Many problems that cannot be solved are quickly resolved over time by the EA "Zix" that accumulates trading profits and swaps

The article title “Many problems that cannot be solved are easily solved by time” is a wise saying written on a calendar received from a friend.

Now, to the main topic.

The EA "Zix" that stacks trading profits and swaps is an EA that steadily builds profits through optimal trades.

It trades only in the direction specified by the parameters, targeting both trading profits and swaps.

This EA is based on the averaging logic of “EA Miw Cross Order & Averaging.”

It assumes positive swaps and is designed for long-term, buy-and-hold operation.

This EA does not perform technical analysis; it trades based solely on positioning.

If there is no position, it takes one for the time being.

If the market direction aligns with the trading direction, it rides the trend to take profits.

If the market moves against it, it uses averaging, and when a certain unrealized profit is reached as the market reverses, it takes profit.

Averaging is performed with careful positioning, aiming to minimize the number of averaging trades.

It may seem odd to trade without considering entry points, relying only on position control, but it has indeed shown good results.

Next, an explanation of “optimal trading.”

This EA determines the profit range and averaging intervals not by simple hard rules, but by dynamic optimization that takes market movements into account, enabling optimal trades.

The profit width of trades is automatically determined based on time frame, price, and market movement.

The averaging interval is automatically determined based on time frame, price, Fibonacci sequence, and market movement.

With these two automated aspects (dynamic optimization by program), optimal trading becomes possible for any currency pair and time frame.

Any currency pair is OK (the pairs listed for trading are those that have been backtested to confirm effectiveness).

Time frames are not limited, but if the spread is about 3 pips or less, a 15-minute chart is recommended; if wider, a 1-hour chart is recommended. Shorter time frames reduce the profit width and averaging interval, capturing finer market movements and potentially increasing profits, but also tends to increase the number of averaging trades. If the spread is 1 pip or less, a 5-minute chart can also be used, but there is a risk of many averaging trades during sharp moves caused by economic announcements or statements by key figures, so it is safer to avoid it. Choosing a longer time frame can reduce risk.

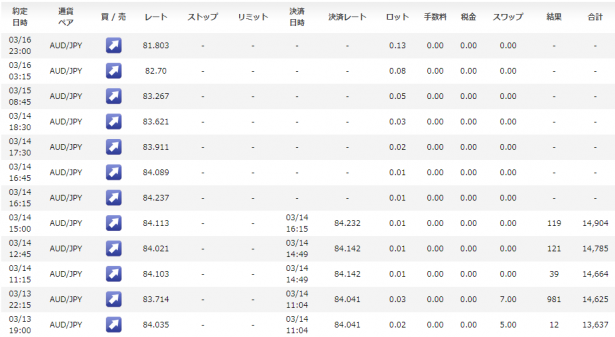

Currently, forward testing the EA “Zix,” which stacks trading profits and swaps, is underway, but due to a risk-off market since the week before last, many positions are held.

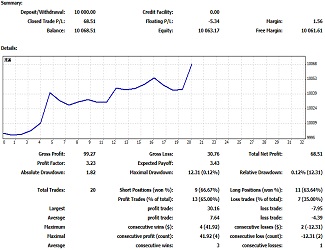

The data above is from forward testing on GoGoJou (AUDJPY 15-minute chart).

In the past I have held seven positions, but this time they have not reached a liquidation point easily. There was a time when it came close to a liquidation point, but the market did not recover sufficiently.

Last week, I did not add positions at all; I was just accumulating swap points.

Going forward, if the market recovers to reach liquidation points, all positions will be closed and the sequence of trades will end; if the market continues to fall, it will reach the next averaging point... either way.

In any case, there is nothing to do but wait, and there is no expiration on holding positions, so waiting continues.

Here, the meaning of the article title becomes clear.

Many problems that cannot be solved are easily solved by time

↓

Many positions that are not liquidated are easily resolved by time

Averaging is one of the trading methods that makes time your ally.

The EA that stacks trading profits and swaps, “Zix”

This article is an excerpt from the blog “The market becomes a tool for freely projecting and shaping it.”