Undervalued Stocks Feature Revenue Up, Profit Down 1782 Joban Development Mr. Tetsuo Inoue

Mr. Tetsuo Inoue's investment salon, Inoue Tetsuo 'Market Trends', features industry-by-industry and company-by-company rankings and analyses, and has become popular content.

Analyses are provided, making it a popular content.

Publication date: 2017/10/20 08:00

Undervalued Feature 1782 Joban Development

TSE JASDAQ Standard, March year-end

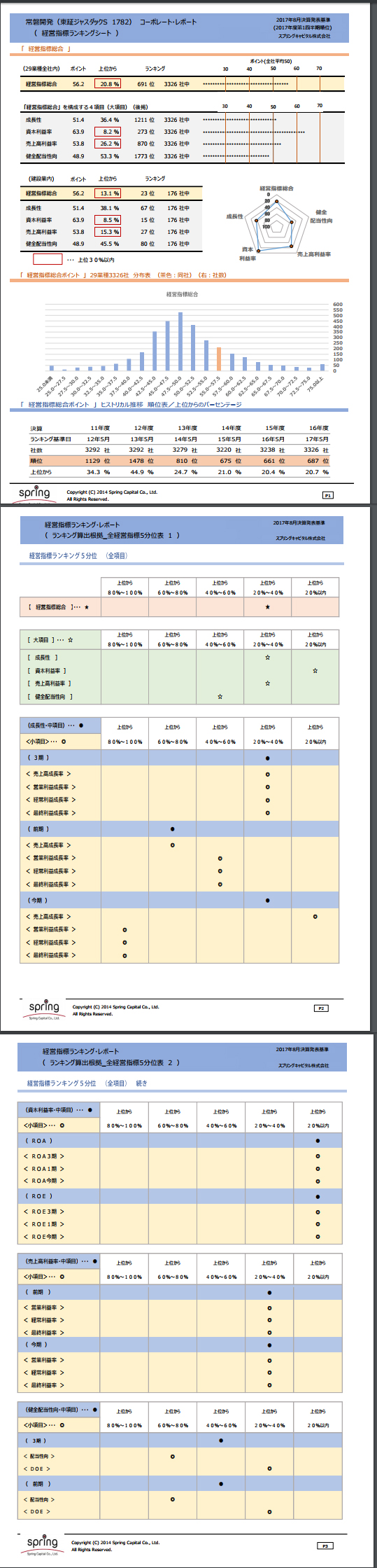

Overall rank: 691st / 3,326 companies

Industry rank: 23rd / 176 companies

(Industry: Construction)

・Iwaki City-based

・Public investment related to reconstruction has declined; housing investment has cooled, but revenue is expected to rise

・However, earnings are expected to decrease

・Orders from private factories and stores are solid, but profit margins are declining

(Valuation) (10/16)

Stock price: ¥7,650

Trading unit: 100 shares

PER: 5.45x

PBR: 0.88x

(Previous term) ROE: 21.07%

(Trailing) Dividend yield: 3.14%

* The criteria for 'undervalued stocks' are as of 10/6: 1) within the top 700 out of 3,326 companies in the August-based ranking, 2) within PER 11x (as of end of last week), 3) within PBR 1.3x (same), 4) trailing dividend yield of 2.5% or more (same). First, we daily introduce the 16 stocks that fully meet 1–4, and thereafter, from 10/10 we introduce the 13 stocks that meet 1, 2 and 4.