The translation of the provided HTML content to English is: Sandwich Mase's Market Topic Lecture|Part 2 AUDJPY

Australian dollar/yen, familiar even to Japanese investors. With the selling of “high-yield currencies,” it’s also fresh in memory that financial institutions across the board handled Australian dollar financial products beyond FX. Here, I will explain a topic about AUD/JPY that I have recently been paying attention to.

*The content of this article is based on the author's views and does not guarantee future profits.

*This article is a reprint/re-edited version of an article from FX攻略.com April 2021 issue. Please note that the market information written in the body differs from the current market.

Invast Securities Sandwich Masase

First-class Financial Planning Technician. Engaged in financial product sales at a bank, and later joined Invast Securities as a currency dealer. Currently in the Marketing Department, working to broaden the enjoyment of investing to society. Known around town for being able to answer financial questions immediately, and daily striving to be an elder brother who is trusted by everyone.

Also, a sandwich enthusiast to the point that colleagues exclaim, “You never get bored, do you…” Always handling work with a sandwich in hand. Moreover, every night before sleep, he makes the next day’s sandwich himself, and his family-man charm is thought to be his charm point by romantics who mistake this for a virtue.

Twitter:https://twitter.com/sandwich_market

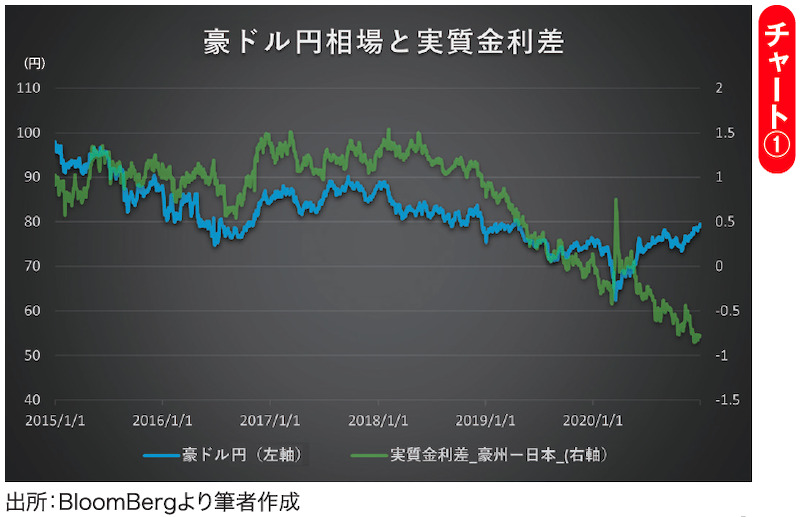

AUD/JPY Losing Its Link to Interest Rates

When looking at currency pair movements, the interest rate differential is often the focus. Here, we use real interest rates calculated from the 10-year yield and expected inflation rate. In the medium-to-long term, currencies with higher real interest rates tend to be bought, and currencies with lower real interest rates tend to be sold, and in the AUD/JPY market, until the end of 2019, it seems the AUD’s weakness and JPY’s strength progressed in tandem with a decline in real interest rate differentials (shrinking real interest rate gap between Australia and Japan) (Chart ①).

However, after the coronavirus shock at the beginning of 2020, the real interest rates of Australia and Japan inverted (Japan > Australia) and since then, —