December 30 (Fri): Nikkei 225 (free viewing item: Focusing on knowing the market direction in advance is the wrong way to study)

Good morning☀

Now, is today the big year-end close?

A little early, but thank you for this year. Good job throughout the year (´・ω・)っ?

Now, I looked at various correlations and anti-correlations, and it seems that the Nikkei 225 is likely to fall.

However, in reality there is a downward【resistance band】.

Will you break through it? Will you not?

I would like to know in advance.

However, even for me who has traded for many years without cutting losses

in advance, I do not know?♂️

Focusing on knowing the market direction in advance is the wrong way to studyso please never do it!

I keep saying it relentlessly, but

'The market is not something you can predict'

Will it go up? Will it go down?

If you try to predict it, you cannot achieve stability.

Can you earn stably with lottery or TOTO?

Can you earn stably with a crapshoot?

Can you consistently hit odd or even with dice?

The market is...

to anticipate multiple scenarios,

taking points where scenarios overlap,

From now, will it go up or down? I don’t know, butthere are points in which the scenario of it going up ultimately occurs, so I will go long.

That’s why.

“The market is like shogi (Japanese chess).”

Yes.What possibilities does the opponent (the market) move in?

How should I respond by anticipating that?

By predicting several moves ahead to aim for profit-taking, and act to put myself in a favorable position.

This area will be written in more detail in the 'Trading Techniques' section.

Next year, we will publish 'Reversal Zone' and 'Trading Techniques,' so please look forward to it?

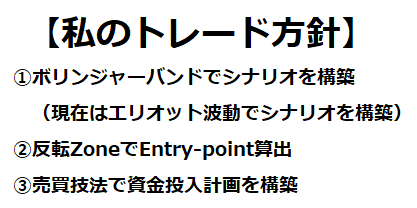

'The Unraveling of Bollinger Bands'

'Reversal Zone'

'Trading Techniques'

If you master these three, you will be able to trade without stop-loss like me, so if you’re interested, please give it your best ( ・ㅂ・)و ク゛ッ !

(※From here, market analysis is limited to members.)