Cryptocurrency Communications | Reasons to Focus on Bitcoin ETFs in 2021 [Oohira]

Mr. Ohira's Profile

FX experience since 2009, cryptocurrency experience since 2015. Utilizing cryptocurrency investment and past experience, he distributes cryptocurrency information on major newsletter sites and investment sites. He participates in a large number of individual investor networks and shares knowledge gained from many investors. Operating a cryptocurrency investment information site that beginners can learn from since 2016.

Blog:The Future Potential of Cryptocurrency – Investment Methods for Beginners to Earn

※This article is a reprint and revision of an article from FX攻略.com April 2021 issue. Please note that the market information written in the本文 differs from the current market.

Major Benefits of Bitcoin ETF

One of the things I have high expectations for in the cryptocurrency market in 2021 is Bitcoin ETFs. An ETF, short for exchange-traded fund, is a security that tracks the price of Bitcoin. From 2017 onwards, applications by companies gradually increased, but the U.S. Securities and Exchange Commission (SEC), the assessing authority, has so far denied all Bitcoin ETF applications.

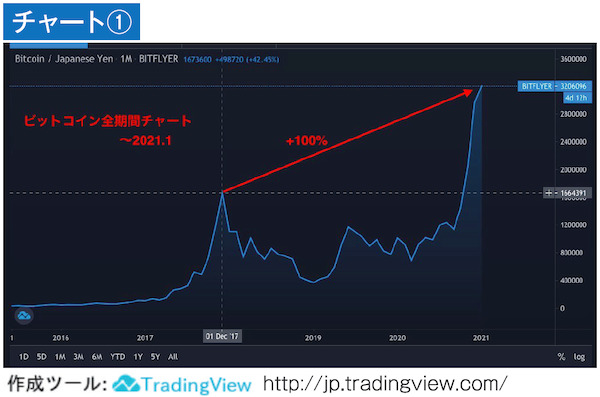

However, in 2021 Bitcoin has shown an even greater presence as an asset value. In addition, Bitcoin price reached a historic high of 4,200,000 yen in January 2021 after surpassing the all-time high of 2,200,000 yen at the end of 2017 (Chart ①).

As explained above, a Bitcoin ETF is a security that tracks Bitcoin’s price. Securities law applies, and there are several differences compared to directly buying Bitcoin. First, since you do not hold Bitcoin directly, security risks are reduced, and the tax treatment is the same as stock investments, making it more favorable than the current cryptocurrency tax rates. Also, since securities can only be traded at brokerages, it is easier for stock investors to purchase Bitcoin ETF, among other notable advantages already described.