The text has some encoded or mixed content. Decoding and translating the inner Japanese text to English while preserving the HTML format: Only one week left, you know... that thing, NEM/XEM: Cryptocurrency Chart Watch 2021

NEM/XEMI kept an eye on its current status.

I would like to observe and analyze the past price movements from technical analysis and consider future movements.

This is the climax, the climax!

The “Sleeping Giant (self-proclaimed) is about to awaken.

Next Monday, Catapult, now rebranded Symbol, will finally launch on the mainnet.

The snapshot is this Friday, but since exchanges will halt trading, buying and selling will stop before the snapshot. So there will be only about 3 to 4 days left after that.

From the previous article, on coincheckthe 88 yen level was breachedand after breaking into the 90s, it has started to turn around. How to interpret this is very difficult.

Probably domestic players are exiting exchanges to prepare for self opt-in, or are preparing for an early XYM listing via overseas moves that are anticipated.

So, the market is seeing selling pressure from short-term trend surfers who have little interest in Symbol and those who are interested but want to settle some positions somewhat.

However, whether that momentum will push past the snapshot is still unclear, in my view.

Overseas, some places still have not started the NGL-hosted trading competition (no announcement yet, so perhaps not yet, but unclear). Also, starting liquidity mining on KuCoin tomorrow could lift prices. They may have more surprises as well.

Nevertheless, if those price-boosting rumors fail to gain traction and selling pressure dominates, thenit may be best to keep expectations pinned on XYMbeing the main focus. Since you can get XYM for free, you might have to forget how much you bought XEM for, and simply have strong expectations with a smile.

Selling at a low price means someone is buying XEM to receive more XYM.

What to do with XEM after the snapshot will be one of three: sell immediately, wait and sell after some observation, or not sell at all for a while. There may be those who never intend to sell, but that is a stance independent of the market, so I’ll skip it, haha.

Some will sell now or after a bit of observation to focus on XYM, while others may choose not to sell yet, hoping for NIS1. In any case, at this stage, it may be prudent not to have too high expectations. The former may end up selling for less than expected, and the latter may have to wait many nights even if they sell higher.

Anyway,in markets, choosing the optimal rather than the best is the best.

However, I have never encountered such an ironically situation (support chains split into two and charts perhaps two futures) before, so to be honest, for the near term,

I don’t know.

Okay, now, let’s check the chart status.

Another question isthe status of the short-term Trix. It surpassed 300 on March 6, then fell below 300. When momentum is strong, it tends to push into the 300s, but now it’s turning bearish. This is one of the signals to take profit.

The 1-month MA has crossed above the cloud, the 1-year MA is below the cloud, and looking at the three MAs (1M, 6M, 1Y) in sum, it forms a perfect order. But the 6-month MA crossing above the cloud is tricky. It may sense overbought conditions in the short term and push it downwards.

Nevertheless, at this price level, by March 20, a complete perfect order including the cloud is expected to form.

Both XEMUSD andXEMBTC look quite positive just by charts. Especially XEMBTC seems like it could rise after late March.

However, with the snapshot-confirmed XEM selling pressure and the XYM listing-driven valuation shifts, plus other fundamentals on the horizon, March is easily expected to be volatile.

But NEM/XEM(NIS1) is not ending; it will emphasize a six-year long-term stable operation and open source development, which isa pleasantly eerie aspect.

Continuing,the NEM economy is surely full of intriguing things.

That is all!

(Ah, this might be the final installment of the series. Thank you all so far! The continuation will be on Twitter!)

Below, the technical settings are for paid members. Since the series ends on March 17, new registrations or subscriptions may not be available for those who join late, but you’re good, right! lol

I would like to observe and analyze the past price movements from technical analysis and consider future movements.

This is the climax, the climax!

The “Sleeping Giant (self-proclaimed) is about to awaken.

Next Monday, Catapult, now rebranded Symbol, will finally launch on the mainnet.

The snapshot is this Friday, but since exchanges will halt trading, buying and selling will stop before the snapshot. So there will be only about 3 to 4 days left after that.

From the previous article, on coincheckthe 88 yen level was breachedand after breaking into the 90s, it has started to turn around. How to interpret this is very difficult.

Probably domestic players are exiting exchanges to prepare for self opt-in, or are preparing for an early XYM listing via overseas moves that are anticipated.

So, the market is seeing selling pressure from short-term trend surfers who have little interest in Symbol and those who are interested but want to settle some positions somewhat.

However, whether that momentum will push past the snapshot is still unclear, in my view.

Overseas, some places still have not started the NGL-hosted trading competition (no announcement yet, so perhaps not yet, but unclear). Also, starting liquidity mining on KuCoin tomorrow could lift prices. They may have more surprises as well.

Nevertheless, if those price-boosting rumors fail to gain traction and selling pressure dominates, thenit may be best to keep expectations pinned on XYMbeing the main focus. Since you can get XYM for free, you might have to forget how much you bought XEM for, and simply have strong expectations with a smile.

Selling at a low price means someone is buying XEM to receive more XYM.

