Introduction to European Fundamentals | Episode 18: Average Inflation Target (AIT) [Miko Matsuzaki]

Miko Matsuzaki Profile

Matsuzaki Yoshiko. Her trading career began at Swiss Bank Tokyo Branch. In 1988 she moved to the United Kingdom, and in 1989 she joined the Dealing Room at Barclays Bank London Head Office. She gave birth in 1991. In 1997 she transferred to Merrill Lynch Investment Bank in London’s City, and later retired in 2000. Now, in addition to FX trading, she disseminates Europe-direct information to Japanese individual investors through blogs, seminars, and YouTube. Her books include “Matsuzaki Miko’s London FX” and “London FX That Always Earns Money” (both published by Jiyu Kokuminsha). Since 2018, she has run the “Fundamentals College.” She also started an online salon for FX etiquette on DMM.

Blog:http://londonfx.blog102.fc2.com/

Fundamentals College:https://fundamentals-college.com/

Online Salon:https://lounge.dmm.com/detail/1215/

https://fundamentals-college.com/

*This article is a republication/edit of a FX攻略.com April 2021 issue article. Please note that the market information described in the text may differ from the current market.

The United States Pushed for a Change in the Framework of Monetary Policy

This time I would like to write about the change in the framework of U.S. monetary policy. Since the global financial crisis of 2008, despite continuous monetary easing, inflation has been difficult to trigger. As the economy shifts into this new model, questions arose about whether central banks alone should continue traditional monetary policy, and the United States was the first to move in changing the policy framework.

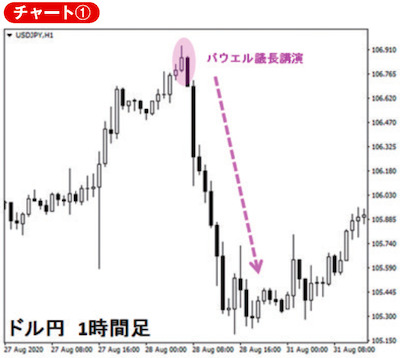

Powell, Chairman of the U.S. Federal Reserve Board (FRB), chose the Jackson Hole Economic Symposium in August 2020 as the stage for his announcement, where he introduced the “Average Inflation Targeting (AIT).”

Chart ① shows the movement of USD/JPY immediately after the announcement; with AIT, markets anticipated that policy rate hikes could be delayed significantly, and the dollar plummeted.