Financial literacy with YEN-kura's Investment University (Academia) | Episode 16 [YEN-kura]

YEN Kura-san Profile

Enzō. Worked for over 20 years as a foreign exchange dealer at US-based Citibank, UK-based Standard Chartered Bank, and other foreign banks. Currently a top professional trader involved in forex, the Nikkei 225, Nikkei options, and individual stock trading. President and CEO of ADVANCE Co., Ltd., which primarily distributes investment information. Deeply knowledgeable not only about major currencies such as the dollar and euro, but also about emerging currencies, including Asian currencies. Also has close relationships with overseas traders and fund professionals.

Newsletter:YEN蔵 Real Top Trading

Blog:YEN蔵’s FX Investment Techniques — Investing in the World with the Dollar, Yen, Euro, Pound, and Australian Dollar

Twitter:https://twitter.com/YENZOU

*This article is a reprint/edit of FX攻略.com May 2021 issue. Please note that the market information described in the text may differ from the current market conditions.

Various market impacts from rising long-term interest rates

U.S. long-term interest rates have risen, causing various market impacts. There are many kinds of long-term rates, but here we use the U.S. 10-year Treasury yield.

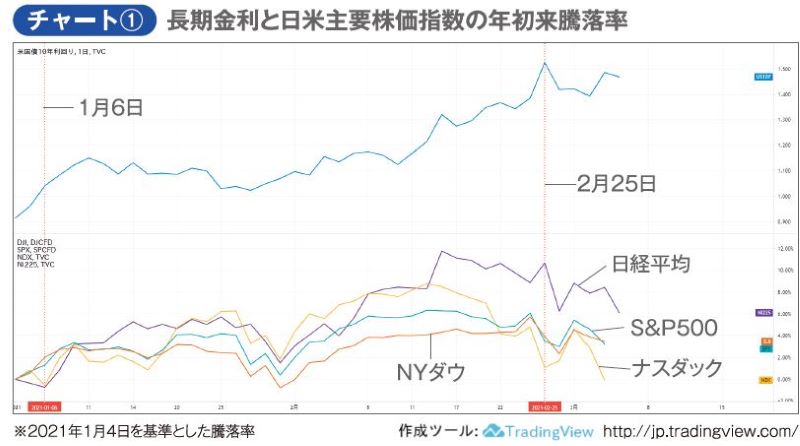

U.S. 10-year yield fell to the 0.3% range in March 2020, but then gradually rose. The turning point came this year. After surpassing 1% on January 6, 2021, it exceeded 1.3% on February 16 and shot up to 1.61% by February 25.

This time, the rise in rates was rapid, and the first to be affected were U.S. stock prices (refer to Chart ①). They recovered somewhat, but the Dow Jones fell from 30,000 to around 30,800, the S&P 500 from 3,950 to 3,790, and the Nasdaq from 14,170 to around 13,000. The rise in rates especially amplified the Nasdaq’s decline due to its heavy weighting in growth stocks. The Nikkei 225 also plummeted from 30,000 to 28,970 (as of March 3).