[Key Currencies "Dollar $" Special Feature ②] Learn questions related to the dollar and FX through Q&A

【Feature】 The US Dollar as the Anchor Currency Is Not a Fluke!

Conquer the FX by Conquering the Dollar!

The dollar, as the anchor currency, is said to account for half of the trading volume in the FX market. While many Japanese traders formulate trading strategies for each currency pair centered on the yen, all trading standards, including foreign exchange and trade, revolve around and are benchmarked by the dollar. By learning the dollar, you can gain an edge in FX. Here, we first unravel the history of the dollar, learn through a Q&A that helps trading, and then look at the outlook for the dollar–yen rate toward 2020.

・① Review of the anchor currency dollar ─ Explore the king of currencies—the dollar!

・② Learn FX-useful questions from things related to the dollar in a Q&A ←This article ends here

・③ Dollar/Yen chapter: 2021 dollar–stretch currency pair big forecast(12/30 published)

・④ Euro/Dollar chapter: 2021 dollar–stretch currency pair big forecast(12/30 published)

・⑤ Pound/Dollar chapter: 2021 dollar–stretch currency pair big forecast(12/31 published)

・⑥ Australian Dollar / US Dollar chapter: 2021 dollar–stretch currency pair big forecast(12/31 published)

※This article is a reprint/edit of FX攻略.com February 2021 issue. Please note that the market information written in the text may differ from current market conditions.

Q. What is the policy interest rate?

A. The rate set by a central bank for the purpose of influencing short-term financial markets

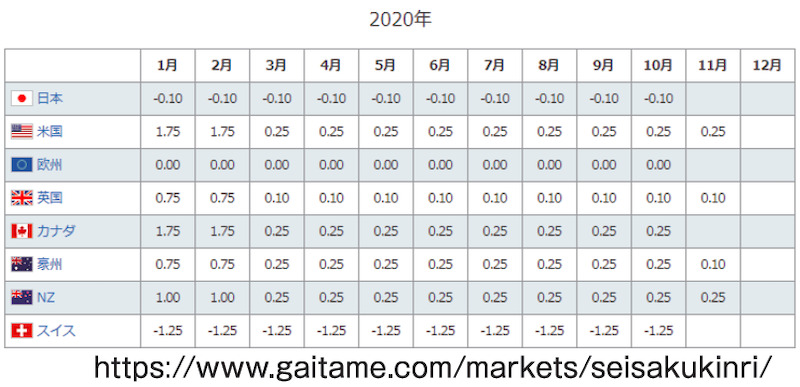

https://www.gaitame.com/markets/seisakukinri/

Generally, it refers to the interest rate at which a country’s central bank lends to banks on a short-term basis. In the United States, it is called the Federal Funds (FF) rate and is determined and changed by the Federal Open Market Committee (FOMC), the FOMC of the Federal Reserve Board (FRB).

Q. What can we understand by looking at the policy rate?

A. Whether monetary policy is tight or easy (accommodative)

If the FF rate rises (hikes), market rates tend to rise as well, restraining both banks and companies from obtaining funds (tightening). Conversely, if the FF rate falls (cut), market rates drop, lending from banks increases, and economic activity tends to expand (ease).

Q. Current U.S. interest rates and future outlook

A. Maintained near-zero interest rates to counter COVID-19; expected to continue for years

In the FOMC meeting held in November 2020, it was unanimously decided to keep the FF rate at 0–0.25%. There are ongoing concerns about the spread of COVID-19 in the U.S., and the pace of economic recovery has been gradual, so rate hikes are not expected in 2021, with monetary easing likely to continue.