EA「Zix」 is steadily increasing its profits.

Since February 22, forward testing started on GoGoJiang for the EA "Zix" that accumulates trading profit and swap, and it is steadily increasing its profits.

Details data ⇒Here

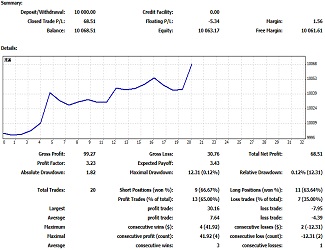

First, regarding the profit amount, the profit graph shows 21,749 yen, while the detailed statistics show 24,127 yen, and they differ. This is because the profit graph does not include swap accruals. The same applies to the profit rate and gain rate. In any case, as a second month of forward testing progresses, the EA that follows a steady-growth pattern is still able to retain a decent amount. At the current pace, an annual rate of more than 10% is expected.

Win rate is 77.22% (122/158), and the profit factor is 1.79, which also exceeds the results of backtesting.

The number of trades is 158, which is high, but this is because forward testing is performed on a 15-minute chart. This EA automatically determines the profit width and Martingale width according to the time frame and price. When the time frame is short, the profit width and Martingale width become smaller, resulting in a higher number of entries. It is also possible to operate on 30-minute or 1-hour charts, where the number of entries (i.e., Martingale instances) is reduced and the risk becomes lower. However, for forward testing, it is run under slightly higher-risk conditions to aim for a demo effect. Even so, with a 1 million yen margin, the account is unlikely to blow up.

Maximum drawdown is large at 34.89%, and as a result, the risk-reward ratio is low at 0.31. This is due to the higher risk taken by operating on a 15-minute chart mentioned above, but there are also other factors inherent to the trading method itself.

This EA, when the market is moving in the trading direction, closes profits when the running profit is greater than the profit width at the bar’s opening and re-enters the position. Eventually the market will reach a turning point, and thereafter it will switch to martingale trading. When the market is moving in the trading direction, positions are continually reopened, so the starting point of martingaling tends to be near the market peak or trough, resulting in larger unrealized losses. One might ask if there is a more intelligent method, but there is no perfect way to determine market turning points, and the original design philosophy is to abandon technical analysis and choose a straightforward approach to securing profits. Nevertheless, to add a twist to the martingale method, a modification has been added.

The martingale method is based on the Fibonacci sequence to determine the Martingale width and position size, and it further considers market movement to determine the Martingale point. This prevents a sudden surge in positions during surprises where the market moves rapidly in the middle of a big bullish or bearish candlestick, avoiding an unnecessary increase in Martingale frequency.

As the number of Martingale instances increases, one is forced into a long-term battle and unrealized losses grow. However, such markets eventually reverse, and profits can be realized, so one must wait. In the above profit graph, there are periods where the profit line is flat and unrealized losses are large, but it has returned to a normal state now.

As long as you trade the market, 100% safety and 0% risk are impossible.

Taking on risk is what yields profit.

Please consider that this EA demonstrates one particular form of the risks involved.

This article is an excerpt from the blog "Watching and Trading Freely Turns the Market into a Leprechaun's Pot of Gold."