Current analysis of USD/JPY: "April will be a period of adjustment" March 31, 2018

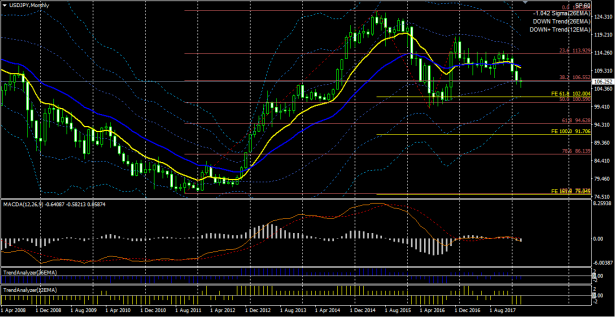

March 31, 2018 - USD/JPY - Monthly

The candle for March has closed as a small-bodied bearish candle. This marks three consecutive months of bearish candles since January. Since the March candle’s lower shadow is longer, it does not suggest a rapid further decline in April.

In relation to the EMA, in the short term there is a three-month continued strong decline, while in the medium term the decline is weaker. Also, the Bollinger Bands are in a contraction, indicating no clear upside or downside. From the perspective of its relationship with the Bollinger Bands, a potential floor may have been formed.

From a wave perspective, we are in a corrective phase since mid-2015, currently in Wave C. This Wave C may extend further and reach Fibonacci expansion 61.8% or 100%, or Wave C could end, forming Waves D and E as a pennant pattern.

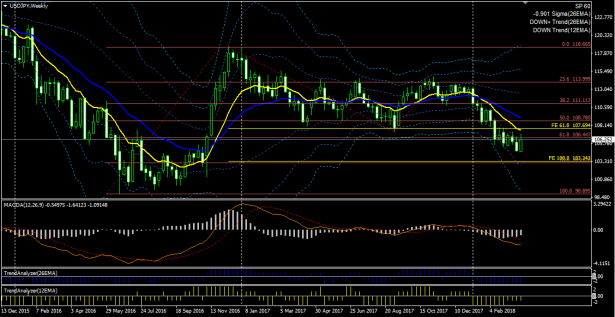

March 31, 2018 - USD/JPY - Weekly

The latest candle is a fairly large bullish candle, and when combined with the preceding bearish candle, it constitutes a market reversal pattern.

In terms of EMA, in the short term there is a weak decline, and in the medium term a strong decline continues. However, the current price is slightly above -1σ on the Bollinger Bands, and the entire candle is biased toward the upper part of the -2σ to -1σ band, suggesting the momentum of the medium-term decline is diminishing. OsMA rising gently confirms this as well.

March 31, 2018 - USD/JPY - Daily

On the daily chart, candles closed above the 26 EMA for now, indicating a downtrend but also the possibility of entering a range for a while. The Bollinger Bands are starting to level off as well, supporting this. For the time being, there may be little direction or some price adjustments.

From the MACD line, two divergences have occurred, suggesting that the downtrend swing starting around December has finally ended.

Wave analysis has been revised, with the light blue Fibonacci retracements indicating Wave 3. Currently, we are seeing a corrective swing against the downward swing forming Wave 4. Considering the duration of Wave 3, Wave 4 is expected to continue for at least about a month.

↓ MACD used in the above charts.

Display MACD, Signal, and OsMA, with four alert types available.

MACD (four alert types, email capable)![]()

↓ The above chart template and indicator set. Technical indicators can also be purchased individually.

MACD (four alert types, email capable) Trade System

Stochastic (alerts and email capable) | Cloud crossing, etc.—MT4 indicator with alert and email sending capabilities |

↓ Now available on GoGoJiang (GogoJiang).

EA that profits by simultaneous trend following and contrarian strategies | EA that steadily accumulates profits with optimal trades |

This article is an excerpt from the blog “When you look and freely position, the market becomes a magic wand.”