EA「Miw」 development behind the scenes: “Dare to throw away common sense.”

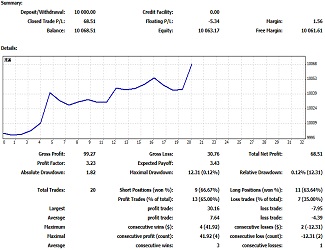

The following is the forward test result of the EA "Miw" that profitably trades both trend following and counter-trend at the same time on GoGoJungle.

The currency pair is AUD/JPY, and the timeframe is 1 hour.

For details of the test results,see here.

As you can see, favorable figures such as a return on investment of 38.41% and a profit factor of 3.75 are listed.

Also, as you can see from the average profit and loss, and the maximum profit and loss, the risk-reward ratio is excellent.

Today, I would like to write about why I created such an EA, the motivation and the background of the development.

I have created several EAs so far, but all of them were based on technical analysis, either following trends or trading on reversals.

Technical analysis works well in smooth markets, but real markets do not always remain smooth; rather, there are many volatile moments where technical analysis is not helpful.

So I thought about whether trading could be done without using technical analysis.

In every FX book, first there is technical analysis, and based on that, you decide entry and exit points, which is the standard approach.

In other words, I deliberately decided to discard common sense.

So, how would you trade?

You don’t know whether the market will go up or down.

For now, why not place a hedge (both sides) first.

Then, as the market moves, one position will be in profit while the other is in loss.

So, you average down on the losing side (add to the losing position).

Eventually, the market reverses, and the averaging-down position also becomes profitable; at that time, you can close all positions.

With that idea, entry and exit points are determined, and you can trade.

Next, I considered the averaging-down method.

Three ideas immediately came to mind:

1. Equal-amount, equal-interval averaging-down

2. Doubling averaging-down

3. Averaging-down based on the Fibonacci sequence

Mode 1 is advantageous in terms of total position volume, but its average price changes too slowly, which may be unsuitable.

Mode 2 rapidly increases position volume (2x, 4x, 8x, 16x...), which has a large effect on the average price, but if the position volume becomes too large, it is concerning.

Mode 3 balances both average price and position volume between Modes 1 and 2, and its match with market movements seemed good, so I chose this method.

Then, by actually coding these elements and running backtests, it turned out to be usable.

↓Details of the EA specifications are explained here.

This article is an excerpt from the blog “Trading and Attaching Freely Turns the Market into a Lucky Charm.”

× ![]()