The Way of Investment (Part 13)

The Road to Wealth in Investing (Part13)

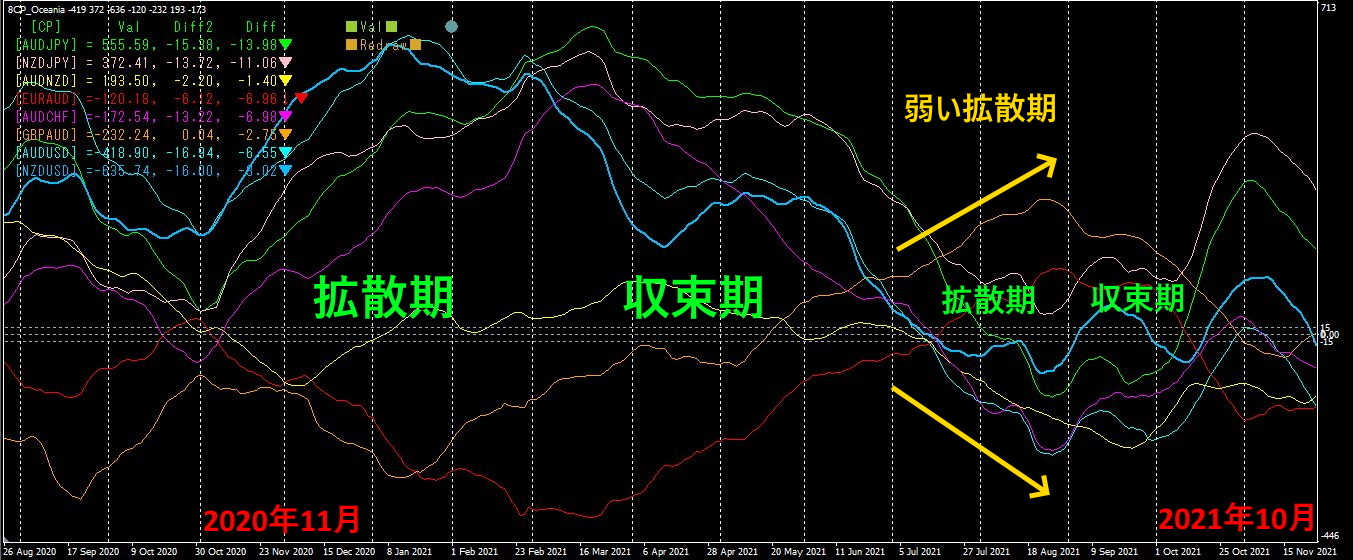

We examined two cases during a weak expansion phase. The period is2021 year7 month to8 month. In a weak expansion phase, price moves are not large, so the results may not be very favorable.

1.

An example of a rising currency pair in a weak expansion phase (GBPAUD)

GBPAUD was entered long, but the profit target was smaller than theSL, so it was not a very good trade. The risk-reward ratio was0.83. It did yield a profit of300PIPS, and the drawdown was small, so the trade was still viable. In a weak expansion phase with small wave amplitudes, trades tend not to look perfectly clean, so taking profits soon is advisable.

2. An example of a falling currency pair in a weak expansion phase (AUDUSD)

AUDUSD was entered short. Profit target240PIPS,SL width125PIPS, drawdown of15PIPS15PIPS, and a risk-reward ratio of1.92

Even in a weak expansion phase, it can be shown that profits are possible, but the position holding period tends to be relatively short. It is advisable to aim for early and reliable profits.