Market Topics Lecture from Sandwich Mase's Market Topic Series|Part 1 Dollar/Yen

When it comes to currency pairs most familiar to us Japanese, isn’t the dollar-yen pair the one that comes to mind? Even for familiar currency pairs, it is important to recognize the situation they are in. This time, we will explain the recent topics surrounding the dollar-yen pair.

※The content of this article is based on the author's views and does not guarantee future profits.

※This article is a reprint/edit of a article from FX攻略.com March 2021 issue. Please note that the market information written in the main text is different from the current market.

Invast Securities Sandwich Manase

First-class Financial Planning Technician. Worked in financial product sales at a bank, then joined Invast Securities as a currency dealer. Currently in the Marketing Department, engaging in activities to spread the enjoyment of investment to the world. It is said that he answers financial questions instantly, and he aspires daily to be a big brother whom everyone can rely on.

Also, he is a sandwich-loving person to the point that colleagues are constantly astonished, sometimes saying “You never get tired of them, do you?” He handles work with a sandwich in hand at all times. Moreover, every night before going to bed, he makes the sandwich for the next day himself, and his romanticized image of such domestic charm is his charm point.

Twitter:https://twitter.com/sandwich_market

Has it become a dead term? Risk-off yen buying

“Risk-off yen appreciation” is a term used to justify situations where, as stock prices in Japan and the U.S. fall during risk-off, the dollar-yen exchange rate moves toward yen strength. Investors had ingrained the equation “Risk-off = yen buys” as if memorizing a multiplication table. But recently, the risk-off yen appreciation has not been functioning in the market.

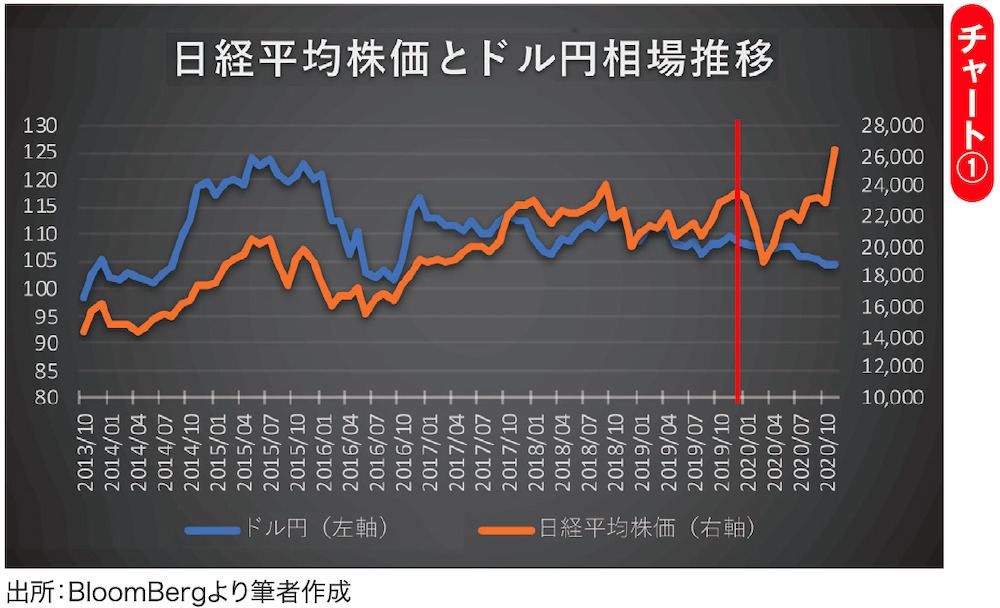

Chart ① shows the monthly closing prices of the Nikkei Index and the dollar-yen rate from October 2013 to November 2020. From 2013 to the mid-2019, the Nikkei and the dollar-yen movements seemed correlated. However, from late 2019 to the present (marked by the red line), there is no correlation in their movements. Considering what happened in the same period, it naturally points to the “COVID-19 shock.”