Forward signal and improvement of AUDUSD 15-minute chart for August 2022 in Australian dollar against US dollar

In this article, titled “Forward Signals and Improvements for AUDUSD 15-minute Chart in August 2022,” we validate the forward signals for AUDUSD on the 15-minute chart during August 2022 for the FX multi-currency trading set below.

FX Expectation and Compounding to Achieve Several-Fold Growth per Year in the Multi-Currency Trading Set

https://www.gogojungle.co.jp/tools/indicators/40023

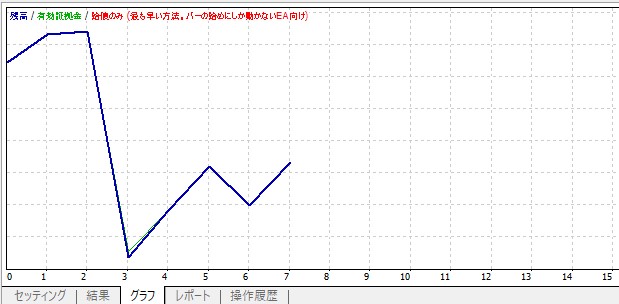

The results of buying and selling with a fixed 1,000 currency lot for AUDUSD 15-minute chart for August 2022 are as follows.

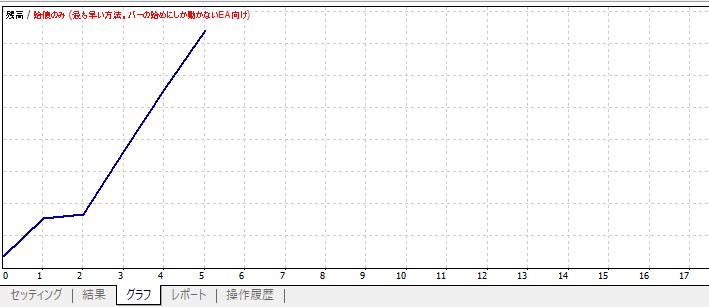

Balance curve with 0.01 lot trading starting from 100,000 yen

Here, signals and signals are used with the same meaning.

In the FX multi-currency trading set, to bridge the gap between backtests and forwards, even if an entry signal appears, you can avoid entering by not clicking the “Buy” or “Sell” button.

From this perspective, assuming that out of all forward signals in August 2022 for AUDUSD that resulted in a loss, the entries of signals that could be avoided were skipped, and revalidated.

As a result, the two signals that were assumed to be skipped were the following two signals.

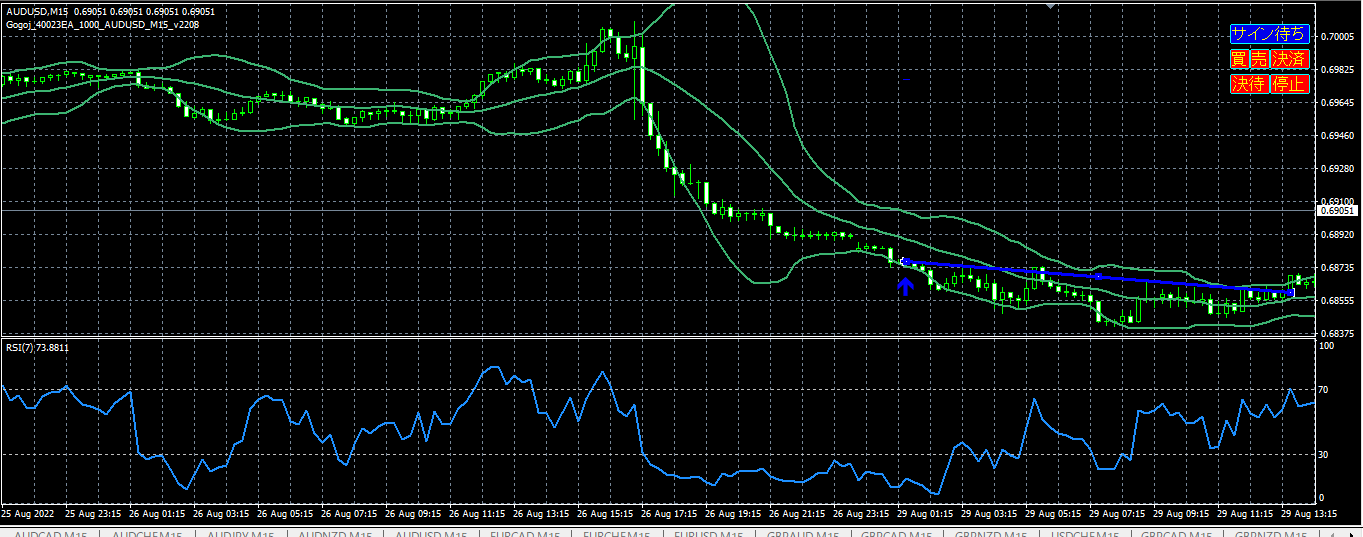

The buy signal in the figure below can be avoided because it is in a downtrend and there is no upward trend yet.

The sell signal in the figure below can be avoided because it is seen as having broken out of the downtrend and turning into an uptrend.

As a result of the improvement, it was deemed possible to avoid the two loss-making signals above, and the balance chart for the forward period after the improvement from August 1 to August 31, 2022 is shown in the figure below.

By the way, here we are only looking at the 15-minute chart and testing whether adjusting the zoom multiplier can avoid losses, without assuming any long-term checks such as the 4-hour or daily chart at the decision point before entry.

This is to emphasize reproducibility, because long-term trend views vary by situation, so they cannot be used in verification from a reproducibility perspective.

Of course, the long-term trend is viewed within the system according to the currency.

Also, as a caution, please note that tests that assume avoiding profitable signals are not included.

For customers who own the FX multi-currency trading set, please consider this as a reference.

Even those who do not own it should consider this as a reference material for pre-purchase consideration, since fully automated trading is very challenging and a setup that allows selecting entry signals is desirable.

Wishing you all success.

Also, you can download the MT4 test report including the backtest period from January 2020 to July 2022 plus the improved forward period from August 1 to August 31, 2022, from the link below.

StrategyTester_AUDUSD_2208_2208.zip

In this system, all trades are done at the opening price of each bar, so whether you set the MT4 Expert Advisor to “Open price of bars only” or to “All ticks” yields the same result.

Thank you very much!