Market optimism for NEM/XEM against BTC: Crypto Chart Watch 2021

NEM/XEMis currently being watched.

I would like to observe and analyze past price movements using technical analysis and consider future price action.

Since the article published last night vanished due to trouble, I will rewrite it here.

At 20:00 on the 23rd, NGL announced that the snapshot of Symbol and the end of the pre-opt-in period would be on March 12, with launch on March 15.

What was predictable in the announcement, the lack of other surprises, Bitcoin being in a crash, and trades occurring due to a mistaken belief that 20:00 was the snapshot, all resulted in the price being pushed back to the pre-announcement level, which was interesting.

However, as an “event,” the real test begins now, so I will keep a keen eye on it.

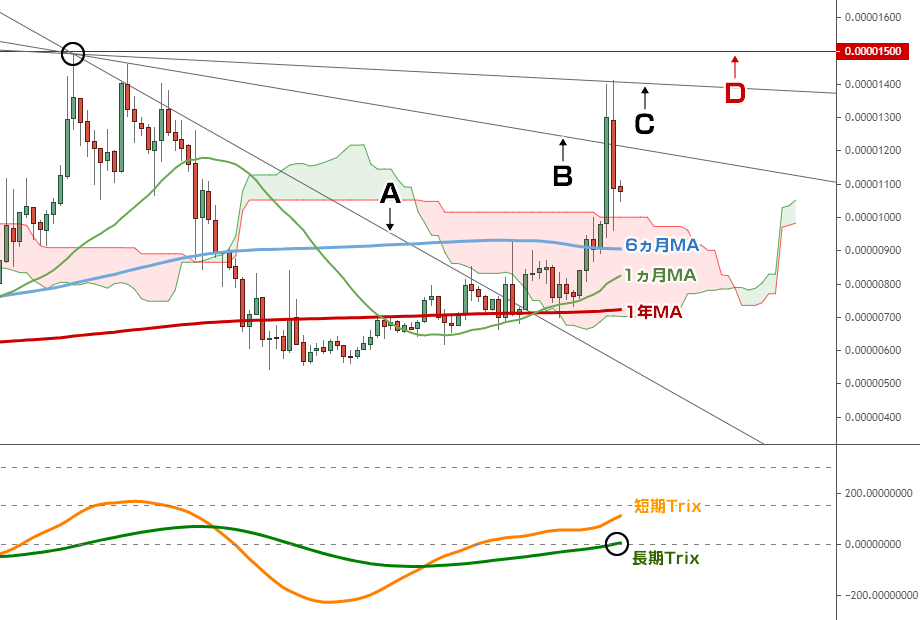

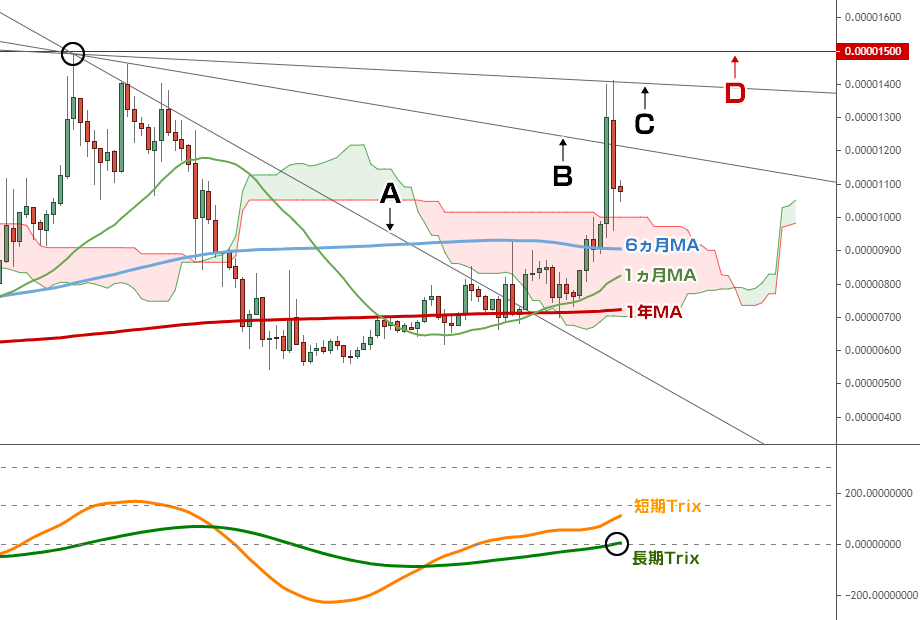

This time, I will observe changes against BTC.The inference from the previous report has become reality.

As the long-term Trix has entered positive territory,the signal has lit up (it lit yesterday as well but disappeared), so we are watching it. Since the 1-month MA is in the cloud, even if the signal is confirmed, it may feel strange for a while. I will post again on Twitter once it is confirmed.

