February 16 (Thu): Dollar Index (Free viewing item: What is the Dollar Index?)

Good evening?

Tax return season has started, hasn't it?

Starting this year? The required submission documents have been greatly reduced, right?

I used to bring everything, since I had many submission documents to print and submit every year, but apparently there are no submission documents now...?

I’ll look into it again when I have some time.

・Proof of insurance deduction

・Annual transaction report

It looks like these are also not required. (If I’m wrong, I’m sorry?)

Last year, a friend of mine printed and submitted an asset trading report as thick as a dictionary! lol

He said he was told not to go that far, but since he had printed it, he just submitted it as is lolll

I thought perhaps they wouldn’t look at all the submission documents, but

simplification is a good thing, isn’t it?

Let’s file the final tax return properly so there won’t be any unnecessary expenses!

Especially“expenses”are often not known or not claimed, so let’s handle them properly.

It will make a big difference!

Free viewing item: Tax return - expenses -?

https://www.gogojungle.co.jp/finance/navi/articles/48352

Please refer to this for more information.

TodayDollar indexDiscussion.

The Dow Jones seems to rise... NASDAQ seems to fall...

There are various ways to view the current situation.

So I thought I would also look at the strength of the dollar itself and analyze the dollar index.

Before thatWhat is the Dollar Index?

The Dollar Index is a measure of the strength of the U.S. dollar against major currencies such as the euro, yen, and pound.

|

Dollar Index ⇧ |

The dollar is being bought. |

|

Dollar Index ⇩ |

The dollar is being sold. |

We judge it as above.

For example, when USD/JPY is rising, is the dollar strong or is the yen weak?

If you also look at the Dollar Index, you can make that judgment as well.

Composition ratio of the Dollar Index

You don’t need to memorize it, but the euro accounts for more than half

Next, the yen and the pound have high weights, so know about those.

However, this ratio is calculated by

“Intercontinental Exchange (ICE)”

which determines the composition ratio of the Dollar Index.

There are also

“Federal Reserve Board (FRB)”

“Bank for International Settlements (BIS)”

“Dow Jones”

“Nikkei”

All of them compute it. Therefore the composition ratios differ for each, and the charts differ as well.

Generally, when people say “Dollar Index,”

the composition is the one calculated by ICE. Keep that in mind.

More than half of the Dollar Index against the euro.

Now, let's compare it with actual charts.

Blue: USD/EURDollar Index

(*For simplicity, I inverted the EUR/USD, creating USD/EUR).

What do you think?

They largely match, don’t they?

Next is the comparison with the second largest weight, the yen.

Blue: USD/JPYDollar Index

Then compare with the pound, which has the third largest weight.

Blue: USD/GBPDollar Index

(*For simplicity, I inverted the GBP/USD, creating USD/GBP).

Although the correlation seems to gradually break,it can be said that it generally correlates.

How to display Dollar Index on TradingView.

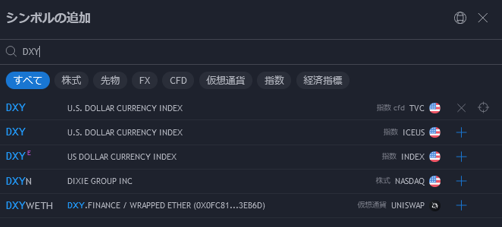

In “Add symbol,” search for DXY.

Three options come up, but essentially they are all the same, so any will do.

By the way…

・Yen Index (JXY)

・Pound Index (BXY)

・Euro Index (EXY)

・Australian Dollar Index (AXY)

There are also others.

(Note: Below, market awareness is for members only.)