What to do with XEM after the snapshot will be one of three: sell immediately, wait and sell after some observation, or not sell at all for a while. There may be those who never intend to sell, but that is a stance independent of the market, so I’ll skip it, haha.

Some will sell now or after a bit of observation to focus on XYM, while others may choose not to sell yet, hoping for NIS1. In any case, at this stage, it may be prudent not to have too high expectations. The former may end up selling for less than expected, and the latter may have to wait many nights even if they sell higher.

Anyway,in markets, choosing the optimal rather than the best is the best.

However, I have never encountered such an ironically situation (support chains split into two and charts perhaps two futures) before, so to be honest, for the near term,

I don’t know.

Okay, now, let’s check the chart status.

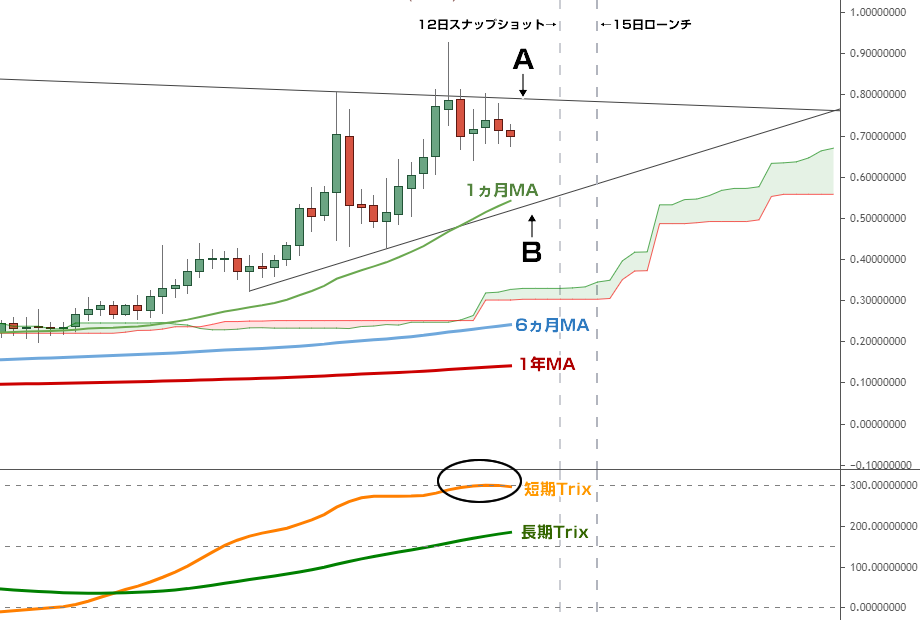

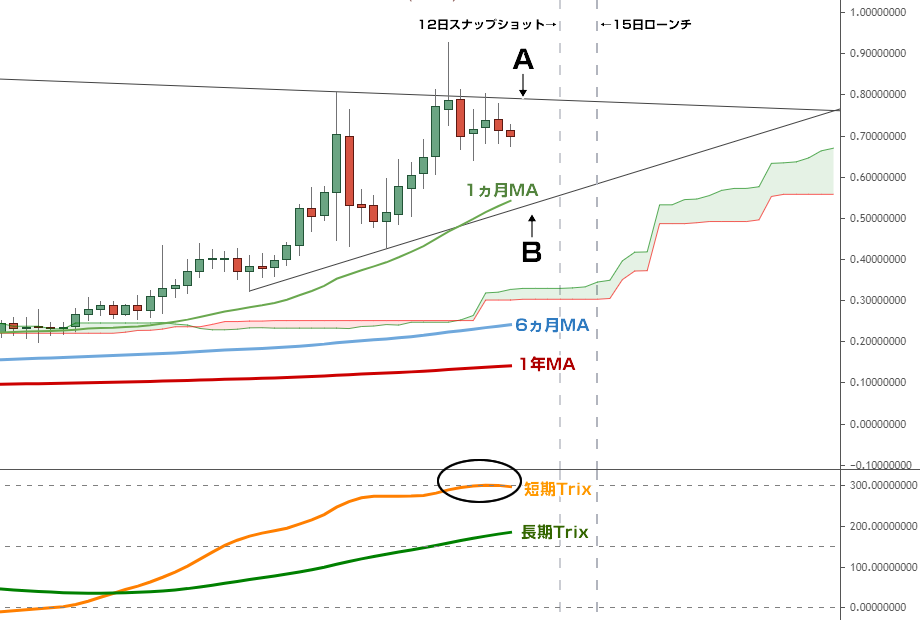

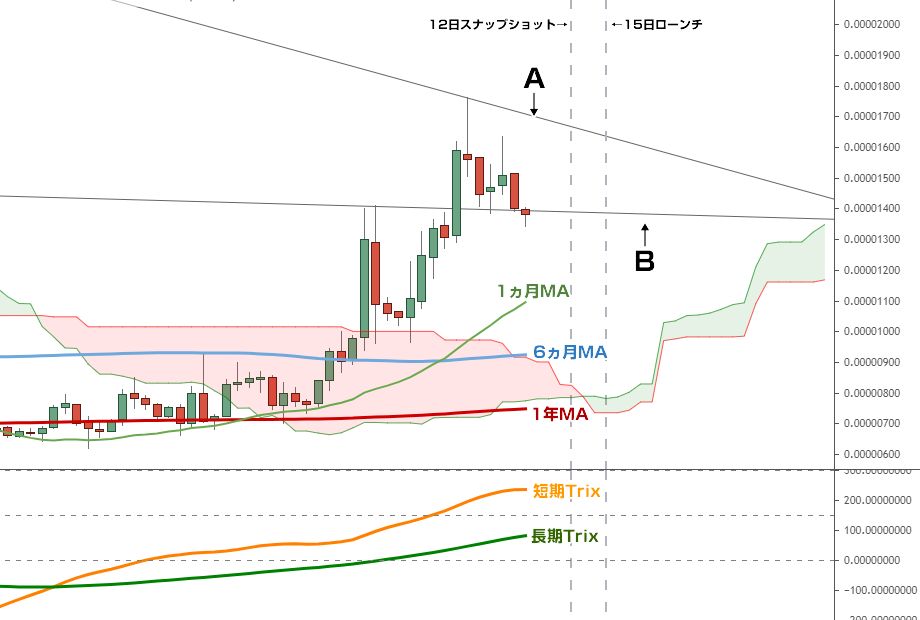

XEMUSD/Poloniex

Resistance A: January 2018 high → February 2021 high

Support B: February 15, 2021 low → February 26, 2021 low

Resistance A remains heavy as before. If we could break through this clearly, it might have extended a bit further, but so far that hasn’t happened. Can it reach it in the remaining days?Support B: February 15, 2021 low → February 26, 2021 low

Another question isthe status of the short-term Trix. It surpassed 300 on March 6, then fell below 300. When momentum is strong, it tends to push into the 300s, but now it’s turning bearish. This is one of the signals to take profit.

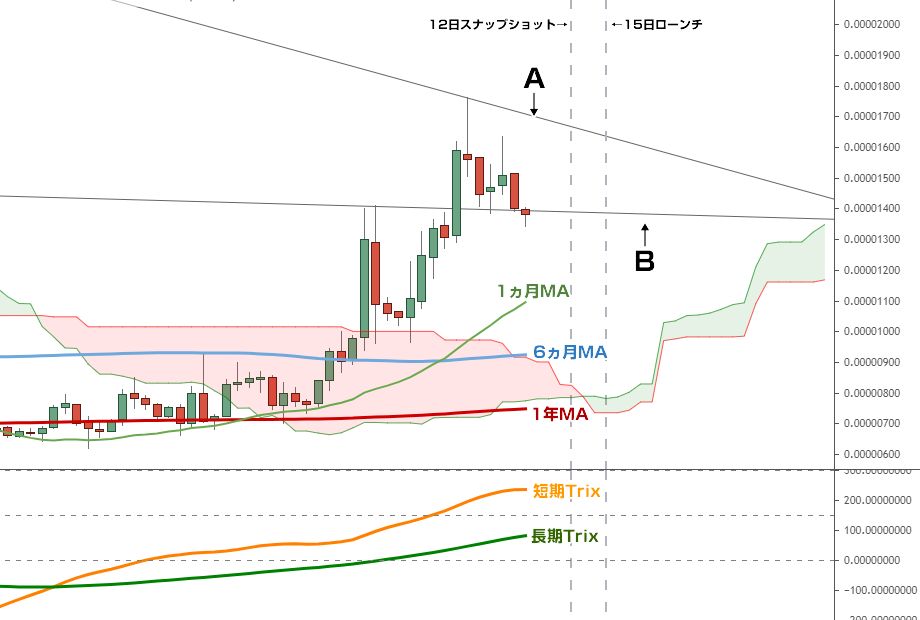