More importantly, this time I recommend watchingthe four resistances. The endpoints of A–C are common. I will explain them one by one.

▼Resistance A

This has already broken. The starting point is the second-highest January 2018, making it very important. The previous peak was May 2017, but since the second high is closer to the peak, I set the starting point there.

▼Resistance B

This starting point isthe previous all-time high on Binance. It temporarily breaks on the rise on the 22nd but is soon pushed back down. Next time, it may break more easily.

▼Resistance C

This is the immediate resistance line. The starting point is the second-highest on Binance.

At that time,it was the peak of the election of the now-deceased NEM Foundation councilors. Following the theft incident, a glimmer of light appeared. It was positive that governance improvements by the entire community began to bear fruit, but the price peaked soon after the election.

If you turn bullish against BTC, you also become strong against fiat currencies, and Bitcoin has been in a bullish mode for a long time, so for a while you may want to focus on XEMBTC.

In 2017, after Bitcoin peaked, XMEBTC surged, causing XEMJPY to rise sharply in the short term.

▼Resistance D

1500 satThis line. I think breaking through it with a proper close on the top is the most desirable achievement.

This line served as the bottom support area in 2018 and acted as resistance in April–May 2019 and September–December 2020, so if it can break through neatly, momentum may increase, but for now the overall sentiment is bearish, so patience may be required for a while.

With three weeks left until the March 12 snapshot, I recommend making careful judgments about the situation.

That is all!

Below, the technical settings are for paid members only. Since the series ends on March 17 and new registrations or ongoing subscriptions are not possible for those unable to subscribe, you can’t view them, but that’s fine, right! w

I would like to observe and analyze past price movements using technical analysis and consider future price action.

Since the article published last night vanished due to trouble, I will rewrite it here.

At 20:00 on the 23rd, NGL announced that the snapshot of Symbol and the end of the pre-opt-in period would be on March 12, with launch on March 15.

What was predictable in the announcement, the lack of other surprises, Bitcoin being in a crash, and trades occurring due to a mistaken belief that 20:00 was the snapshot, all resulted in the price being pushed back to the pre-announcement level, which was interesting.

However, as an “event,” the real test begins now, so I will keep a keen eye on it.

This time, I will observe changes against BTC.The inference from the previous report has become reality.

XEMBTC/Poloniex

Resistance A: January 2018 high → December 2020 high

Resistance B: April 2018 high → December 2020 high

Resistance C: December 2018 high → December 2020 high

Resistance D: 1500 sat

The three MA states are not that good. The long-term trend is upward, but the 1-month MA is still in the cloud, so we are in a waiting state. Even if price moves smoothly forward, a perfect order alignment is likely not before late March, so there is no need to consider it at this moment.Resistance B: April 2018 high → December 2020 high

Resistance C: December 2018 high → December 2020 high

Resistance D: 1500 sat

As the long-term Trix has entered positive territory,the signal has lit up (it lit yesterday as well but disappeared), so we are watching it. Since the 1-month MA is in the cloud, even if the signal is confirmed, it may feel strange for a while. I will post again on Twitter once it is confirmed.

More importantly, this time I recommend watchingthe four resistances. The endpoints of A–C are common. I will explain them one by one.

▼Resistance A

This has already broken. The starting point is the second-highest January 2018, making it very important. The previous peak was May 2017, but since the second high is closer to the peak, I set the starting point there.

▼Resistance B

This starting point isthe previous all-time high on Binance. It temporarily breaks on the rise on the 22nd but is soon pushed back down. Next time, it may break more easily.

▼Resistance C

This is the immediate resistance line. The starting point is the second-highest on Binance.

At that time,it was the peak of the election of the now-deceased NEM Foundation councilors. Following the theft incident, a glimmer of light appeared. It was positive that governance improvements by the entire community began to bear fruit, but the price peaked soon after the election.

If you turn bullish against BTC, you also become strong against fiat currencies, and Bitcoin has been in a bullish mode for a long time, so for a while you may want to focus on XEMBTC.

In 2017, after Bitcoin peaked, XMEBTC surged, causing XEMJPY to rise sharply in the short term.

▼Resistance D

1500 satThis line. I think breaking through it with a proper close on the top is the most desirable achievement.

This line served as the bottom support area in 2018 and acted as resistance in April–May 2019 and September–December 2020, so if it can break through neatly, momentum may increase, but for now the overall sentiment is bearish, so patience may be required for a while.

With three weeks left until the March 12 snapshot, I recommend making careful judgments about the situation.

That is all!

Below, the technical settings are for paid members only. Since the series ends on March 17 and new registrations or ongoing subscriptions are not possible for those unable to subscribe, you can’t view them, but that’s fine, right! w

× ![]()