Current state analysis of USD/JPY: "Elliott Wave Principle Wave 4 in progress" March 21, 2018, 13:00

Today Japan is on holiday in addition to awaiting the FOMC, keeping a wait-and-see stance.

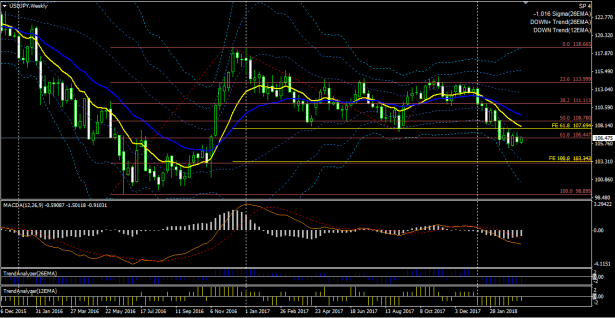

March 21, 2018 USD/JPY Weekly

Looking at the weekly chart, it is clear that the price is continuing to adjust around the 61.8% Fibonacci retracement level.

The downtrend remains unchanged. In the short term, the trend momentum is weakening, as shown by the 12 EMA Trend Analyzer and OA/MA. The mid-term trend remains strong (26 EMA Bollinger Bands are expanding).

March 21, 2018 USD/JPY Daily

Although the daily chart also shows a continuing downtrend, the MACD line is gradually rising and new lows have stopped being made, indicating the trend is weakening. In recent days, candles have been moving around the 12 EMA, so in the short term there is no clear trend. The 26 EMA Bollinger Bands are converging, indicating a weakening mid-term trend as well.

If you draw Fibonacci retracements on the recent decline (Elliott Wave 3), the current correction (Elliott Wave 4) has touched only 23.6% once, and there has been little price-based correction. Since the decline period has lasted two months, the correction period is expected to exceed one month. It remains to be seen whether the next move will be time-only correction, or a price-based correction aiming for 38.2%.

March 21, 2018 USD/JPY 4-hour

After making a low on March 2, the market has been moving sideways with decreasing price range.

↓ The MACD used in the above chart.

Display MACD, Signal, and OsMA, with four alert options available.

MACD (four alert options, email capable)![]()

↓ This is the template and indicator set for the above chart. Technical indicators can also be purchased separately.

MACD (four alert options, email capable) Trade System

Stochastic (alert, email capable) | MT4 indicator that can send alerts and emails upon cloud breakdown, etc. |

↓ Now on sale.

EA that profits by combining trend-following and counter-trend strategies

This article is an excerpt from the blog “Watching and freely applying turns the market into a magical tool.”