The Future of Foreign Exchange Markets: Episode 133 [Tomotaro Tajima]

Tomotaro Tajima Profile

Economic analyst. President and CEO of Alfina Trusted. Born in Tokyo in 1964. After graduating from Keio University, he shifted career from Mitsubishi UFJ Securities where he worked. He analyzes and researches a wide range from finance and economics to strategic corporate management, and ultimately individual asset formation and fund management. He serves as lecturer at lectures, seminars, and training organized by private companies, financial institutions, newspapers, local governments, and various business associations, with about 150 lectures per year. He has numerous serialized writings and comments in print media, including Shūkan Gendai “The Rules of Net Trading” and Examinina “Money Maestro Training Course.” He has also authored columns on many websites about stocks and foreign exchange, earning high regard as a stock and forex strategist. He has also written for the Home Economy section of the free citizen’s “Kiso Chishiki: Basic Knowledge of Contemporary Terms.” After regular appearances on TV (TV Asahi “Yajima Plus,” BS Asahi “Sunday Online”) and radio (MBS “Tōmoya no Asa-ichi Radio”), he is currently a regular commentator on Nikkei CNBC “Market Wrap” and Daiwa Securities Information TV “Economy Marche.” His main DVDs include “Very Easy to Understand: Tomotaro Tajima’s FX Introduction” and “Very Easy to Understand: Tomotaro Tajima’s FX Practical Technical Analysis.” His major books include “Wealth Revaluation Manual” (Paru Shuppan), “FX Chart: The Equation for Profit” (Alchemix), “Why FX Can Make You Asset Rich?” (Text) and many others. His latest publication is “How to Profit by Riding the Rising U.S. Economy.”

*This article is a reproduction/edit of an article from FX Strategy.com May 2021 issue. Please note that the market information stated in the text may differ from current market conditions.

The Sharp Rise in U.S. Treasury Yields Is Merely the Rebound from Being Too Low

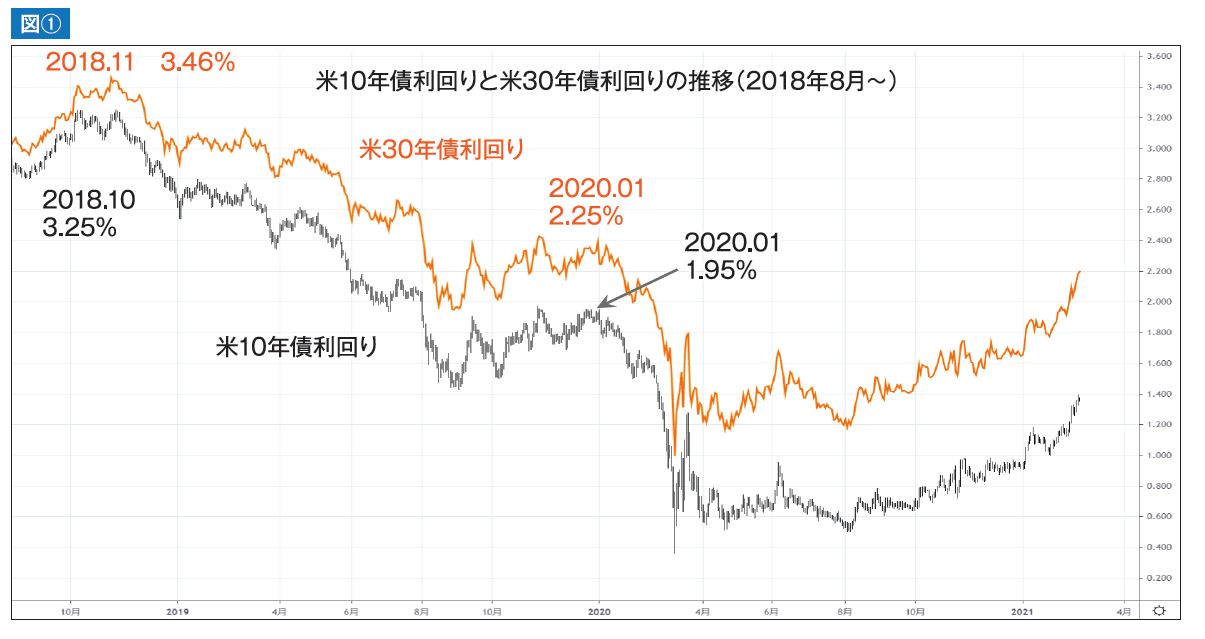

One of the topics attracting the most attention in the market at the time of writing is the rapid rise in U.S. bond yields. As shown in Figure 1, both the U.S. 10-year yield and the U.S. 30-year yield have accelerated their ascent since the start of the year, with the 10-year around 1.4% and the 30-year near 2.3%.