The Market Trend of "Demand-Supply Demon" Tetsuo Inoue — Professional Market Analysis Know-How and Notable Stocks Revealed! | Episode 13

Tetsuo Inoue Profile

Inoue, Tetsuo. Representative of Spring Capital, certified member of the Japan Society of financial analysts. After graduating from Sophia University, he served as head of the investment division at a domestic insurance company, then transitioned to the role of Chief Strategist and Director of Japanese Equity Management at UAM Japan, Inc. (now Old Mutual Group). Subsequently, he held the same position at Proud Investment Advisors and MCP Group, one of Asia’s largest fund-of-funds operators, before becoming independent. He is known as the “Demand and Supply Demon” and serves as a personality on Nikkei CNBC TV programs “Yo Express” and “~ Aggressive IR ~ Market Breakthrough,” as well as on Radio Nikkei “Asaza” among others.

From original technical analysis and demand-supply trends, Mr. Inoue analyzes the direction of the stock market (stock indices) from his unique perspective in his newsletter “Market Tides,” and in the video school “Winner’s Screening - Stock Hybrid Battle -” where Mr. Inoue collaborates with B-Commun’s Mr. Shintaro Sakamoto to explain the market and introduce selected stocks. It is well received on GogoJungle.

Newsletter:Market Tides

Video School:Winner’s Screening - Stock Hybrid Battle -

*This article is a reprint/edit of an article from FX攻略.com, April 2021 issue. Please note that the market information described herein may differ from current market conditions.

Who are the foreign investors mainly buying Japanese stocks?

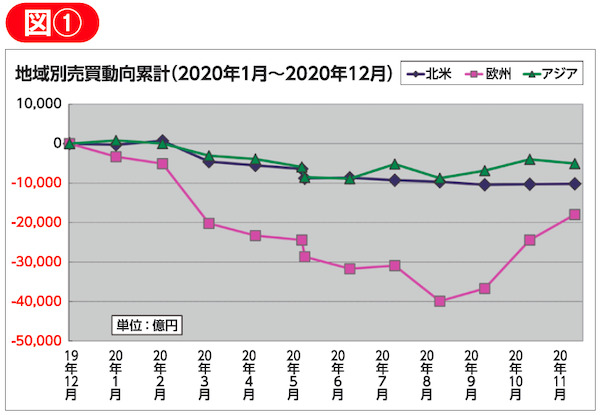

On January 20, the Tokyo Stock Exchange announced the monthly “Region-by-Region Overseas Investors in Japanese Stocks,” which confirmed last year’s regional trading trends by foreigners. The total trading activity in the three key regions—North America, Europe, and Asia—sold more than ¥4.6 trillion in nine months from January to September, but in the three months from October onward there was a net purchase of about ¥2.5 trillion.

Figure 1 illustrates this, showing that Europe was the main driver last year, while movements in other regions were smaller. The net buying amount for Europe in the three months after October last year was as large as about ¥2.2 trillion.