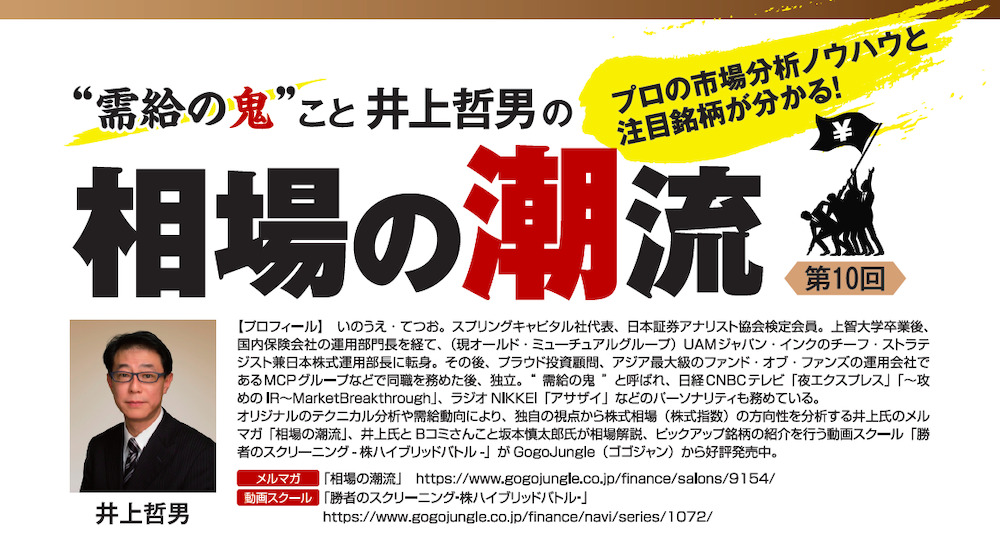

The market trend of "Supply and Demand Demon" Tetsuo Inoue—Professional market analysis know-how and notable stocks revealed! | Episode 10

Inoue Tetsuo Profile

Inoue Tetsuo. Representative of Spring Capital, fellow of the Japanese Securities Analysts Association. After graduating from Sophia University, he served as head of the investment department at a domestic insurance company, then became Chief Strategist and Head of Japanese Equity Investment at UAM Japan Inc. (now Old Mutual Group). Subsequently, he held the same position at Proud Investment Advisors and MCP Group, one of the largest funds of funds in Asia, before becoming independent. Renowned as a “demand and supply demon,” he is also a personality on Nikkei CNBC TV programs “Night Express” and “〜Attack IR〜 Market Breakthrough,” as well as on Radio NIKKEI “Asa Zai.”

With original technical analysis and trends in supply and demand, Inoue analyzes the direction of the stock market (stock indices) from his unique perspective in his newsletter “Market Tides,” and in a video school “Winner’s Screening - Stock Hybrid Battle -” where Inoue and B-chan, also known as Shin-taro Sakamoto, provide market commentary and highlight stocks; these are well-received on GogoJungle (GogoJungle).

Newsletter:Market Tides

Video School:Winner’s Screening - Stock Hybrid Battle -

*This article is a reprint/edit of an article from FX攻略.com January 2021 issue. Please note that the market information written herein may differ from the current market.

In the long term, fiscal policy and interest rates will be the theme

The U.S. fiscal year runs from October to September of the following year, and the U.S. federal deficit for the year ending last September was $3.132 trillion. This is more than double the roughly $1.4 trillion during the Lehman Brothers era, and the deficit increased threefold in one year. However, this deficit exactly matches the amount of the “COVID-19 package” from this spring. As a result, federal debt swelled to $27 trillion, and while the debt-to-GDP ratio is not explicitly disclosed annually, it is presumed to have exceeded 120%.

This time, the timing of the additional economic measures became market material because U.S. airlines, facing severe business difficulties, had set October 1 as the deadline to resume layoffs despite the aforementioned COVID-19 package.