EA「Zix」 further improve revenue through operation methods

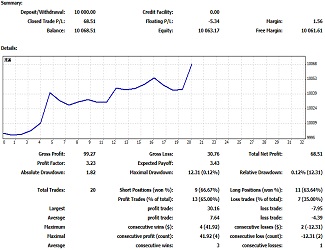

Since February 22, forward testing has started on Gogojan for the EA that accumulates profit from trading profit and swap, “Zix,” and it is steadily increasing its revenue.

The forward test is being conducted on AUD/JPY 15-minute chart.

First, regarding the revenue figures, the profit and loss graph shows 23,309 yen, while the detailed statistics show 25,789 yen, and they differ. This is believed to be because the revenue graph does not include swap points. The same applies to return rate and profit and loss rate. In any case, as the forward test has only a couple of weeks left, these are still good numbers.

Now, today I would like to introduce two methods to further increase the revenue of the EA “Zix.”

■ Method 1: Run the EA in two different directions

The EA “Zix” trades in a direction where swap points are positive, aiming for both trading profits and swap points. However, swap points are small compared to trading profits, so the purpose of this method is to increase trading profits themselves.

Concretely, for example, run EA “Zix” on AUD/JPY 15-minute chart with a buy position on the same account, and run another EA “Zix” on AUD/JPY 15-minute chart with a sell position (use a separate magic number).

By doing this, while the buy direction entails long-ninpo trades, the sell direction buys and sells repeatedly, increasing revenue. If successful, it could boost revenue by about 80% compared to trades in a single direction.

With this method, swaps may be negative overall, but the margin remains the same, so capital efficiency improves (this is assuming a max margin for hedging; most FX brokers use this method, but in a gross exposure system, twice the margin is required, so please be careful).

■ Method 2: Run another EA while averaging down

When you average down and hold more positions, it may take days for the trades to complete. As shown in the revenue curve above, there have been times when averaging down lasted about three weeks. Given the EA’s nature, such occurrences can happen, but in a sense, it is a waste of time.

Therefore, for example, when the number of positions reaches six, run another EA “Zix” with a different magic number. This allows you to profit from the fine movements of the market during averaging down. When the averaging down finishes, the additional EA stops operating.

This method requires a maximum of double the margin. It is suited for those with ample funds or accounts with low required margin due to high leverage.

Of course, combining Method 1 and Method 2 is also possible.

This article is an excerpt from the blog “Watch and freely apply, and the market becomes a magic wand”.