[Fund Management] Break away from recent bias and manage funds rigorously!

------------------------------------------------

Empathy level 99.9%!

What is the FX manga that is all the rage now??

↓

------------------------------------------------

This is Ryusei of FX!

“Money management is important!”

is something you hear everywhere,

but

in the true sense

a trader who can exercise strict money management

israre

to say the least.

The origin of money management is

“thorough knowledge of the strategy being used”

.

In other words,

“how well you understand the strategy you employ”

is what it comes down to, but

in that regard,

many people only vaguely

their own methods.

Even if you say you understand the method,

merely understanding entry and exit conditions

is far from sufficient,

because without thorough money management,

there is no way to achieve proper management.

At this point,

“???”

is what many people may be thinking, so

let’s take a closer look!

The fear of recent bias in performance

Humans have a cognitive bias called

“recency bias”

.

We look at recent trends and judge them as universal trends,

and react emotionally to them.

Let’s give a simple example.

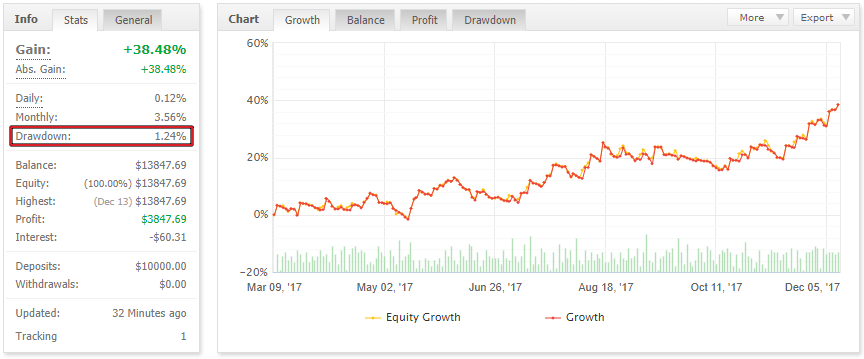

The following is the nine-month forward performance of BigBangProfitSignalEA.

(as of end December 2017)

Starting with $10,000,

profit of $3,847.

Within the 38.47% profit,

note the maximum drawdown.

Maximum DD is 1.42%.

At first glance,

one might think it’s fine to take on more risk,

and many would think that is acceptable.

After all,

you could trade ten times the lot size in this system,

and the maximum drawdown would still be only 10.42%.

Within that, the return would be

384% (^^;)

Based on such thinking,

increasing the lot size would fall under

“recency bias”

.

In trader mentality,

this is the most dangerous way of thinking.

Because,

the results from nine months of trades

are only a small sample to refer to when evaluating trades.

Picking just nine months of results

and treating them as universal is

extremely dangerous thinking.

Risk settings derived from long-term validation data

In my logic BBP,

we derive risk settings from 13 years of extensive validation data.

BBP with a fully non-discretionary system trade logic

allows highly precise validation to understand the strategy’s potential,

and thus enables

strict money management.

Moreover, since the lot settings are derived,

looking at the last nine months you won’t worry about

“the lots are too small”

.

All aspects of the lot settings are meaningful,

so you understand the danger of unnecessarily increasing risk.

Nowadays, even skilled traders are often “recency-bias” types

There are cases where traders who once made large profits

suddenly drop from the average and disappear.

Seeing these, I would remark that

“they were trapped by recency bias.”

.

Humans tend to trust what they have experienced,

and if they’ve made profits in the past,

they tend to trust the trading method that formed that profit.

But if that trading method itself is an expectation built from a small sample,

what happens?

It’s easy for performance to suddenly stop improving

.

That’s the depth of trading.

Even if you are currently profitable,

the universality of the method you are using

may be weak.

Handling a trade method with universal weakness means

it’s easy to imagine the funds could collapse,

and it might be just a matter of time,

“recency-bias”

adapting to the latest market conditions.

Over-optimization can occur even for discretionary traders

As mentioned,

“recency bias”

leading to biased overconfidence in a trading method,

“over-optimization”

is also possible.

“Over-optimization”

is a concept known in

the process of EA creation.

Over-optimizing parameters to past price movements

is when you excessively optimize for historical data,

and for real traders it means

.

In other words,

“over-optimization of discretionary traders”

it’s also the case.

For example, many traders,

if they have won for 2-3 years,

they believe, “my method can’t be wrong.”

But if you think about it, a trading system that has only won for 2-3 years in backtests is

“a laughably weak level”

to rely on.

Many people will rate such an EA low.

The essence is

that it applies to real traders too.

A technical analysis method that works for three years may stop working in year four.

Thus, if you rely on too little information to evaluate a trading method,

Three years of validation may feel long, but it is still a short validation period.

Is your discretionary trading method robust?

It’s scary, isn’t it?

It’s deep, isn’t it?

Yet it’s also interesting!

Discretionary traders also

face “over-optimization”

in ways, which may surprise some people.

Summary

Money management begins with

perfectly understanding the strategy you will use.

“Thorough knowledge of the strategy to be used”

is something that must be supported by

high-precision analysisas a foundation, but

many traders believe they can use high-precision analysis on trading methods that cannot be highly precise.

Even traders currently profiting may not have universal validity in their methods,

falling into over-optimization without realizing it.

People who say things like,

“I understand the market rules (if this then that)”

falling into over-optimization

.

sufficient information (high-precision past validation).

“high-precision analysis”

and is thus a deeply nuanced field.

Common sayings like

“Stop-loss is a fixed percentage of funds”

or

“Set stop-loss levels to protect psychologically tolerable amounts”

often have very weak foundations for money management.

Because you are dealing with methods that cannot be validated with high-precision analysis,

you end up relying on vague, qualitative money management methods.

I cannot operate with such baseless money management techniques.

Now trending,

the FX manga with 99.9% empathy is …

↓

https://ryusei-fx.biz/lp_mail/

------------------------------------