The Noble Path of Investment (Bonus Episode 3)

The Principled Path of Investing (Bonus Edition 3)

“FX “after-the-fact” rock-paper-scissors?

When looking at economic indicator event calendars, events such as policy rate announcements and statements occur quite frequently. By using the “currency strength/weakness indicator” around the timing of these releases,“FX after-the-fact rock-paper-scissors”can be realized.

1. Case 5 (USD)

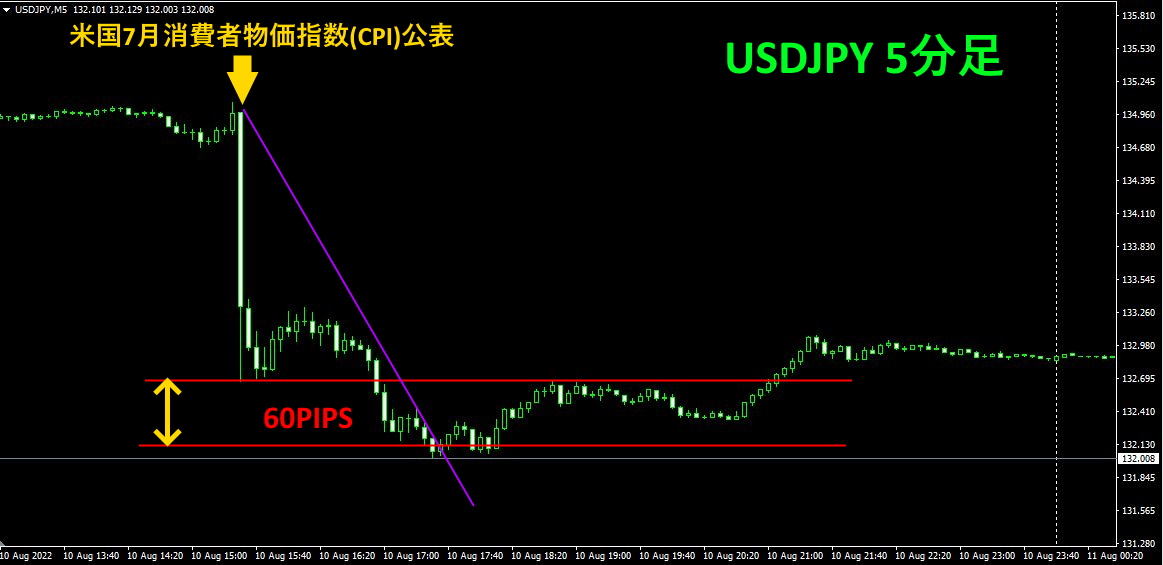

On August 10, 21:30JST), the U.S. July Consumer Price Index (CPI) was released. The U.S. CPI increased by 8.5% year over year, and high levels persisted. As a market reaction, the USD weakened as a currency, and the USDJPY rate declined.

The chart below is the 5-minute chart of USDJPY around the CPI release time.

Right after the release, a large bearish candlestick formed. After a brief rebound, it gradually declined. After breaking below the lower shadow of the big bearish candle, you enter a short position under the rules of “after-the-fact rock-paper-scissors.” Draw a diagonal downtrend line; when price breaks above it, take profit. This alone yielded about60PIPS of profit.