Artificial Intelligence, Market, and Computers | Episode 14 Current AI, Finance, and the Future [Naoto Okumura]

Naoto Okumura Profile

Okumura Hisashi. Completed the Master’s program in Engineering in 1987. Field: AI (Artificial Intelligence). Developed numerous mathematical models at Nikko Securities. Co-developed an investment model with Stanford University professor Dr. William Sharp (Nobel Prize in Economics in 1990) and launched the world’s first online delivery of Tokyo Stock Exchange prices. Additionally established venture companies with Israeli Mossad science advisors, commercialized AI technology, and implemented it in major airports, achieving many results at the intersection of finance and IT. Currently provides models that evaluate analyst ratings with AI “MRA,” AI-estimated near-future FX rates “FXeye,” and chart analysis displaying risk and return “Twilight Zone.” To raise Japan’s financial literacy, hosts a Financial Literacy School.

Hobbies: audio and sports. Began aerobics competitions 15 years ago, NAC Master Division Single Champion 9 consecutive times, 2016 Senior 2nd place, 2014–2016 Japan Championships Chiba Prefecture representative, 2017–2018 Japan Championships Master 3 runner-up. Despite claiming to be athletic, he is actually "unable to handle ball games" (clumsy with ball sports). A motto: “No matter how late a decision is, it’s never too late.”

Blog:https://okumura-toushi.com/

*This article is a reprint/re-edit of an article from FX攻略.com May 2021 issue. Please note that the market information described in the text may differ from the current market.

What is the Difference Between Machine Learning and Deep Learning?

In previous installments, we looked at the technical history and achievements of AI alongside contemporaneous topics in computers and markets, from birth to present. This time, we will examine how far AI is practically applied today, focusing on the financial industry.

The hallmark of modern AI is “collect big data and then perform machine learning on it.” Both have existed since the 20th century.

Machine learning is often used without distinguishing it from deep learning, but they are different domains. Machine learning means that machines, i.e., computers, learn broadly from data. In the most common supervised learning, a teacher provides correct or incorrect answers. Like a Kumon Math program, effectiveness increases through relentless repetition. What to learn is predetermined.

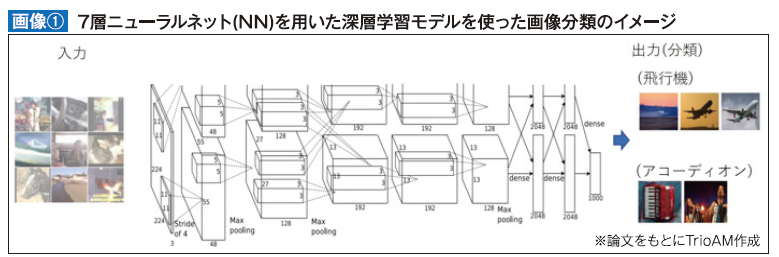

On the other hand, deep learning is a subfield of supervised machine learning. By simulating the processing of human neural cells, it handles complex human behavior across multiple layers, adjusts the weights of these layers to produce an answer, and compares that answer with the teacher’s ground truth data to learn. Because there are many layers, the term “deep” is used, but this has a different meaning from “deep” in depth psychology (unconscious mind). This technology gained wide recognition after Toronto University achieved outstanding results using multi-layer neural networks in the 2012 image recognition competition (ILSVRC, run by Stanford and others).

*Created by TrioAM based on the papers

https://papers.nips.cc/paper/2012/file/c399862d3b9d6b76c8436e924a68c45b-Paper.pdf

Using 1.2 million training images of 1,000 categories to correctly classify 100,000 test images was the challenge, but it won with overwhelming accuracy, giving rise to the deep learning boom. By 2020, this paper had about 55,000 citations, profoundly influencing subsequent research.

The computations required for deep learning were not done on CPUs but on graphics processors (GPUs). GPU leader NVIDIA announced CUDA (Compute Unified Device Architecture) in 2006, enabling massively parallel processing that fully utilized processor capabilities. Since then, general-purpose GPUs have become indispensable for deep learning.

NVIDIA’s value surged with the AI boom, and by the end of February 2021 its market capitalization was about 39 trillion yen, surpassing Intel (about 27 trillion yen) to become the world’s largest semiconductor company.

*Created by TrioAM