XEMBTC/Poloniex

Resistance A: January 2018 high → March 3, 2021 high

Support B: December 2018 high → December 2020 high

Against BTC, the current situation is that it’s around 1500 satoshis, which has functioned as a support, and traders are wondering whether it can surpass the newly adjusted Resistance A. This is the current state.Support B: December 2018 high → December 2020 high

The 1-month MA has crossed above the cloud, the 1-year MA is below the cloud, and looking at the three MAs (1M, 6M, 1Y) in sum, it forms a perfect order. But the 6-month MA crossing above the cloud is tricky. It may sense overbought conditions in the short term and push it downwards.

Nevertheless, at this price level, by March 20, a complete perfect order including the cloud is expected to form.

Both XEMUSD andXEMBTC look quite positive just by charts. Especially XEMBTC seems like it could rise after late March.

However, with the snapshot-confirmed XEM selling pressure and the XYM listing-driven valuation shifts, plus other fundamentals on the horizon, March is easily expected to be volatile.

But NEM/XEM(NIS1) is not ending; it will emphasize a six-year long-term stable operation and open source development, which isa pleasantly eerie aspect.

Continuing,the NEM economy is surely full of intriguing things.

That is all!

(Ah, this might be the final installment of the series. Thank you all so far! The continuation will be on Twitter!)

Below, the technical settings are for paid members. Since the series ends on March 17, new registrations or subscriptions may not be available for those who join late, but you’re good, right! lol

× ![]()