japan, where higher earnings are heavily taxed, it is difficult to realize large profits (top tax rate 55%).

Holding for more than one year to reduce taxes is not necessarily the ideal policy for investment (selling immediately after buying can be highly speculative).

Bitcoin is traded speculatively

Concerns about U.S. banks are rising, but this should be a moment for Bitcoin (BTC) to shine, and Morgan Stanley Morgan Stanleystated in a report on3月13日の調査

However, in reality, “Bitcoin is not independent of the traditional banking system,”BTCprice is supported by “liquidity of U.S. dollar banks” and is traded more as a speculative asset than a currency, according to the report

https://www.coindeskjapan.com/177877/?utm_source=twitter&utm_medium=ifttt

Is money Bitcoin? Or the banks?

1Within less than a week,3 banks failed. The U.S. government moved to protect deposits to prevent further panic. It effectively rescued2 banks, and one was allowed to fail (actually, voluntary liquidation). The question remains whether this is the right move and what the risk of further bank failures might be.

However, there was no option not to rescue Silicon Valley Bank and Signature Bank from the start. Bank failures have become very rare and would have caused significant panic. Silicon Valley Bank and Signature Bank rode a wave of easily available funds created by the Fed’s policies. How far can private and public interests separate? If the U.S. government takes on the task of formal bank rescue, should deposits be left in banks?

https://www.coindeskjapan.com/177749/

Bitcoin has risen sharply in the short term while acknowledging speculative aspects, but the expression that government bailouts due to bank failures will lead to a decline in dollar value suggests a stance that Bitcoin is an asset, which I feel is being affirmed.

News that cryptocurrency wallets have been embedded in Microsoft’s edge browser

Information spread that the main Microsoft browser,edgehad an undisclosed cryptocurrency wallet feature added.

https://twitter.com/BTC_Archive/status/1637050622804475904

It is only added; ordinary users cannot use it yet.

Bitcoin could reach $1,000,000 in three months?

Balaji Srinivasan, former Chief Technology Officer of the major U.S. crypto exchange Coinbase, on the 18th warned of hyperinflation in the U.S. and suggested Bitcoin could reachBalaji Srinivasanin the next18 days, within three months to100万ドル(1億3,000万円)

This person argues, “Like the 2008 financial crisis, banks were lying.” There is a serious issue that banks do not hold enough funds to cover customer withdrawals, which cannot be explained by a typical fractional reserve situation and warrants warning.

Many banks have already failed.2008After the financial crisis, we should have learned to distrust bankers

Digital devaluation of the dollar is approaching and could be severe

Three months later, a million dollars is unlikely, but since 2017 or earlier, Bitcoin price targets of a million dollars have been heard little by little.

Here, rather than a strict million-dollar forecast, I quote the text because what matters is what basis this person has for such a claim.

※In the paid subscription section, we conduct deeper stock/coin analysis. Even beyond Bitcoin and Ethereum, I would like to delve deeper into investing. If you want to know the future flow of the cryptocurrency market and catch that wave, consider subscribing. Research is very important to continue.

(This article has been distributed since 2016)